Answered step by step

Verified Expert Solution

Question

1 Approved Answer

77 infiatson is 2.3% and Mexstan iriflation is 4.2%. Al the end of the year the tim repoys the dollar loan. a. If Bimbo expected

77

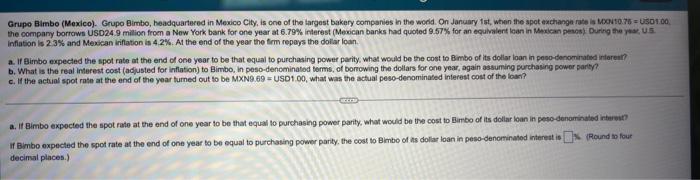

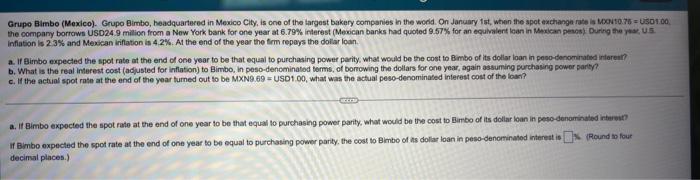

infiatson is 2.3% and Mexstan iriflation is 4.2%. Al the end of the year the tim repoys the dollar loan. a. If Bimbo expected the spot rate at the end of one year to be that equal to purchasing power parity, what would be the cost to Bimbo of its dollar loan in peso-denomiratide iniareir? b. What is the real interest cost (adjusted for inflation) to Birmbo, in peso-denominatod terms, of bonowing the dollars for one year, again assuming purchasing power party? c. If the actual spot rate at the end of the year tumed out to be MXN9.69 = USD1.00, what was the actual peso-denominated interest cost of the loan? a. If Bimbo expected the spot rate at the end of one year to be that equal to purchasing power parity, what would be the cost to Bimbo of its dollar loan in peso-denaminaled intewir? If Bimbo expected the spot rate at the end of one year to be equal to purchasing power parity, the cost to Bimbe of ns dolar loan in peso-denominated intereat is decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started