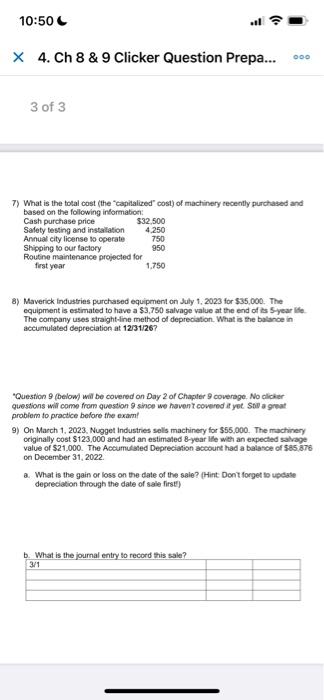

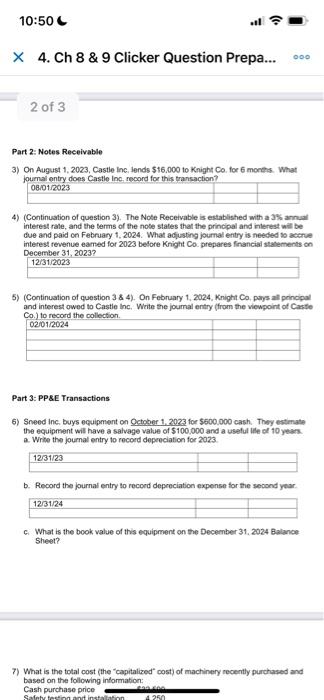

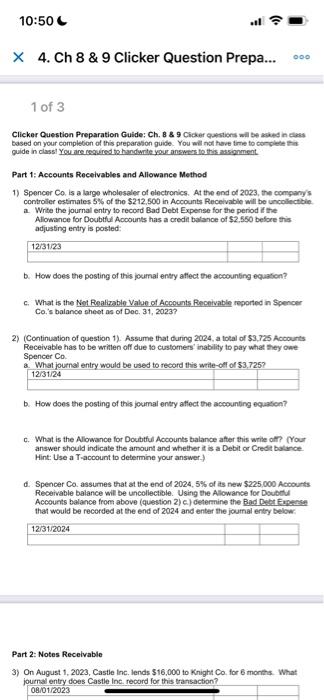

7) What is the total cost (the "capilalized" cost) of machinery recently purchased and 8) Maverick industries purchased equipment on July 1, 2023 for $35,000. The equipment is estimatod to have a $3,750 salvage value at the end of ts 5 year ilfe. The company uses straight-line method of depreciation. What is the balance in accumulated depreciation at 12/31/26? "Question 9 (belom) will be covered an Day 2 of Chappter 9 coverage. No clicker questions will come from question 9 since we haven T covered it yet Ste a great probliom to practice before the exam! 9) On March 1, 2023, Nugget industries sels machinery for 355,000 . The machinery originally cost $123,000 and had an estimated 8-year life with an expected salvage value of $21.000. The Accumulated Depreciation account had a balarce of $35,876 on December 31, 2022. a. What is the gain of loss on the date of the sale? (Hint Dont forget to update depreciation through the date of sale lirse] b. What is the iournal entrv to record this sale? Part 2: Notes Receivable 3) On August 1, 2023, Castle linc, lends 516.000 to Knight Co, for 6 months. What journal entrv does Castie Inc. record for this transaction? 4) (Continuation of question 3). The Note Receivable is established with a a\% annual interest rale, and the terms of the note states that the principal and inlerest will be due and paid on February 1, 2024. What acjusting journal entry is needed so active interest revenue eamed for 2023 belore Kright Co. prepares francial statements on 5) (Continuation of question 38 4). On February 1, 2024, Knight Co, pars all principal and interest owod to Castle lnc. Write the joumal entry (from the viewpoint of Caste Co. i in merert the ronliertinn Part 3: PP\&E Transactions 6) Sneed Inc. buys equipment on Gctober 1.2023 for 5600.000 cash. They estimate the equipment will have a salvage value of $100,000 and a useful tile of 10 years. a. Write the journal entry to recoed depeciation for 2023 b. Record the journal entry to recoed depreciation expense for the seoond year. c. What is the book value of this equipment on the Decernber 31, 2024 Balanoe Sheet? 7) What is the total cost (the "capitalized" cost) of machinery cecently purchased and based on the following information: Cash purchase price madias Clicker Question Preparation Guide: Ch. 8 \& 9 Cider questions will be asked in class based on your completion of this preparasion guide. You will nat have time to conplete tha guide in classi You ane repired be handinte youg answers to thes absignment. Part 1: Accounts Recelvables and Allowance Method 1) Spencer Co, is a large wholesaler of electronics. At the end of 2023 , the company's controlier estimates 5% of the $212,500 in Accounts Receivable will be uncollectibic. a. Write the journal entry to recoed Bad Debt Expense for the period if the Alowance for Doubtful Acoounts has a credil balance of $2,550 before this adjusting entry is posted: b. How does the posting of this joumal entry affect the aceounting equation? c. What is the Not Renalizabie Valun of Accounts Recoivablen reported in Spencer Co,'s balance sheet as of Doc. 31, 2023? 2) (Continuation of question 1). Assume that during 2024, a tolal of 53,725 Accourts Receivable has to be written off due to customers' inability to pay what they owe Spencer Co. a. What journal entry would be used to record this write-of of $3,725 ? 12/31/24 b. How does the posting of this joumal entry atiect the acopunting equation? c. What is the Alowance for Doubthul Accounts balance after this wrie olf?? (Your answer should indicate the amount and whether it is a Debit or Credit balance. Hint: Use a T-account to determine your answer-3) d. Spencer Co. assumes that at the end of 2024, 5\% of ts new 5225.000 Acoourts Receivable balance will be uncoliectible. Using the Allowance for Doubdul Accourts balance from above (question 2) c.) determine the Bad Rebt Fapacen that would be recorded at the end of 2024 and enter the joumal entry below: \( 1 2 \longdiv { 3 1 / 2 0 2 4 } \) Part 2: Notes Recelvable 3) On August 1, 2023, Castle Inc. lends $16,000 to Kright Co. for 6 months. What journal entry does Castle inc. recond for this transaction