Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7.2.1 Liabilities of 1 each are due at the ends of periods 1 and 2. There are three securities available to produce asset income

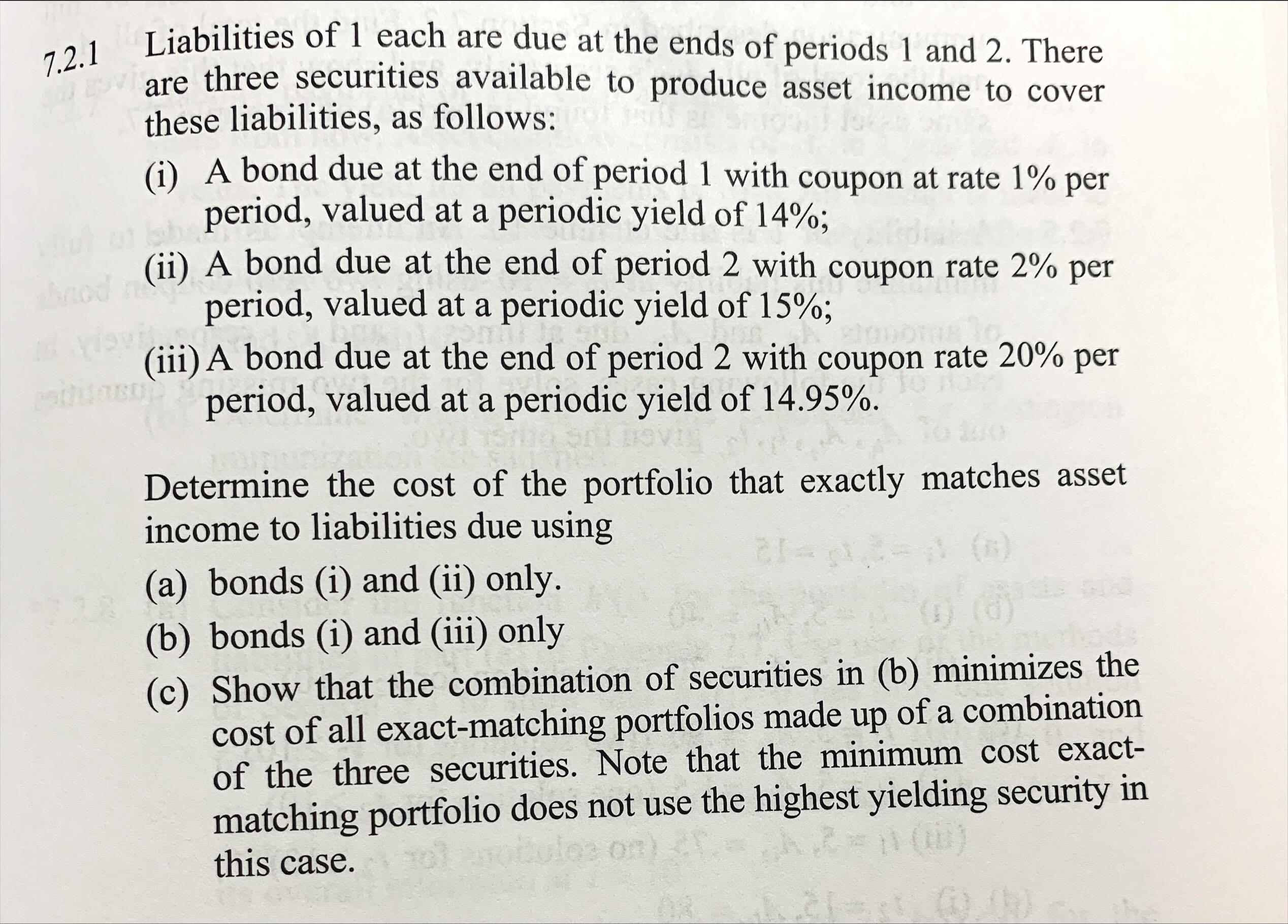

7.2.1 Liabilities of 1 each are due at the ends of periods 1 and 2. There are three securities available to produce asset income to cover these liabilities, as follows: (i) A bond due at the end of period 1 with coupon at rate 1% per period, valued at a periodic yield of 14%; shnod n (ii) A bond due at the end of period 2 with coupon rate 2% per period, valued at a periodic yield of 15%; mit al vlovi... (iii) A bond due at the end of period 2 with coupon rate 20% per period, valued at a periodic yield of 14.95%. 15706 501 DO Determine the cost of the portfolio that exactly matches asset income to liabilities due using 21-0 (a) bonds (i) and (ii) only. (b) bonds (i) and (iii) only (c) Show that the combination of securities in (b) minimizes the cost of all exact-matching portfolios made up of a combination of the three securities. Note that the minimum cost exact- matching portfolio does not use the highest yielding security in this case. 02121= () ()

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To determine the cost of the portfolio that exactly matches asset income to liabilities due we can c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started