Answered step by step

Verified Expert Solution

Question

1 Approved Answer

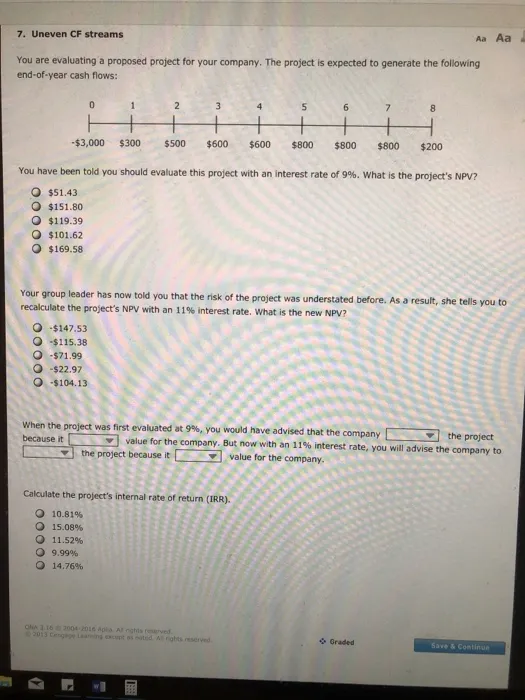

7. Uneven CF streams You are evaluating a proposed project for your company. The project is expected to generate the following end-of-year cash flows:

7. Uneven CF streams You are evaluating a proposed project for your company. The project is expected to generate the following end-of-year cash flows: -$3,000 0 -$147.53 O $115.38 O-$71.99 O-$22.97 -$104.13 1 $300 2 11.52% 9.99% 14.76% 3 7 + $500 $600 $600 $800 $800 $800 4 5 6 You have been told you should evaluate this project with an interest rate of 9%. What is the project's NPV? $51.43 O $151.80 $119.39 $101.62 $169.58 Calculate the project's internal rate of return (IRR). 10.81% O 15.08% Your group leader has now told you that the risk of the project was understated before. As a result, she tells you to recalculate the project's NPV with an 11% interest rate. What is the new NPV? ONA 116 2004-2016 Apla Al nights reserved. When the project was first evaluated at 9%, you would have advised that the company because it 8 the project value for the company. But now with an 11% interest rate, you will advise the company to the project because it value for the company. $200 Aa Aa Graded Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calculate the Net Present Value NPV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started