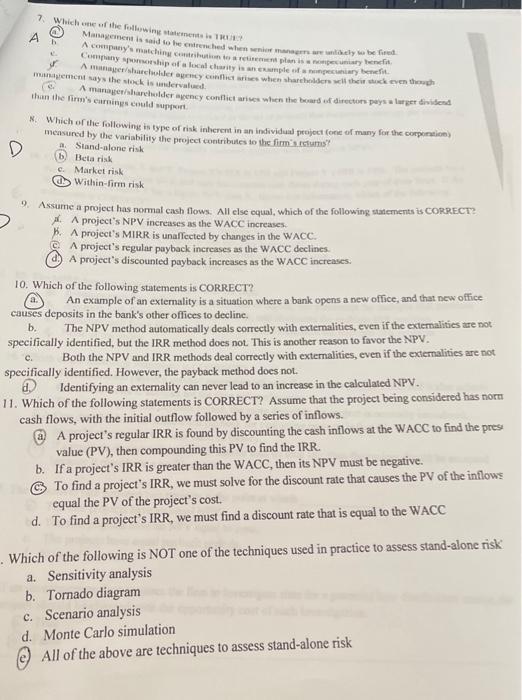

7. Which ene of the following stakenerts is 1kis? N. Which of thie following is type of riak interent in an infividual peojoct (one of many for the componeion) mesured by the variability the project contributes to the fimis reflums? (b. Stand-alone risk c. Market risk (d) Within-fim risk 9. Assume a project has normal cash flows. All else oqual, which of the following stamenents is CORRECT? A. A project's NPV increases as the WACC increases. F. A project's MIRR is unaffected by changes in the WACC. C. A project's regular payback increases as the WACC declines. (d.) A project's discounted payback increases as the WACC increases. 10. Which of the following statements is CORRECT? (a) An example of an extemality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to decline. b. The NPV method automatically deals correetly with externalities, even if the externalities are not. specifically identified, but the IRR method does not This is another reason to favor the NPV. c. Both the NPV and IRR methods deal correctly with externalities, even if the extemalities are not. specifically identified. However, the payback method does not. d. Identifying an externality can never lead to an increase in the calculated NPV. 11. Which of the following statements is CORRECT? Assume that the project being considered has norn cash flows, with the initial outflow followed by a series of inflows. (a) A project's regular IRR is found by discounting the cash inflows at the WACC to find the prese value (PV), then compounding this PV to find the IRR. b. If a project's IRR is greater than the WACC, then its NPV must be negative. C. To find a project's IRR, we must solve for the discount rate that causes the PV of the inflows equal the PV of the project's cost. d. To find a project's IRR, we must find a discount rate that is equal to the WACC Which of the following is NOT one of the techniques used in practice to assess stand-alone risk a. Sensitivity analysis b. Tornado diagram c. Scenario analysis d. Monte Carlo simulation c) All of the above are techniques to assess stand-alone risk