Answered step by step

Verified Expert Solution

Question

1 Approved Answer

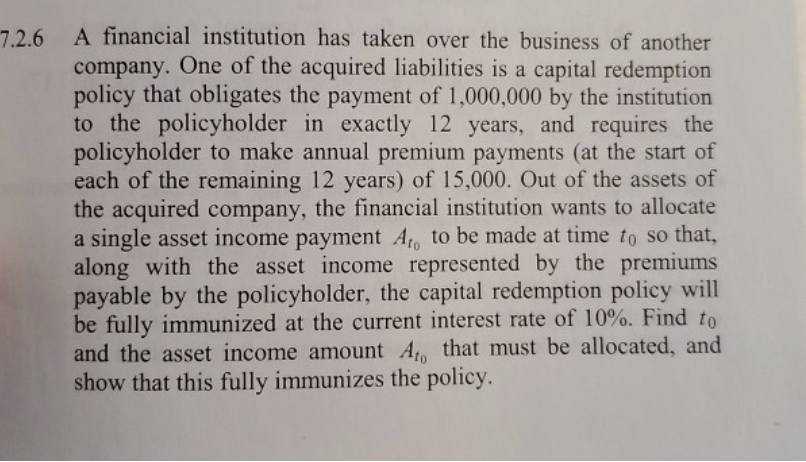

7.2.6 A financial institution has taken over the business of another company. One of the acquired liabilities is a capital redemption policy that obligates

7.2.6 A financial institution has taken over the business of another company. One of the acquired liabilities is a capital redemption policy that obligates the payment of 1,000,000 by the institution to the policyholder in exactly 12 years, and requires the policyholder to make annual premium payments (at the start of each of the remaining 12 years) of 15,000. Out of the assets of the acquired company, the financial institution wants to allocate a single asset income payment At, to be made at time to so that, along with the asset income represented by the premiums payable by the policyholder, the capital redemption policy will be fully immunized at the current interest rate of 10%. Find to and the asset income amount A, that must be allocated, and show that this fully immunizes the policy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To fully immunize the capital redemption policy we need to ensure that the present value of all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started