Answered step by step

Verified Expert Solution

Question

1 Approved Answer

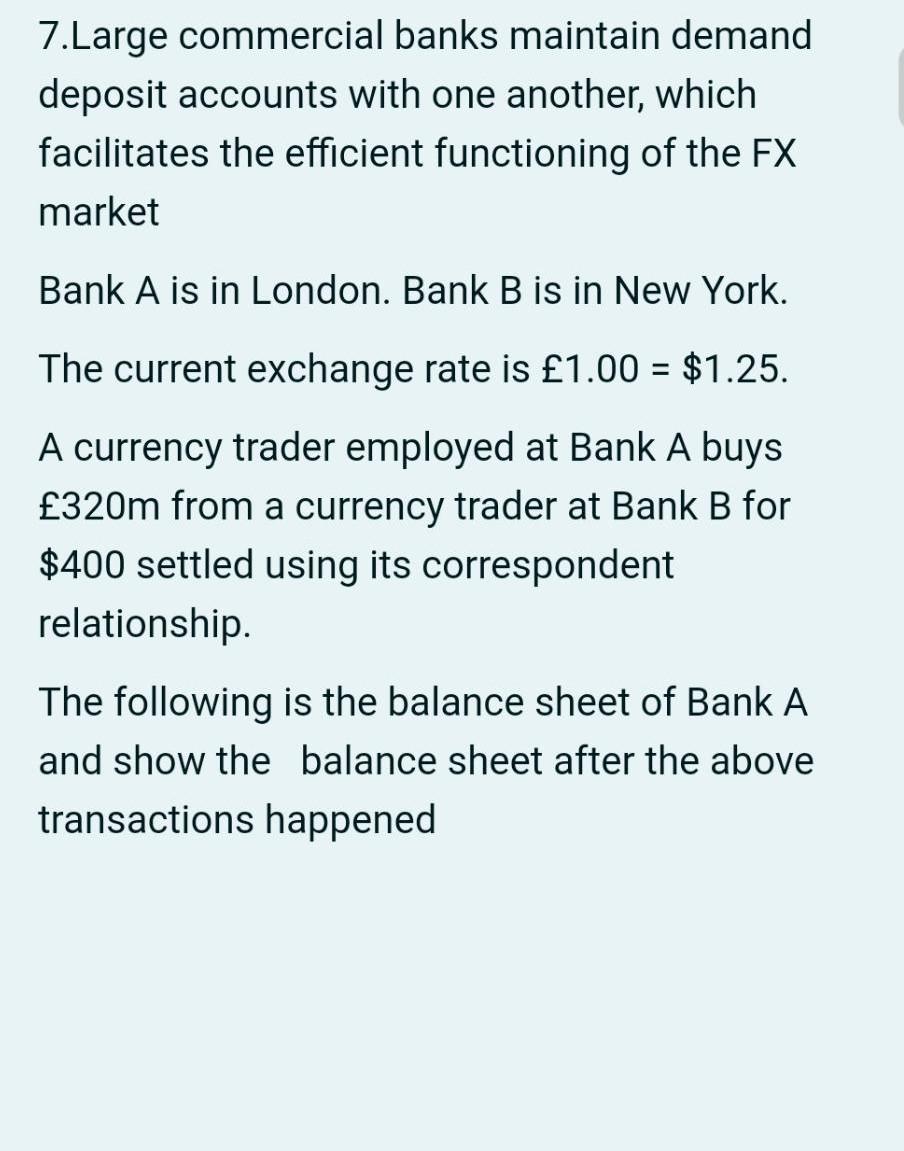

7.Large commercial banks maintain demand deposit accounts with one another, which facilitates the efficient functioning of the FX market Bank A is in London. Bank

