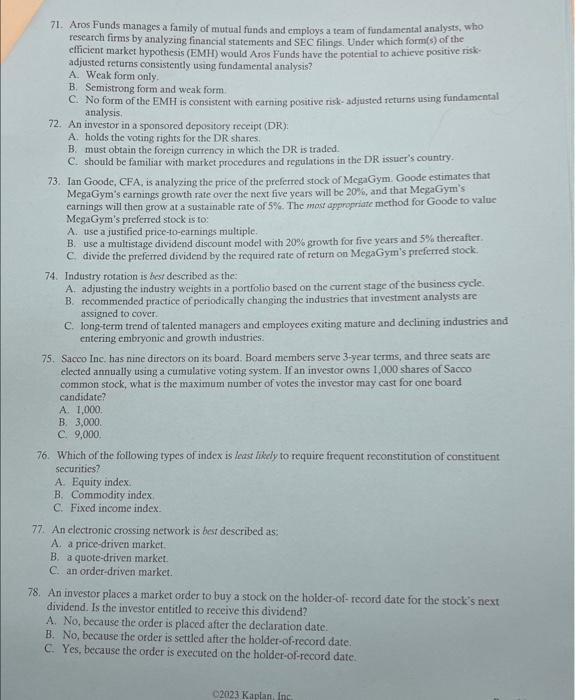

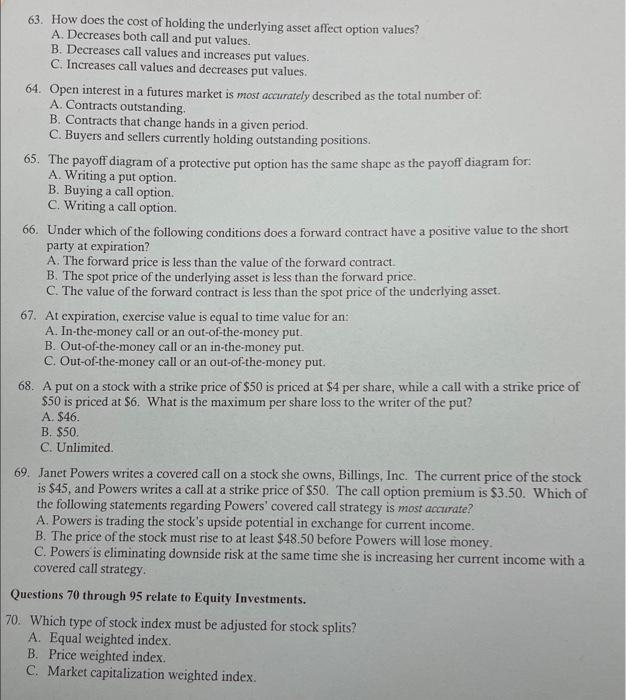

71. Aros Funds manages a family of mutual funds and employs a team of fundamental analysts, who research firms by analyzing financial statements and SEC filings. Under which form(s) of the efficient market hypothesis (EMH) would Aros Funds have the potential to achieve positive riskadjusted returns consistently using fundamental analysis? A. Weak form only. B. Semistrong form and weak form. C. No form of the EMH is consistent with earning positive risk- adjusted returns using fundamental analysis. 72. An investor in a sponsored depository receipt (DR): A. holds the voting rights for the DR shares. B. must obtain the foreign currency in which the DR is traded. C. should be familiar with market procedures and regulations in the DR issuer's country. 73. Ian Goode, CFA, is analyzing the price of the preferred stock of MegaGym. Goode estimates that MegaGym's earnings growth rate over the next five years will be 20%, and that MegaGym's earnings will then grow at a sustainable rate of 5%. The mos appropriate method for Goode to value MegaGym's preferred stock is to: A. use a justified price-to-earnings multiple. B. use a multistage dividend discount model with 20% growth for five years and 5% thereafter C divide the preferred dividend by the required rate of return on MegaGym's preferred stock: 74. Industry rotation is best described as the: A. adjusting the industry weights in a portfolio based on the current stage of the business cycle. B. recommended practice of periodically changing the industries that investment analysts are assigned to cover. C. longterm trend of talented managers and employees exiting mature and declining industries and entering embryonic and growth industries. 75. Sacco Inc, has nine directors on its board. Board members serve 3 -year terms, and three seats are elected annually using a cumulative voting system. If an investor owns 1,000 shares of Sacco common stock, what is the maximum number of votes the investor may cast for one board candidate? A. 1,000 B. 3,000 . C. 9,000 76. Which of the following types of index is lass likely to require frequent reconstitution of constituent securitics? A. Equity index. B. Commodity index C. Fixed income index. 77. An electronic crossing network is ber described as: A. a price-driven market. B. a quote-driven market. C. an order-driven market. 78. An investor places a market order to buy a stock on the holder-of-record date for the stock's next dividend. Is the investor entitled to receive this dividend? A. No, because the order is placed after the declaration date. B. No, because the order is settled after the holder-of-record date: C. Yes, because the order is executed on the holder-of-record date. 63. How does the cost of holding the underlying asset affect option values? A. Decreases both call and put values. B. Decreases call values and increases put values. C. Increases call values and decreases put values. 64. Open interest in a futures market is most accurately described as the total number of: A. Contracts outstanding. B. Contracts that change hands in a given period. C. Buyers and sellers currently holding outstanding positions. 65. The payoff diagram of a protective put option has the same shape as the payoff diagram for: A. Writing a put option. B. Buying a call option. C. Writing a call option. 66. Under which of the following conditions does a forward contract have a positive value to the short party at expiration? A. The forward price is less than the value of the forward contract. B. The spot price of the underlying asset is less than the forward price. C. The value of the forward contract is less than the spot price of the underlying asset: 67. At expiration, exercise value is equal to time value for an: A. In-the-money call or an out-of-the-money put. B. Out-of-the-money call or an in-the-money put. C. Out-of-the-money call or an out-of-the-money put. 68. A put on a stock with a strike price of $50 is priced at $4 per share, while a call with a strike price of $50 is priced at $6. What is the maximum per share loss to the writer of the put? A. $46. B. $50. C. Unlimited. 69. Janet Powers writes a covered call on a stock she owns, Billings, Inc. The current price of the stock is $45, and Powers writes a call at a strike price of $50. The call option premium is $3.50. Which of the following statements regarding Powers' covered call strategy is most accurate? A. Powers is trading the stock's upside potential in exchange for current income. B. The price of the stock must rise to at least $48.50 before Powers will lose money. C. Powers is eliminating downside risk at the same time she is increasing her current income with a covered call strategy. Questions 70 through 95 relate to Equity Investments. 70. Which type of stock index must be adjusted for stock splits? A. Equal weighted index. B. Price weighted index. C. Market capitalization weighted index