Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Unearned revenues are recorded by companies that a. Receive money at the time the performance of a service is complete b. Receive money in

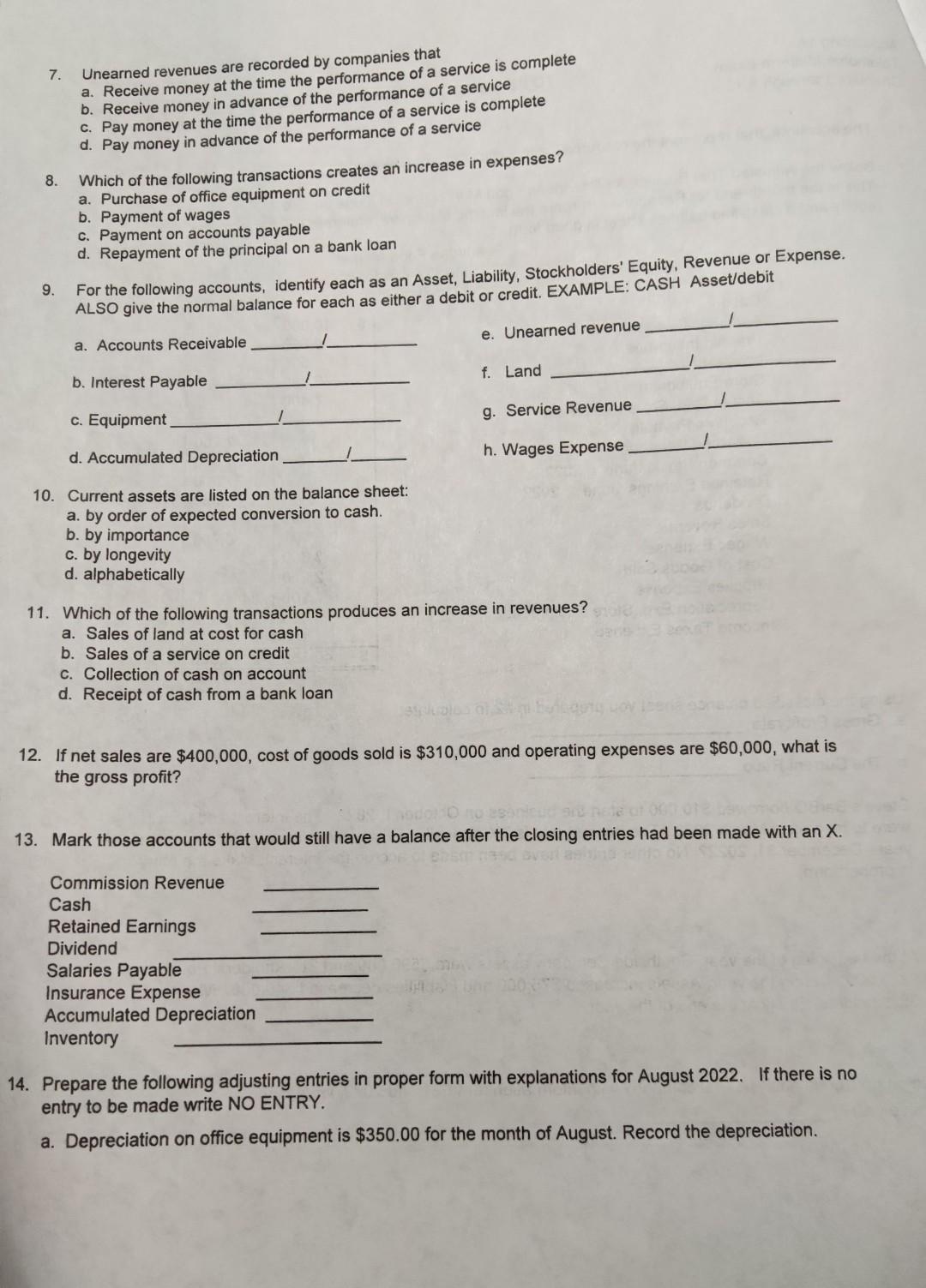

7. Unearned revenues are recorded by companies that a. Receive money at the time the performance of a service is complete b. Receive money in advance of the performance of a service c. Pay money at the time the performance of a service is complete d. Pay money in advance of the performance of a service 8. Which of the following transactions creates an increase in expenses? a. Purchase of office equipment on credit b. Payment of wages c. Payment on accounts payable d. Repayment of the principal on a bank loan 9. For the following accounts, identify each as an Asset, Liability, Stockholders' Equity, Revenue or Expense. ALSO give the normal balance for each as either a debit or credit. EXAMPLE: CASH Asset/debit a. Accounts Receivable e. Unearned revenue b. Interest Payable f. Land c. Equipment g. Service Revenue d. Accumulated Depreciation h. Wages Expense 10. Current assets are listed on the balance sheet: a. by order of expected conversion to cash. b. by importance c. by longevity d. alphabetically 11. Which of the following transactions produces an increase in revenues? a. Sales of land at cost for cash b. Sales of a service on credit c. Collection of cash on account d. Receipt of cash from a bank loan 12. If net sales are $400,000, cost of goods sold is $310,000 and operating expenses are $60,000, what is the gross profit? 13. Mark those accounts that would still have a balance after the closing entries had been made with an X. Commission Revenue Cash Retained Earnings Dividend Salaries Payable Insurance Expense Accumulated Depreciation Inventory 14. Prepare the following adjusting entries in proper form with explanations for August 2022. If there is no entry to be made write NO ENTRY. a. Depreciation on office equipment is $350.00 for the month of August. Record the depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started