Question

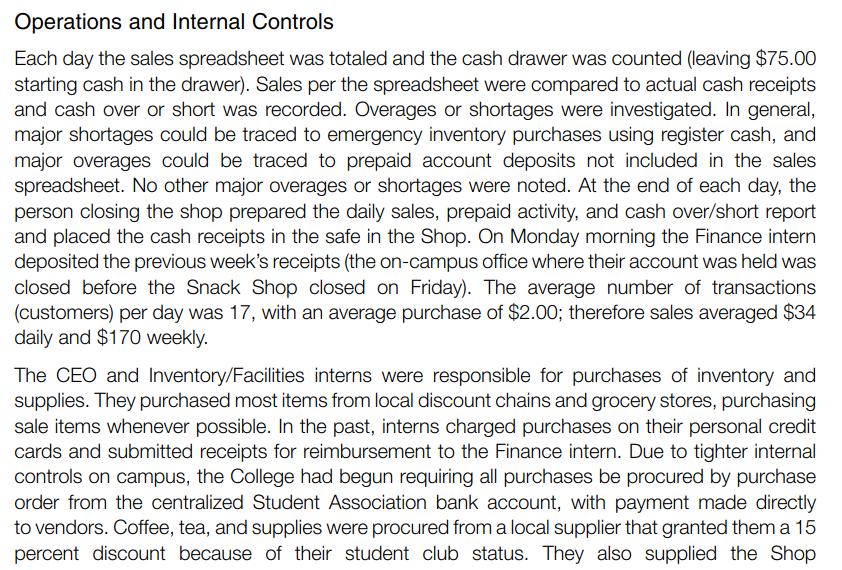

7. Why are breakeven sales dollars different when considering the weighted average contribution margin for the sales mix than when the average contribution margin (without

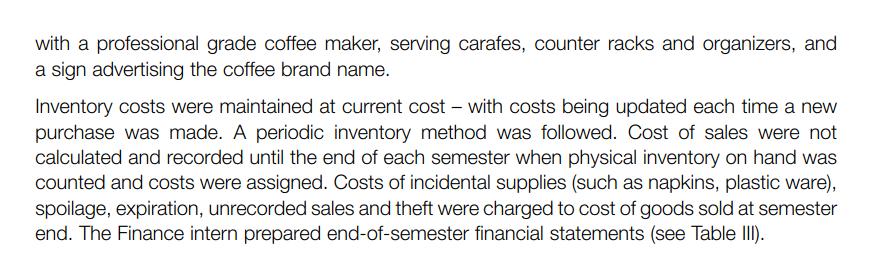

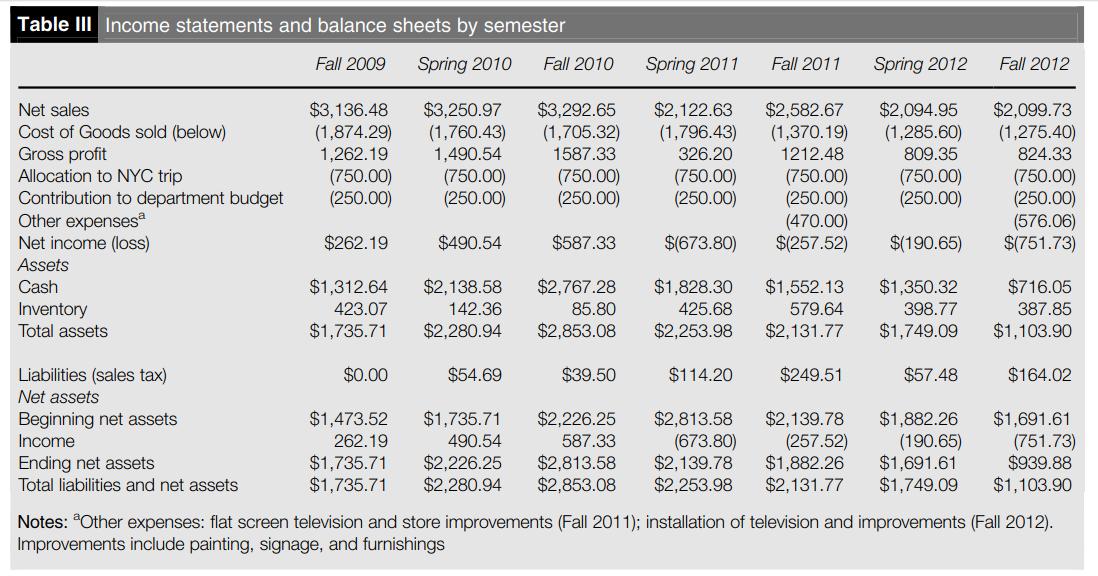

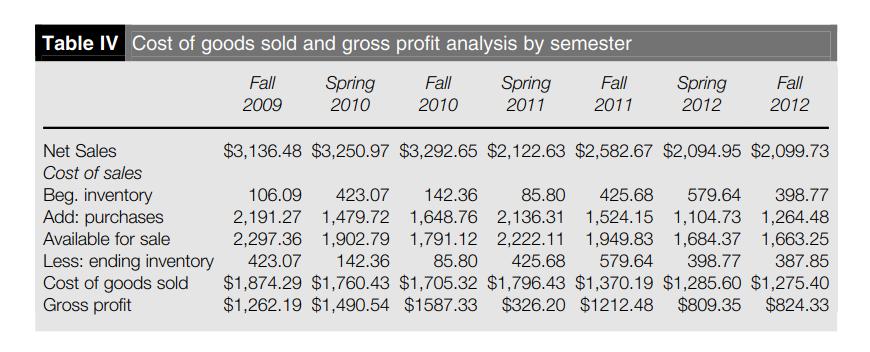

7. Why are breakeven sales dollars different when considering the weighted average contribution margin for the sales mix than when the average contribution margin (without considering the sales mix) is used? What costs are not captured in the calculation? Hint: see Table I and Operations and Internal Controls above.

Table I Product categories, sales mix, and gross profit percentages Average selling price Average gross profit percent Percent of Category total sales $1.24 $1.50 $1.00 $1.25 Coffee and tea 17 57 Bottled and canned beverages Snacks and candy 48 55 29 38 Other 29 Total 100.0 Note: The gross profit percentages do not factor in product expiration or spoilage, incidental supplies, unrecorded sales, or theft

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Business Reporting For Decision Making

Authors: Jacqueline Birt, Keryn Chalmers, Albie Brooks, Suzanne Byrne, Judy Oliver

4th Edition

978-0730302414, 0730302415

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App