Answered step by step

Verified Expert Solution

Question

1 Approved Answer

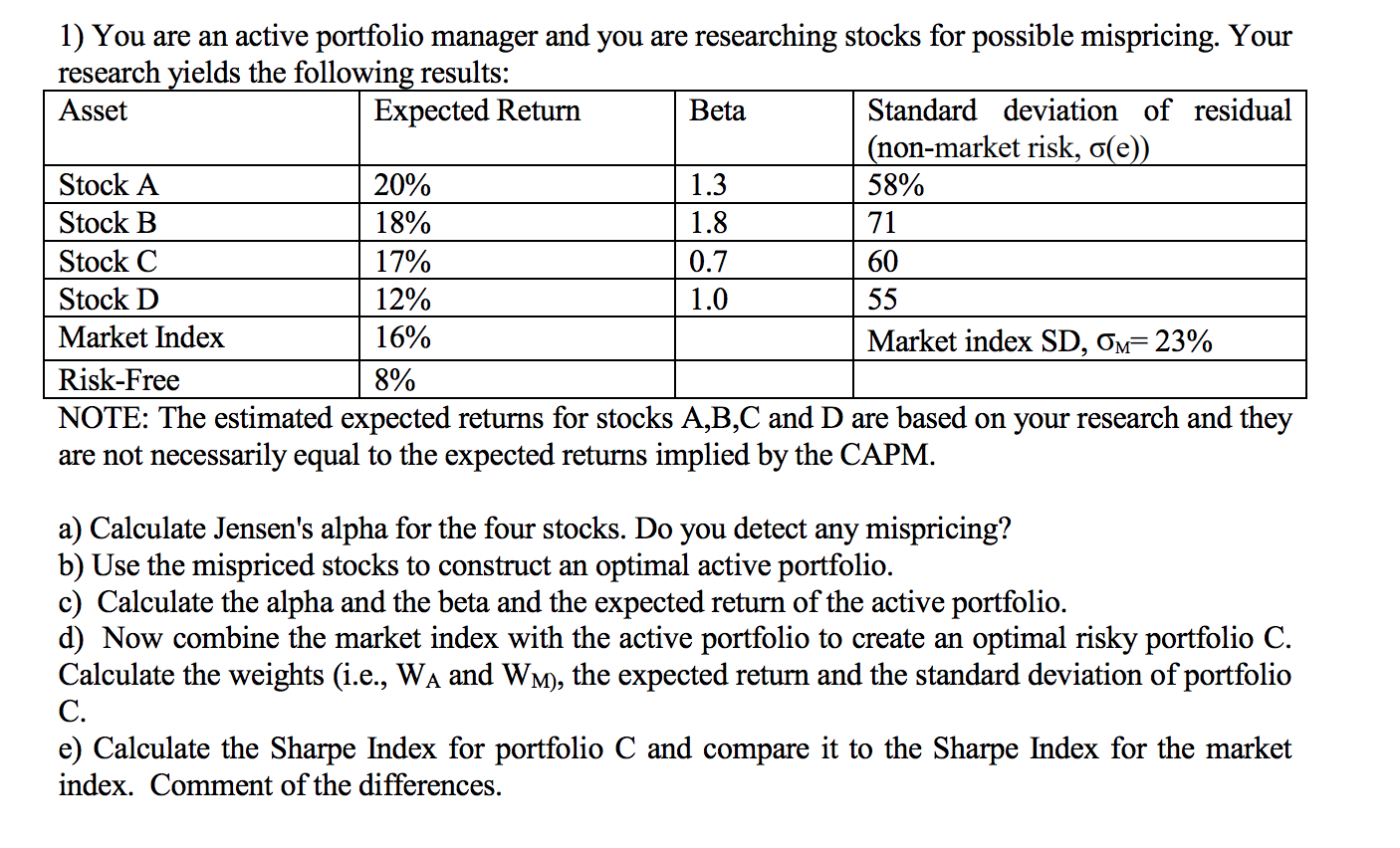

71 1) You are an active portfolio manager and you are researching stocks for possible mispricing. Your research yields the following results: Asset Expected Return

71 1) You are an active portfolio manager and you are researching stocks for possible mispricing. Your research yields the following results: Asset Expected Return Beta Standard deviation of residual | (non-market risk, o(e)) Stock A 20% | 1.3 58% Stock B 18% 1.8 Stock C 17% 0.7 Stock D 12% 1.0 Market Index 16% Market index SD, OM= 23% Risk-Free NOTE: The estimated expected returns for stocks A,B,C and D are based on your research and they are not necessarily equal to the expected returns implied by the CAPM. 60 55 8% a) Calculate Jensen's alpha for the four stocks. Do you detect any mispricing? b) Use the mispriced stocks to construct an optimal active portfolio. c) Calculate the alpha and the beta and the expected return of the active portfolio. d) Now combine the market index with the active portfolio to create an optimal risky portfolio C. Calculate the weights (i.e., WA and WM), the expected return and the standard deviation of portfolio e) Calculate the Sharpe Index for portfolio C and compare it to the Sharpe Index for the market index. Comment of the differences. 71 1) You are an active portfolio manager and you are researching stocks for possible mispricing. Your research yields the following results: Asset Expected Return Beta Standard deviation of residual | (non-market risk, o(e)) Stock A 20% | 1.3 58% Stock B 18% 1.8 Stock C 17% 0.7 Stock D 12% 1.0 Market Index 16% Market index SD, OM= 23% Risk-Free NOTE: The estimated expected returns for stocks A,B,C and D are based on your research and they are not necessarily equal to the expected returns implied by the CAPM. 60 55 8% a) Calculate Jensen's alpha for the four stocks. Do you detect any mispricing? b) Use the mispriced stocks to construct an optimal active portfolio. c) Calculate the alpha and the beta and the expected return of the active portfolio. d) Now combine the market index with the active portfolio to create an optimal risky portfolio C. Calculate the weights (i.e., WA and WM), the expected return and the standard deviation of portfolio e) Calculate the Sharpe Index for portfolio C and compare it to the Sharpe Index for the market index. Comment of the differences

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started