Answered step by step

Verified Expert Solution

Question

1 Approved Answer

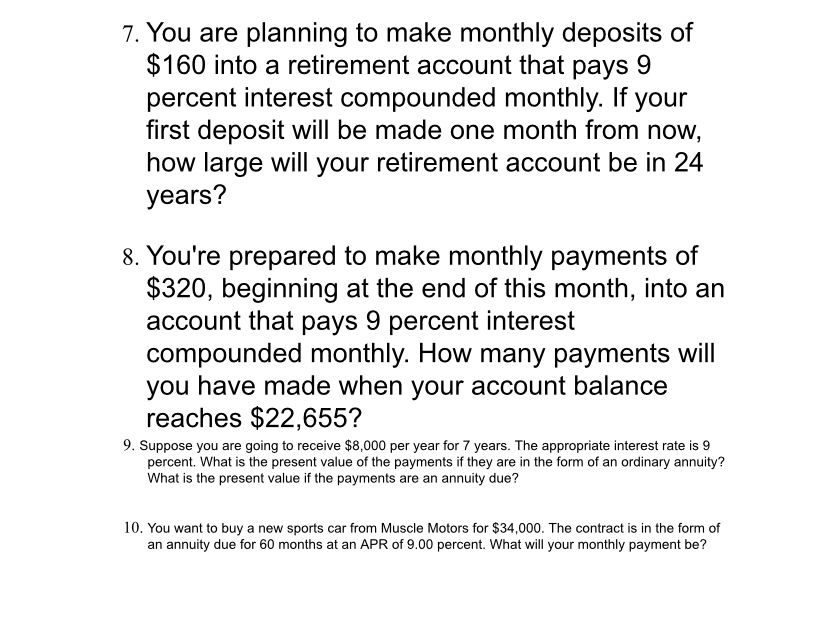

7 . you are planning to make monthly deposits of $ 1 6 0 into a retirement account that pays 9 percent interest compounded monthly.

you are planning to make monthly deposits of

$ into a retirement account that pays

percent interest compounded monthly. If your

first deposit will be made one month from now,

how large will your retirement account be in

years?

you're prepared to make monthly payments of

$ beginning at the end of this month, into an

account that pays percent interest

compounded monthly. How many payments will

you have made when your account balance

reaches $

Suppose you are going to receive $ per year for years. The appropriate interest rate is

percent. What is the present value of the payments if they are in the form of an ordinary annuity?

What is the present value if the payments are an annuity due?

You want to buy new sports car from Muscle Motors for $ The contract is in the form of

an annuity due for months at an APR of percent. What will your monthly payment be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started