Answered step by step

Verified Expert Solution

Question

1 Approved Answer

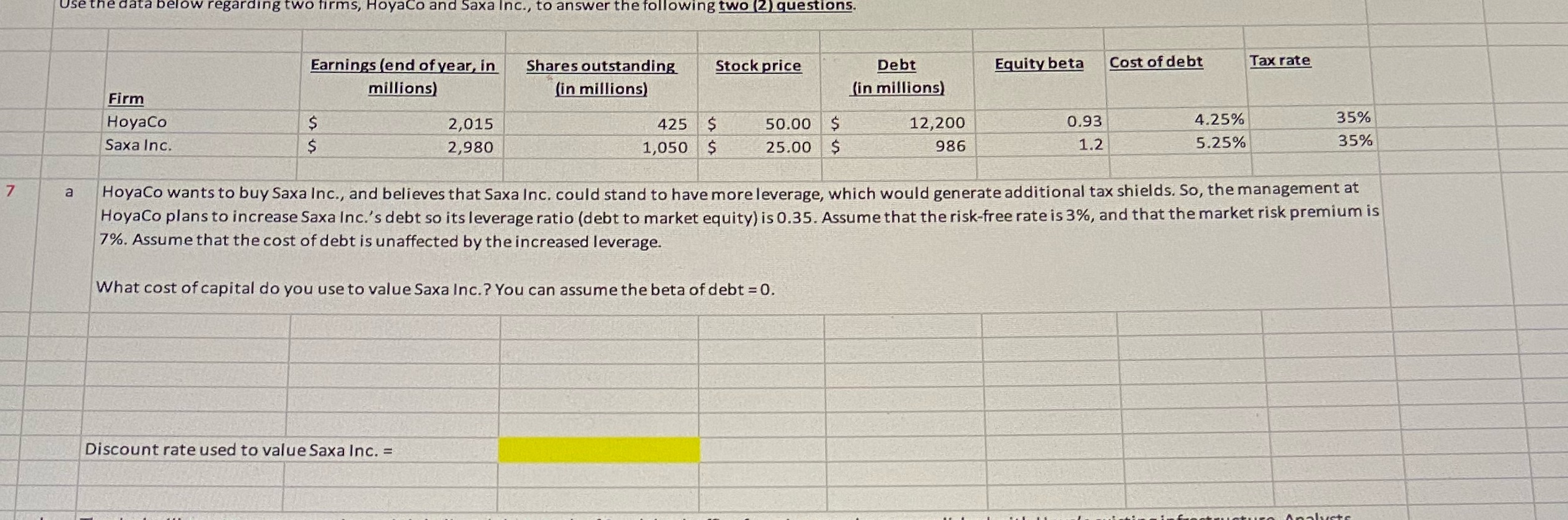

7 Use the data below regarding two firms, HoyaCo and Saxa Inc., to answer the following two (2) questions. Firm HoyaCo Saxa Inc. Earnings

7 Use the data below regarding two firms, HoyaCo and Saxa Inc., to answer the following two (2) questions. Firm HoyaCo Saxa Inc. Earnings (end of year, in millions) $ $ 2,015 2,980 Discount rate used to value Saxa Inc. = Shares outstanding (in millions) Stock price 425 $ 1,050 $ 50.00 $ 25.00 $ Debt (in millions) 12,200 986 Equity beta 0.93 1.2 Cost of debt 4.25% 5.25% Tax rate 35% 35% a HoyaCo wants to buy Saxa Inc., and believes that Saxa Inc. could stand to have more leverage, which would generate additional tax shields. So, the management at HoyaCo plans to increase Saxa Inc.'s debt so its leverage ratio (debt to market equity) is 0.35. Assume that the risk-free rate is 3%, and that the market risk premium is 7%. Assume that the cost of debt is unaffected by the increased leverage. What cost of capital do you use to value Saxa Inc.? You can assume the beta of debt = 0. Analysts

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculations to determine the cost of capital to value Saxa Inc after increasing its leverage 1 Mark...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started