7.16?

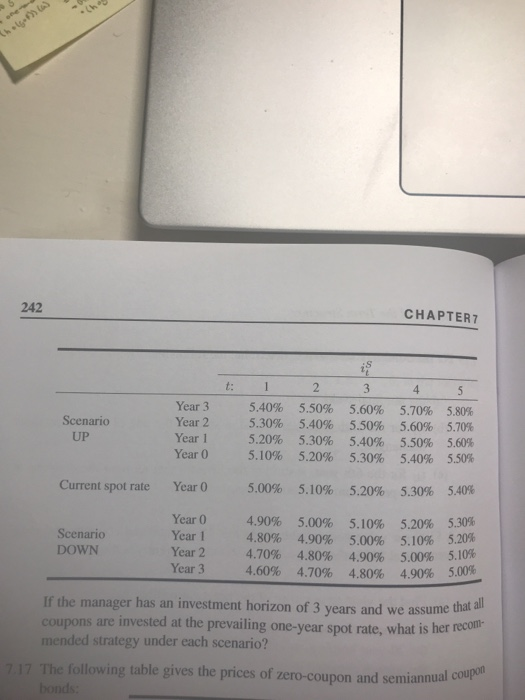

4% semiannual coupons and is re- The bond is currently selling at $105. $103 after 20 years. The bond is NA $100 pull demable at $107 maturity of the bond convertible yearly (a) Find the yield to ma reinvested at 4.5% compounded semiannually, find -period yield convertible yearly. Compare this with (b) If coupons can be rein the 20-year holding period the answer obtained in (a). r value bond has 7.5% annual coupons 5% annual coupons and is callable at the end oh the 12th years at par. The price of the bond at issue was the yield to maturity is 7%. Mary purchased 115 A $100 par value of the 8th through the 12 determined by assun the bond and held it u d and held it until it was called after 10 years. late the yield to maturity of Mary's investment in the 10-year pe- (a) Calculate the yield tom riod. b) Calculate the 10-year holding-period yield of Mary if coupons can be reinvested at only 6%. 116 Consider two bonds, A and B. Bond A is a 5-year 2% annual-coupon bond, and Bond B is a 3-year 4% annual-coupon bond. In addition to the cur- rent spot-rate curve, a fund manager assumes 2 scenarios of spot-rate curve movements in the next 3 years. Scenario UP assumes an instantaneous 0.1% parallel shift upwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. Scenario DOWN assumes an instantaneous 0.1% parallel shift downwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. The spot-rate curves, under vari- ous scenarios, are summarised in the following table. 242 CHAPTER 7 Scenario UP Year 3 Year 2 Year 1 Year 0 1 5.40% 5.30% 5.20% 5.10% 2 5.50% 5.40% 5.30% 5.20% 3 5.60% 5.50% 5.40% 5.30% 4 5.70% 5.60% 5.50% 5.40% 5 5.80% 5.70% 5.60% 5.50% Current spot rate Year 0 5.00% 5.10% 5.20% 5.30% 5.40% Scenario DOWN Year 0 Year 1 Year 2 Year 3 4.90% 4.80% 4.70% 4.60% 5.00% 4.90% 4.80% 4.70% 5.10% 5.00% 4.90% 4.80% 5.20% 5.10% 5.00% 4.90% 5.30% 5.20 5.10% 5.00% If the manager has an investment horizon of 3 years and we assume that coupons are invested at the prevailing one-year spot rate, what is her recom mended strategy under each scenario? 17. The following table gives the prices of zero-coupon and semiannual coup 4% semiannual coupons and is re- The bond is currently selling at $105. $103 after 20 years. The bond is NA $100 pull demable at $107 maturity of the bond convertible yearly (a) Find the yield to ma reinvested at 4.5% compounded semiannually, find -period yield convertible yearly. Compare this with (b) If coupons can be rein the 20-year holding period the answer obtained in (a). r value bond has 7.5% annual coupons 5% annual coupons and is callable at the end oh the 12th years at par. The price of the bond at issue was the yield to maturity is 7%. Mary purchased 115 A $100 par value of the 8th through the 12 determined by assun the bond and held it u d and held it until it was called after 10 years. late the yield to maturity of Mary's investment in the 10-year pe- (a) Calculate the yield tom riod. b) Calculate the 10-year holding-period yield of Mary if coupons can be reinvested at only 6%. 116 Consider two bonds, A and B. Bond A is a 5-year 2% annual-coupon bond, and Bond B is a 3-year 4% annual-coupon bond. In addition to the cur- rent spot-rate curve, a fund manager assumes 2 scenarios of spot-rate curve movements in the next 3 years. Scenario UP assumes an instantaneous 0.1% parallel shift upwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. Scenario DOWN assumes an instantaneous 0.1% parallel shift downwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. The spot-rate curves, under vari- ous scenarios, are summarised in the following table. 242 CHAPTER 7 Scenario UP Year 3 Year 2 Year 1 Year 0 1 5.40% 5.30% 5.20% 5.10% 2 5.50% 5.40% 5.30% 5.20% 3 5.60% 5.50% 5.40% 5.30% 4 5.70% 5.60% 5.50% 5.40% 5 5.80% 5.70% 5.60% 5.50% Current spot rate Year 0 5.00% 5.10% 5.20% 5.30% 5.40% Scenario DOWN Year 0 Year 1 Year 2 Year 3 4.90% 4.80% 4.70% 4.60% 5.00% 4.90% 4.80% 4.70% 5.10% 5.00% 4.90% 4.80% 5.20% 5.10% 5.00% 4.90% 5.30% 5.20 5.10% 5.00% If the manager has an investment horizon of 3 years and we assume that coupons are invested at the prevailing one-year spot rate, what is her recom mended strategy under each scenario? 17. The following table gives the prices of zero-coupon and semiannual coup