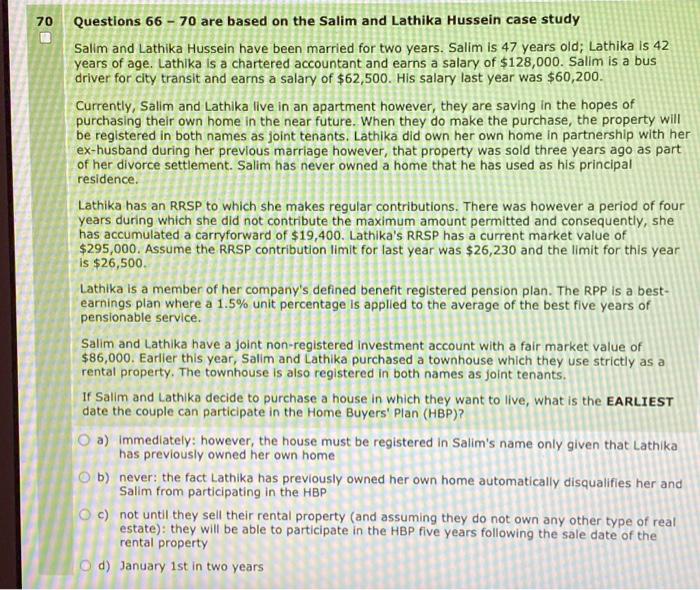

70 Questions 66 - 70 are based on the Salim and Lathika Hussein case study Salim and Lathika Hussein have been married for two years. Salim is 47 years old; Lathika is 42 years of age. Lathika is a chartered accountant and earns a salary of $128,000. Salim is a bus driver for city transit and earns a salary of $62,500. His salary last year was $60,200. Currently, Salim and Lathika live in an apartment however, they are saving in the hopes of purchasing their own home in the near future. When they do make the purchase, the property will be registered in both names as joint tenants. Lathika did own her own home in partnership with her ex-husband during her previous marriage however, that property was sold three years ago as part of her divorce settlement. Salim has never owned a home that he has used as his principal residence Lathika has an RRSP to which she makes regular contributions. There was however a period of four years during which she did not contribute the maximum amount permitted and consequently, she has accumulated a carryforward of $19,400. Lathika's RRSP has a current market value of $295,000. Assume the RRSP contribution limit for last year was $26,230 and the limit for this year is $26,500. Lathika is a member of her company's defined benefit registered pension plan. The RPP is a best- earnings plan where a 1.5% unit percentage is applied to the average of the best five years of pensionable service. Salim and Lathika have a joint non-registered Investment account with a fair market value of $86,000. Earlier this year, Salim and Lathika purchased a townhouse which they use strictly as a rental property. The townhouse is also registered in both names as joint tenants. if Salim and Lathika decide to purchase a house in which they want to live, what is the EARLIEST date the couple can participate in the Home Buyers' Plan (HBP)? a) immediately: however, the house must be registered in Salim's name only given that Lathika has previously owned her own home b) never: the fact Lathika has previously owned her own home automatically disqualifies her and Salim from participating in the HBP c) not until they sell their rental property (and assuming they do not own any other type of real estate): they will be able to participate in the HBP five years following the sale date of the rental property d) January 1st in two years