Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Two 3-year index-linked bonds are issued on 1st January 2019. Both are redeemable at par and their nominal face value is 100. The

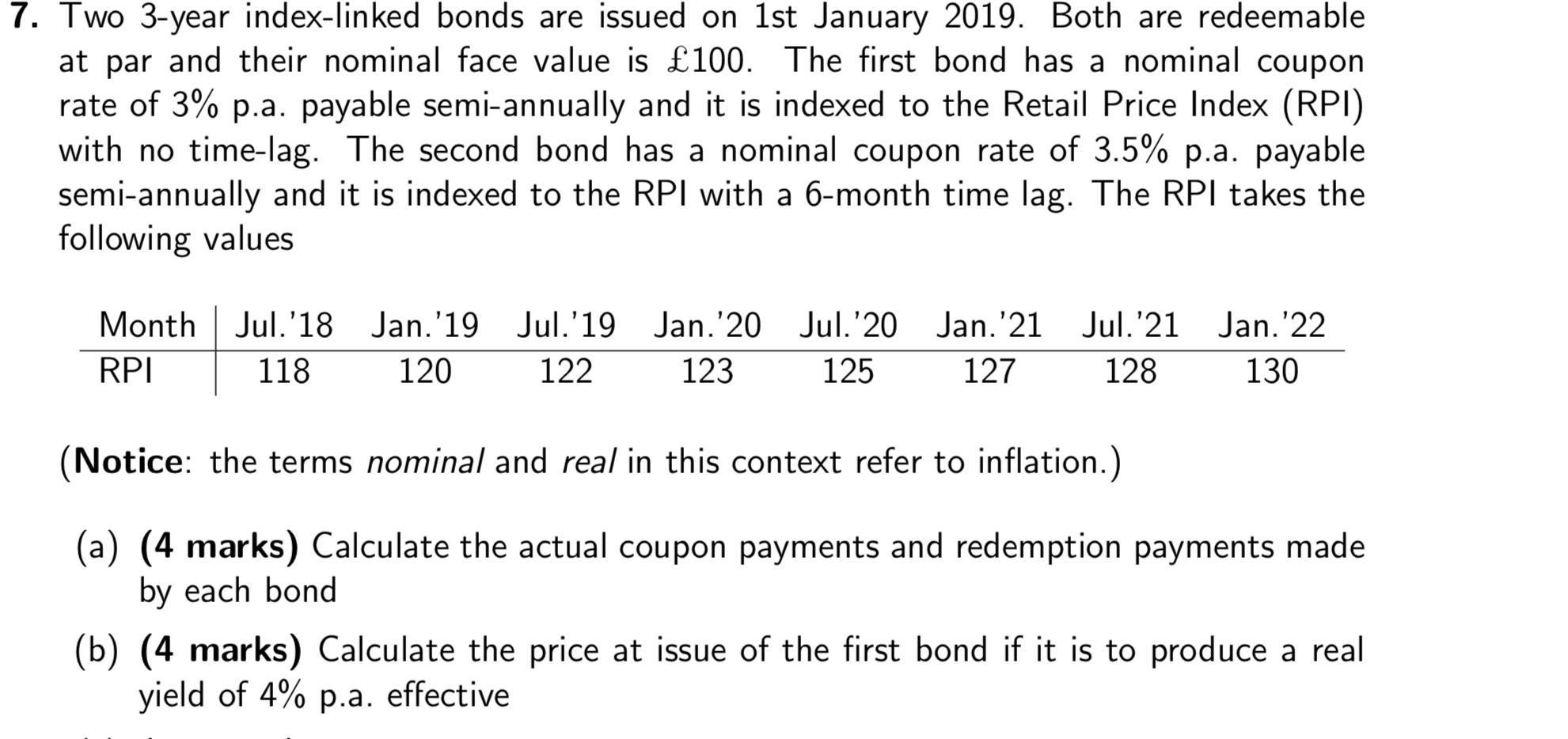

7. Two 3-year index-linked bonds are issued on 1st January 2019. Both are redeemable at par and their nominal face value is 100. The first bond has a nominal coupon rate of 3% p.a. payable semi-annually and it is indexed to the Retail Price Index (RPI) with no time-lag. The second bond has a nominal coupon rate of 3.5% p.a. payable semi-annually and it is indexed to the RPI with a 6-month time lag. The RPI takes the following values Month RPI Jul. '18 Jan. '19 Jul.'19 118 120 122 Jan. '20 Jul.'20 Jan.'21 123 125 127 Jul.'21 Jan.'22 128 130 (Notice: the terms nominal and real in this context refer to inflation.) (a) (4 marks) Calculate the actual coupon payments and redemption payments made by each bond (b) (4 marks) Calculate the price at issue of the first bond if it is to produce a real yield of 4% p.a. effective

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started