Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7-7 Justice System is purchasing a new bar code-scanning device and the table below relevant cost items for the purchase. The operating expenses are

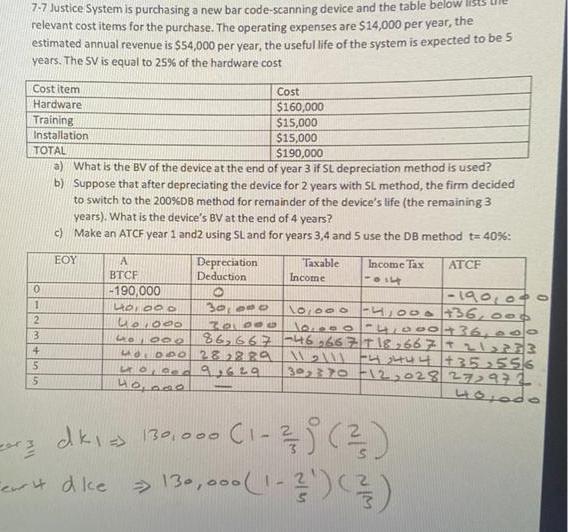

7-7 Justice System is purchasing a new bar code-scanning device and the table below relevant cost items for the purchase. The operating expenses are $14,000 per year, the estimated annual revenue is $54,000 per year, the useful life of the system is expected to be 5 years. The SV is equal to 25% of the hardware cost Cost item Hardware Training Installation TOTAL Cost $160,000 $15,000 $15,000 $190,000 a) What is the BV of the device at the end of year 3 if SL depreciation method is used? b) Suppose that after depreciating the device for 2 years with SL method, the firm decided to switch to the 200% DB method for remainder of the device's life (the remaining 3 years). What is the device's BV at the end of 4 years? c) Make an ATCF year 1 and 2 using SL and for years 3,4 and 5 use the DB method t=40%: EOY A BTCF 0 1 -190,000 Depreciation Deduction 0 Taxable Income Income Tax 1014 ATCF -190,000 10,000 -4,000 +36,000 10.000 -4,000 +36,000 86,667 46,667 T 18,667 +21333 40,000 30,000 2 40,000 70 000 3 401000 + 5 40,000 28,889 40,000 9,629 112111 5 - +42444 +35,556 30,370 12,028 27,972 400do 40,000 dk => 130,000 130,000 (1-2) (23) Fer dke A>> 130,000 (1-2) (3)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a BV of device at the end of year 3 using SL method Cost of hardware 160000 Useful life 5 years Salv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started