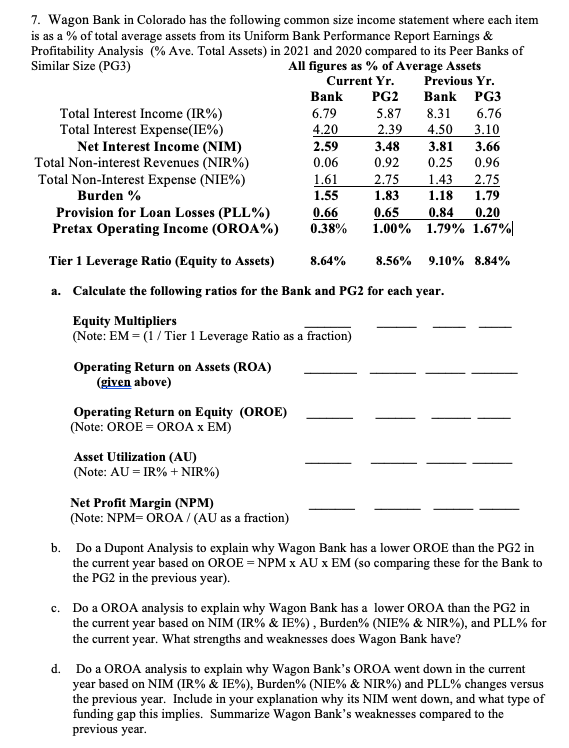

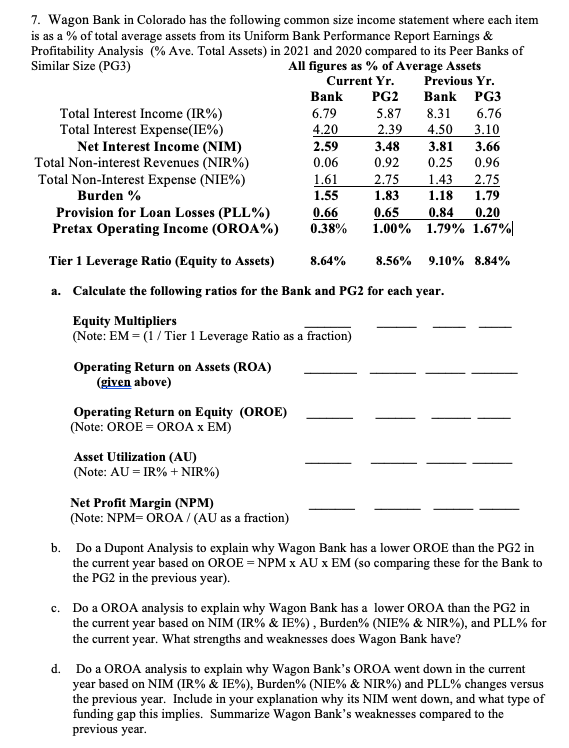

7. Wagon Bank in Colorado has the following common size income statement where each item is as a \% of total average assets from its Uniform Bank Performance Report Earnings \& Profitability Analysis (\% Ave. Total Assets) in 2021 and 2020 compared to its Peer Banks of Similar Size (PG3) All figures as \% of Average Assets a. Calculate the following ratios for the Bank and PG2 for each year. Equity Multipliers (Note: EM = (1 / Tier 1 Leverage Ratio as a fraction ) Operating Return on Assets (ROA) (given above) Operating Return on Equity (OROE) (Note: OROE = OROA x EM) Asset Utilization (AU) (Note: AU=IR%+NIR%) Net Profit Margin (NPM) (Note: NPM=OROA / (AU as a fraction) b. Do a Dupont Analysis to explain why Wagon Bank has a lower OROE than the PG2 in the current year based on OROE = NPM x AU x EM (so comparing these for the Bank to the PG2 in the previous year). c. Do a OROA analysis to explain why Wagon Bank has a lower OROA than the PG2 in the current year based on NIM (IR \% \& IE\%), Burden\% (NIE\% \& NIR \%), and PLL\% for the current year. What strengths and weaknesses does Wagon Bank have? d. Do a OROA analysis to explain why Wagon Bank's OROA went down in the current year based on NIM (IR\% \& IE\%), Burden\% (NIE\% \& NIR \%) and PLL\% changes versus the previous year. Include in your explanation why its NIM went down, and what type of funding gap this implies. Summarize Wagon Bank's weaknesses compared to the previous year. 7. Wagon Bank in Colorado has the following common size income statement where each item is as a \% of total average assets from its Uniform Bank Performance Report Earnings \& Profitability Analysis (\% Ave. Total Assets) in 2021 and 2020 compared to its Peer Banks of Similar Size (PG3) All figures as \% of Average Assets a. Calculate the following ratios for the Bank and PG2 for each year. Equity Multipliers (Note: EM = (1 / Tier 1 Leverage Ratio as a fraction ) Operating Return on Assets (ROA) (given above) Operating Return on Equity (OROE) (Note: OROE = OROA x EM) Asset Utilization (AU) (Note: AU=IR%+NIR%) Net Profit Margin (NPM) (Note: NPM=OROA / (AU as a fraction) b. Do a Dupont Analysis to explain why Wagon Bank has a lower OROE than the PG2 in the current year based on OROE = NPM x AU x EM (so comparing these for the Bank to the PG2 in the previous year). c. Do a OROA analysis to explain why Wagon Bank has a lower OROA than the PG2 in the current year based on NIM (IR \% \& IE\%), Burden\% (NIE\% \& NIR \%), and PLL\% for the current year. What strengths and weaknesses does Wagon Bank have? d. Do a OROA analysis to explain why Wagon Bank's OROA went down in the current year based on NIM (IR\% \& IE\%), Burden\% (NIE\% \& NIR \%) and PLL\% changes versus the previous year. Include in your explanation why its NIM went down, and what type of funding gap this implies. Summarize Wagon Bank's weaknesses compared to the previous year