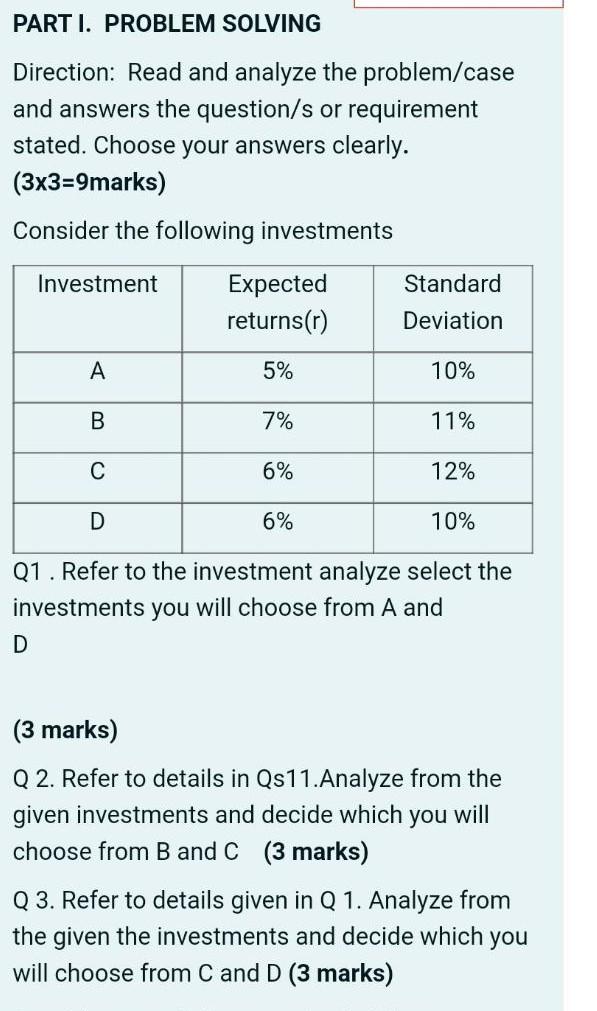

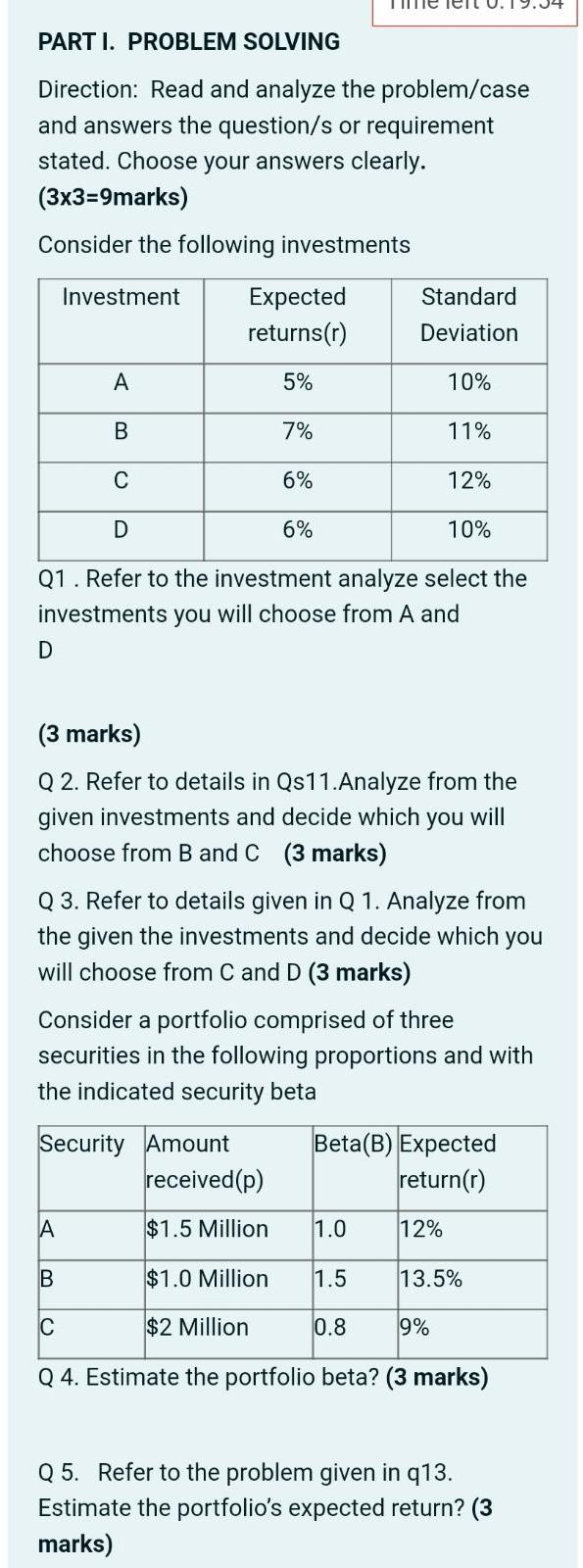

7.Large commercial banks maintain demand deposit accounts with one another, which facilitates the efficient functioning of the FX market Bank A is in London. Bank B is in New York. The current exchange rate is 1.00=$1.25. A currency trader employed at Bank A buys 320m from a currency trader at Bank B for $400 settled using its correspondent relationship. The following is the balance sheet of Bank A and show the balance sheet after the above transactions happened PART I. PROBLEM SOLVING Direction: Read and analyze the problem/case and answers the question/s or requirement stated. Choose your answers clearly. (3x3=9marks) Consider the following investments Q1. Refer to the investment analyze select the investments you will choose from A and D (3 marks) Q 2. Refer to details in Qs11.Analyze from the given investments and decide which you will choose from B and C (3 marks) Q 3. Refer to details given in Q 1. Analyze from the given the investments and decide which you will choose from C and D (3 marks) PART I. PROBLEM SOLVING Direction: Read and analyze the problem/case and answers the question/s or requirement stated. Choose your answers clearly. (33=9marks) Consider the following investments Q1. Refer to the investment analyze select the investments you will choose from A and D (3 marks) Q 2. Refer to details in Qs11.Analyze from the given investments and decide which you will choose from B and C (3 marks) Q 3. Refer to details given in Q 1. Analyze from the given the investments and decide which you will choose from C and D (3 marks) Consider a portfolio comprised of three securities in the following proportions and with the indicated security beta Q 4. Estimate the portfolio beta? (3 marks) Q 5. Refer to the problem given in q13. Estimate the portfolio's expected return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started