7.4?

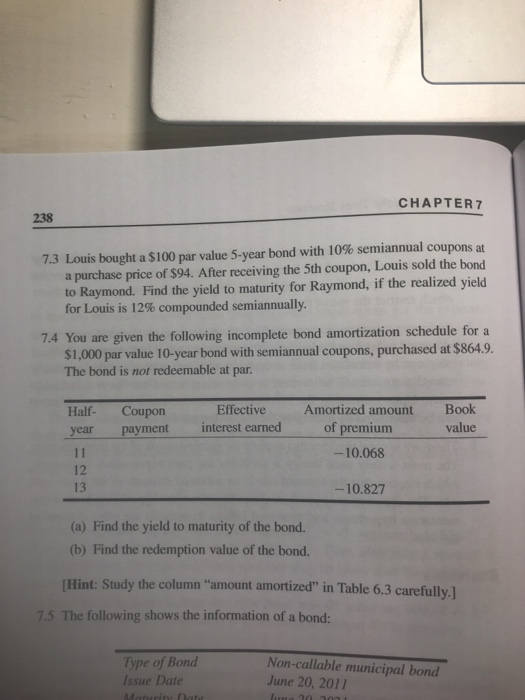

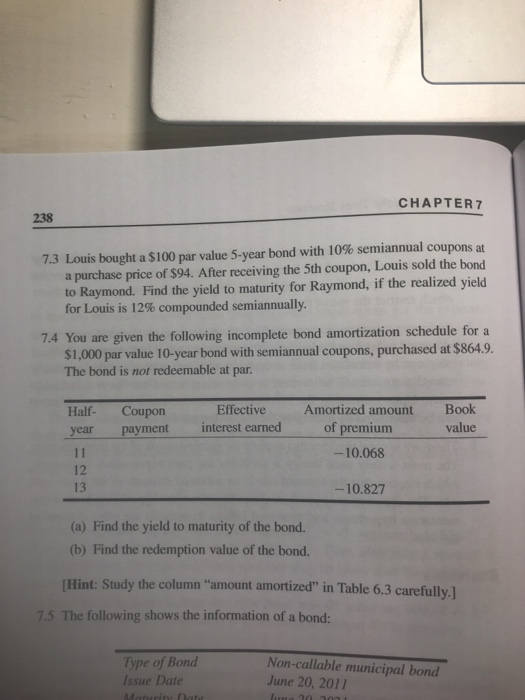

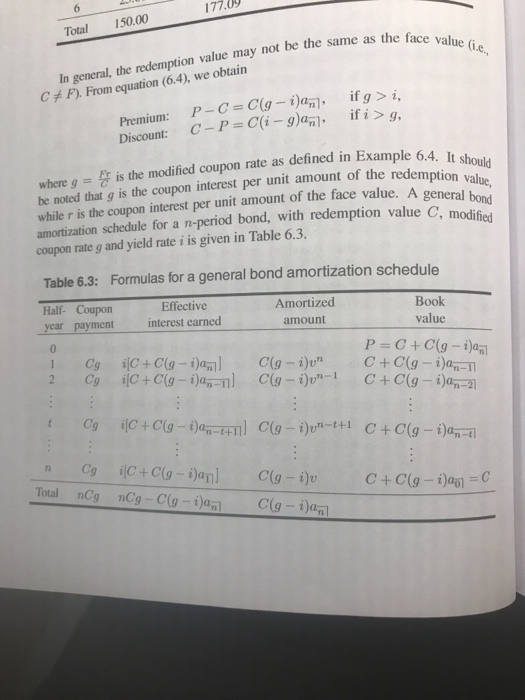

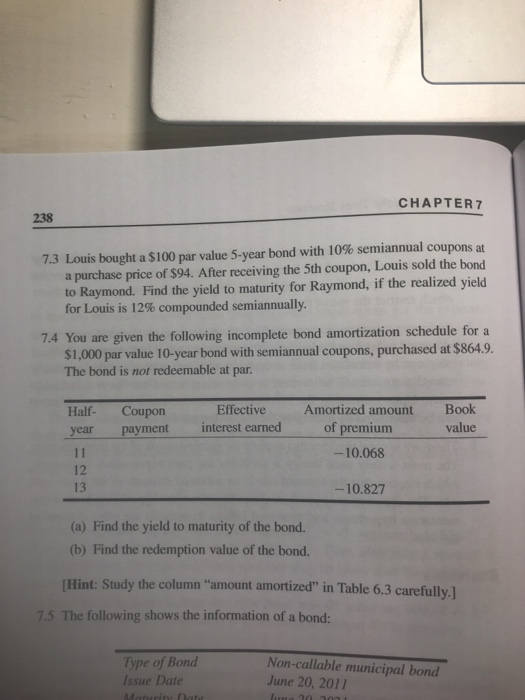

CHAPTER 7 238 7.3 Louis bought a $100 par value 5-year bond with 10% semiannual coupons at a purchase price of $94. After receiving the 5th coupon, Louis sold the bond to Raymond. Find the yield to maturity for Raymond, if the realized yield for Louis is 12% compounded semiannually. 7.4 You are given the following incomplete bond amortization schedule for a $1,000 par value 10-year bond with semiannual coupons, purchased at $864.9. The bond is not redeemable at par. Half- year Coupon payment Effective interest earned Amortized amount of premium - 10.068 Book value 13 - 10.827 (a) Find the yield to maturity of the bond. (b) Find the redemption value of the bond. (Hint: Study the column "amount amortized" in Table 6.3 carefully.] 7.5 The following shows the information of a bond: Type of Bond Issue Date Materi Date Non-callable municipal bond June 20, 2011 177.09 150.00 Total as the face value (.e. In general, the redemption value may not be the same as the C + F). From equation (6.4), we obtain if g>i. ifi > 9. Premium: Discount: P-C=C(9-ial C-P = C(-9) ; of the redemption value, ace value. A general bond dified coupon rate as defined in Example 6.4. It shoul is the modified coupon rate as defined in Ex where g = be noted that is the coupon interest per unit amount of the redempti whiler is the coupon interest per unit amount of the face value. A gen amortization schedule for a n-period bond, with redemption value C, mod coupon rate g and yield rate i is given in Table 6.3. Table 6.3: Formulas for a general bond amortization schedule Half- Coupon year payment Effective interest earned Amortized amount Book value 0 1 2 CgilC + C(9 - iaml CgilC+C(g-ilan-il Clg - i)un Clg - i)un-1 P = C + C(g- i)an C + C(g-i)-1 C + C(g-ian-2 + CgilC+C(g-i) - ml Clg - i)un-t+1 C+C(g-in-1 1 CgilC+Cg - i)an Total ncgnCg-C(g-ian C+C(g-i)071 = C C(g-i) C(g-i)an CHAPTER 7 238 7.3 Louis bought a $100 par value 5-year bond with 10% semiannual coupons at a purchase price of $94. After receiving the 5th coupon, Louis sold the bond to Raymond. Find the yield to maturity for Raymond, if the realized yield for Louis is 12% compounded semiannually. 7.4 You are given the following incomplete bond amortization schedule for a $1,000 par value 10-year bond with semiannual coupons, purchased at $864.9. The bond is not redeemable at par. Half- year Coupon payment Effective interest earned Amortized amount of premium - 10.068 Book value 13 - 10.827 (a) Find the yield to maturity of the bond. (b) Find the redemption value of the bond. (Hint: Study the column "amount amortized" in Table 6.3 carefully.] 7.5 The following shows the information of a bond: Type of Bond Issue Date Materi Date Non-callable municipal bond June 20, 2011 177.09 150.00 Total as the face value (.e. In general, the redemption value may not be the same as the C + F). From equation (6.4), we obtain if g>i. ifi > 9. Premium: Discount: P-C=C(9-ial C-P = C(-9) ; of the redemption value, ace value. A general bond dified coupon rate as defined in Example 6.4. It shoul is the modified coupon rate as defined in Ex where g = be noted that is the coupon interest per unit amount of the redempti whiler is the coupon interest per unit amount of the face value. A gen amortization schedule for a n-period bond, with redemption value C, mod coupon rate g and yield rate i is given in Table 6.3. Table 6.3: Formulas for a general bond amortization schedule Half- Coupon year payment Effective interest earned Amortized amount Book value 0 1 2 CgilC + C(9 - iaml CgilC+C(g-ilan-il Clg - i)un Clg - i)un-1 P = C + C(g- i)an C + C(g-i)-1 C + C(g-ian-2 + CgilC+C(g-i) - ml Clg - i)un-t+1 C+C(g-in-1 1 CgilC+Cg - i)an Total ncgnCg-C(g-ian C+C(g-i)071 = C C(g-i) C(g-i)an