Answered step by step

Verified Expert Solution

Question

1 Approved Answer

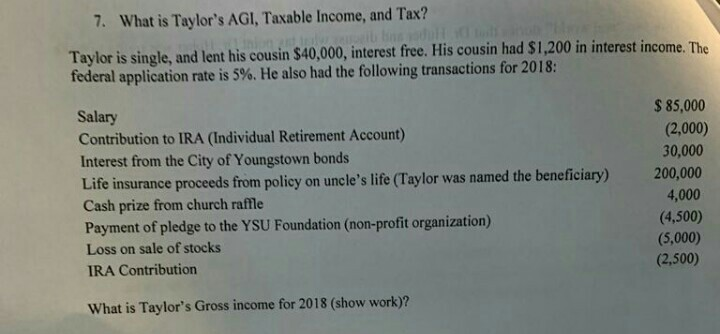

7. What is Taylor's AGI, Taxable Income, and Tax? Taylor is single, and lent his cousin $40,000, interest free. His cousin had $1,200 in interest

7. What is Taylor's AGI, Taxable Income, and Tax? Taylor is single, and lent his cousin $40,000, interest free. His cousin had $1,200 in interest income. The federal application rate is 5%. He also had the following transactions for 2018: Salary Contribution to IRA (Individual Retirement Account) $ 85,000 (2,000) 30,000 Interest from the City of Youngstown bonds Life insurance proceds from policy on uncle's life (Taylor was named the beneficiary) Cash prize from church raffle Payment of pledge to the YSU Foundation (non-profit organization) Loss on sale of stocks IRA Contribution 200,000 4,000 (4,500) (5,000) (2,500) What is Taylor's Gross income for 2018 (show work)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started