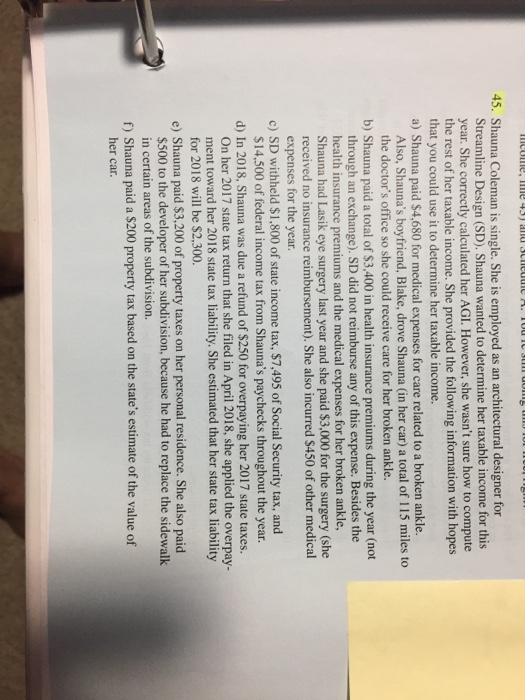

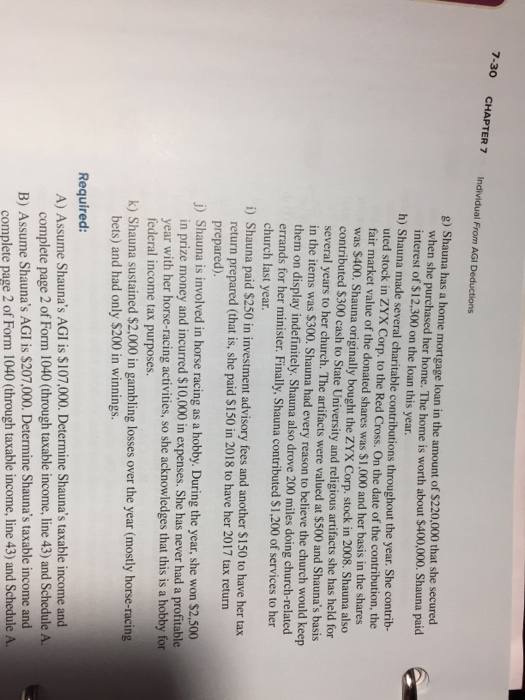

7-30 CHAPTER 7 Individual From AGI Deductions 8) Shauna has a home mortgage loan in the amount of $220,000 that she secured when she purchased her home. The home is worth about $400,000. Shauna paid interest of $12,300 on the loan this year h) Shauna made several charitable contributions throughout the year. She contrib- uted stock in ZYX Corp. to the Red Cross. On the date of the contribution, the fair market value of the donated shares was $1,000 and her basis in the shares was $400. Shauna originally bought the ZYX Corp. stock in 2008. Shauna also contributed $300 cash to State University and religious artifacts she has held for several years to her church. The artifacts were valued at $500 and Shauna's basis in the items was $300. Shauna had every reason to believe the church would keep them on display indefinitely. Shauna also drove 200 miles doing church-related errands for her minister. Finally, Shauna contributed $1,200 of services to her church last year. hauna paid $250 in investment advisory fees and another $150 to have her tax return prepared (that is, she paid $150 in 2018 to have her 2017 tax return prepared). j) Shauna is involved in horse racing as a hobby. During the year, she won $2,500 in prize money and incurred $10,000 in expenses. She has never had a profitable year with her horse-racing activities, so she acknowledges that this is a hobby for federal income tax purposes. k) Shauna sustained $2.000 in gambling losses over the year (mostly horse-racing bets) and had only $200 in winnings. Required: A) Assume Shauna's AGI is $107,000. Determine Shauna's taxable income and complete page 2 of Form 1040 (through taxable income, line 43) and Schedule A. B) Assume Shauna's AGI is $207,000. Determine Shauna's taxable income and complete page 2 of Form 1040 (through taxable income, line 43) and Schedule A 7-30 CHAPTER 7 Individual From AGI Deductions 8) Shauna has a home mortgage loan in the amount of $220,000 that she secured when she purchased her home. The home is worth about $400,000. Shauna paid interest of $12,300 on the loan this year h) Shauna made several charitable contributions throughout the year. She contrib- uted stock in ZYX Corp. to the Red Cross. On the date of the contribution, the fair market value of the donated shares was $1,000 and her basis in the shares was $400. Shauna originally bought the ZYX Corp. stock in 2008. Shauna also contributed $300 cash to State University and religious artifacts she has held for several years to her church. The artifacts were valued at $500 and Shauna's basis in the items was $300. Shauna had every reason to believe the church would keep them on display indefinitely. Shauna also drove 200 miles doing church-related errands for her minister. Finally, Shauna contributed $1,200 of services to her church last year. hauna paid $250 in investment advisory fees and another $150 to have her tax return prepared (that is, she paid $150 in 2018 to have her 2017 tax return prepared). j) Shauna is involved in horse racing as a hobby. During the year, she won $2,500 in prize money and incurred $10,000 in expenses. She has never had a profitable year with her horse-racing activities, so she acknowledges that this is a hobby for federal income tax purposes. k) Shauna sustained $2.000 in gambling losses over the year (mostly horse-racing bets) and had only $200 in winnings. Required: A) Assume Shauna's AGI is $107,000. Determine Shauna's taxable income and complete page 2 of Form 1040 (through taxable income, line 43) and Schedule A. B) Assume Shauna's AGI is $207,000. Determine Shauna's taxable income and complete page 2 of Form 1040 (through taxable income, line 43) and Schedule A