Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7.21 -Required 1- Compute the project profitability index for each investment project. 2- Rank the four projects according to preference, in terms of: a)Net present

7.21 -Required

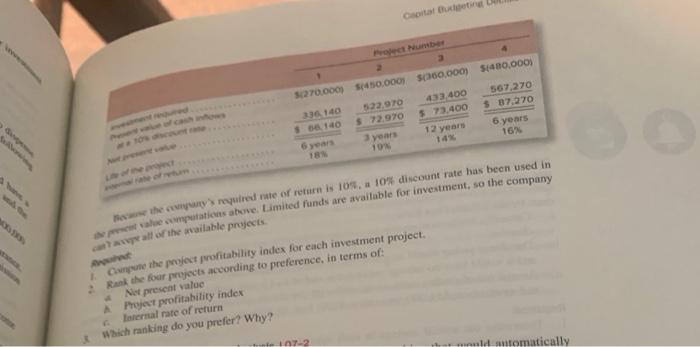

delivery as a result of reduced throughput time Aimum dollar value per year would management have to attach to these intangible henefits in order to make the new welding machine an acceptable investment? PROBLEM 7-21 Preference Ranking of investment Projects LOT-5 The management of Revco Products is exploring four different investment opportunities. Informa in om the four projects under study follows: Cat Blue Pot Nube $140,000 270.000 $450.000 300.000) 433,400 73.400 567,270 $ 37,270 6 years 16 522,970 $72.970 yan 10 336140 366140 12 years 188 they'required rate of return is 105, a 10% discount rate has been used in le computations above. Limited funds are available for investment, so the company wall or the available projects Compute the project profitability index for each investment project. Rank the four projects according to preference, in terms of: Net present value Project profitability index Forernal rate of return Which ranking do you prefer? Why? - 2 ud automatically 1- Compute the project profitability index for each investment project.

2- Rank the four projects according to preference, in terms of:

a)Net present value

b)Project profitability index

c)Internal rate of return

3- Which ranking do you prefer? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started