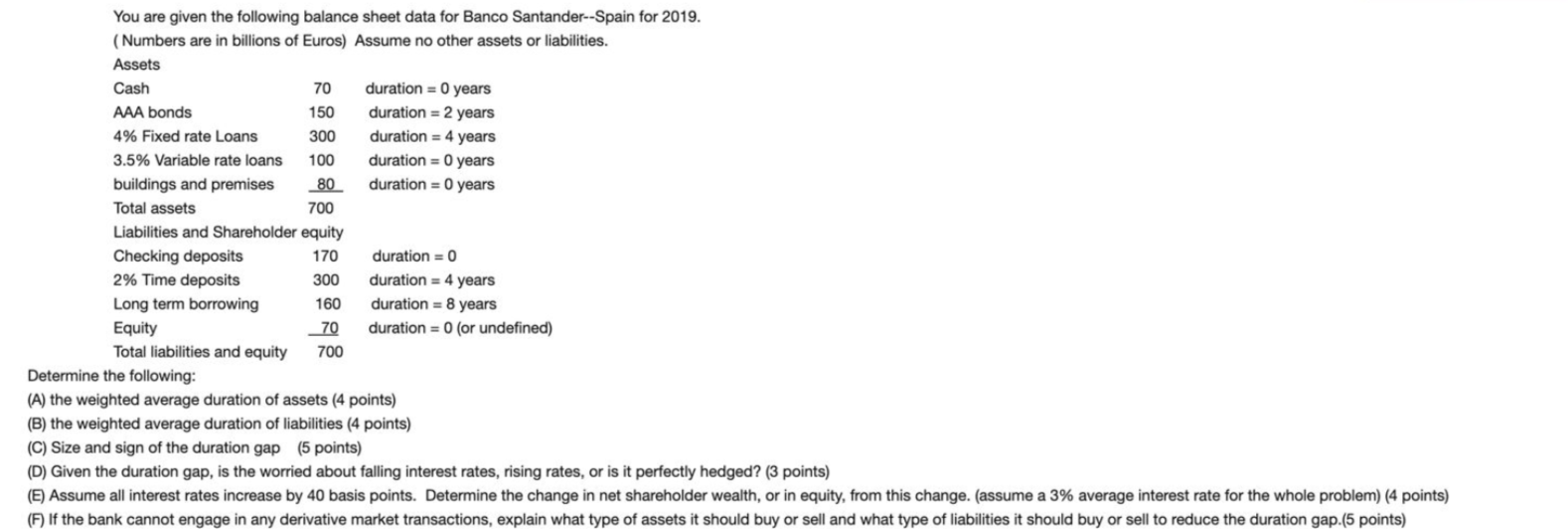

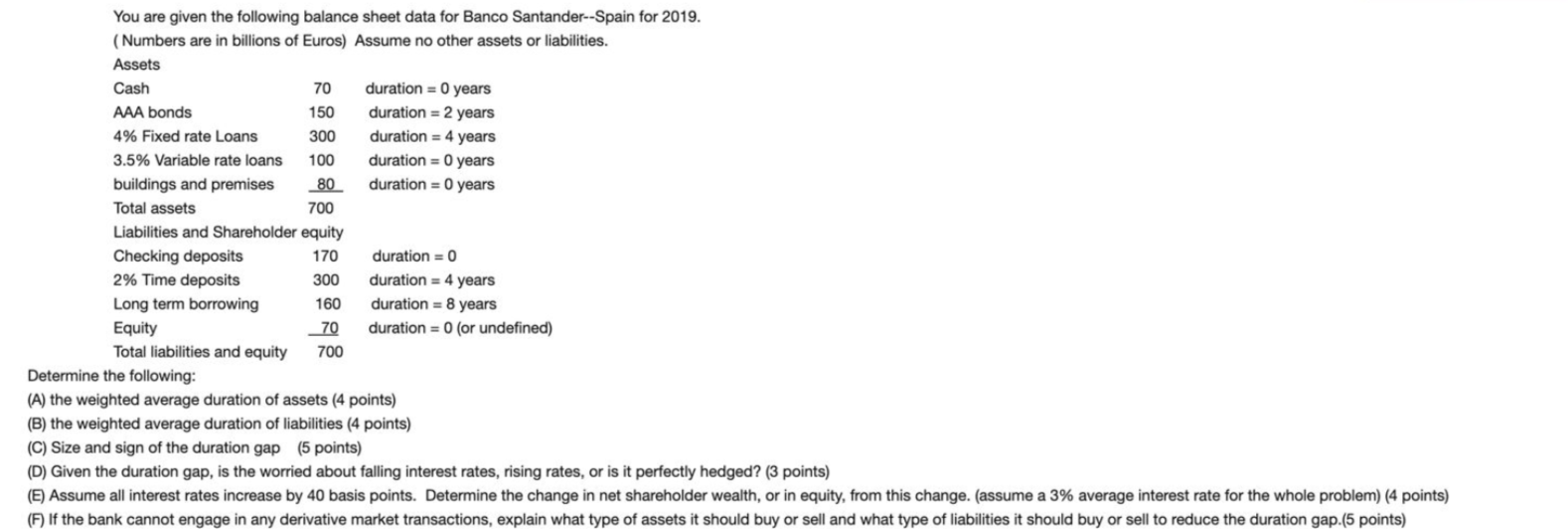

700 You are given the following balance sheet data for Banco Santander--Spain for 2019. (Numbers are in billions of Euros) Assume no other assets or liabilities. Assets Cash 70 duration = 0 years AAA bonds 150 duration = 2 years 4% Fixed rate Loans 300 duration = 4 years 3.5% Variable rate loans 100 duration = 0 years buildings and premises 80 duration = 0 years Total assets Liabilities and Shareholder equity Checking deposits 170 duration = 0 1 2% Time deposits 300 duration = 4 years Long term borrowing 160 duration = 8 years = Equity 70 duration = 0 (or undefined) Total liabilities and equity 700 Determine the following: (A) the weighted average duration of assets (4 points) (B) the weighted average duration of liabilities (4 points) (C) Size and sign of the duration gap (5 points) (D) Given the duration gap, is the worried about falling interest rates, rising rates, or is it perfectly hedged? (3 points) (E) Assume all interest rates increase by 40 basis points. Determine the change in net shareholder wealth, or in equity, from this change. (assume a 3% average interest rate for the whole problem) (4 points) (F) If the bank cannot engage in any derivative market transactions, explain what type of assets it should buy or sell and what type of liabilities it should buy or sell to reduce the duration gap.(5 points) 700 You are given the following balance sheet data for Banco Santander--Spain for 2019. (Numbers are in billions of Euros) Assume no other assets or liabilities. Assets Cash 70 duration = 0 years AAA bonds 150 duration = 2 years 4% Fixed rate Loans 300 duration = 4 years 3.5% Variable rate loans 100 duration = 0 years buildings and premises 80 duration = 0 years Total assets Liabilities and Shareholder equity Checking deposits 170 duration = 0 1 2% Time deposits 300 duration = 4 years Long term borrowing 160 duration = 8 years = Equity 70 duration = 0 (or undefined) Total liabilities and equity 700 Determine the following: (A) the weighted average duration of assets (4 points) (B) the weighted average duration of liabilities (4 points) (C) Size and sign of the duration gap (5 points) (D) Given the duration gap, is the worried about falling interest rates, rising rates, or is it perfectly hedged? (3 points) (E) Assume all interest rates increase by 40 basis points. Determine the change in net shareholder wealth, or in equity, from this change. (assume a 3% average interest rate for the whole problem) (4 points) (F) If the bank cannot engage in any derivative market transactions, explain what type of assets it should buy or sell and what type of liabilities it should buy or sell to reduce the duration gap.(5 points)