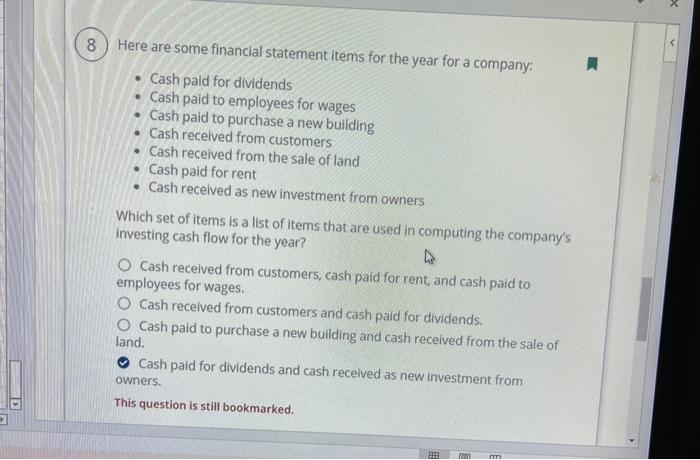

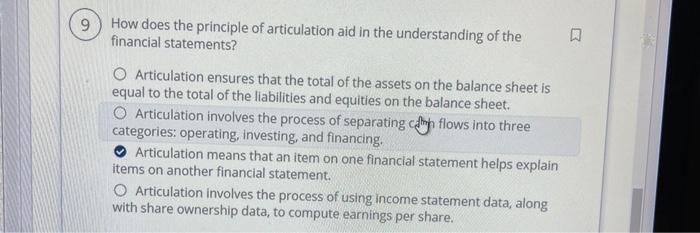

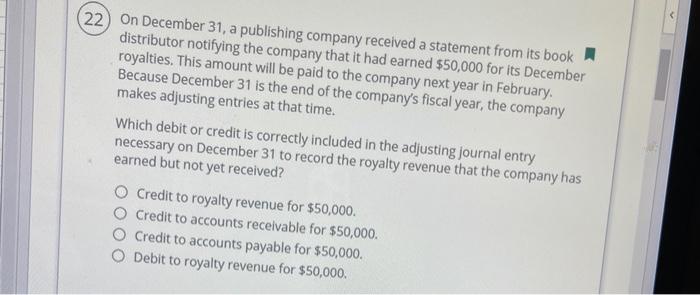

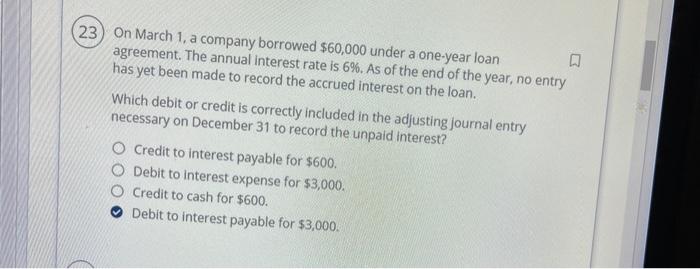

8 00 Here are some financial statement items for the year for a company: Cash paid for dividends Cash paid to employees for wages Cash paid to purchase a new building Cash received from customers Cash received from the sale of land Cash paid for rent Cash received as new investment from owners Which set of items is a list of items that are used in computing the company's investing cash flow for the year? O Cash received from customers, cash paid for rent, and cash paid to employees for wages. O Cash received from customers and cash paid for dividends. O Cash paid to purchase a new building and cash received from the sale of land. Cash paid for dividends and cash received as new investment from owners. This question is still bookmarked. M 9 How does the principle of articulation aid in the understanding of the financial statements? O Articulation ensures that the total of the assets on the balance sheet is equal to the total of the liabilities and equities on the balance sheet. Articulation involves the process of separating colory flows into three categories: operating, investing, and financing. Articulation means that an item on one financial statement helps explain items on another financial statement. Articulation involves the process of using income statement data, along with share ownership data, to compute earnings per share. (22) On December 31, a publishing company received a statement from its book distributor notifying the company that it had earned $50,000 for its December royalties. This amount will be paid to the company next year in February Because December 31 is the end of the company's fiscal year, the company makes adjusting entries at that time. Which debit or credit is correctly included in the adjusting Journal entry necessary on December 31 to record the royalty revenue that the company has earned but not yet received? Credit to royalty revenue for $50,000. Credit to accounts receivable for $50,000. Credit to accounts payable for $50,000. O Debit to royalty revenue for $50,000. (23) On March 1, a company borrowed $60,000 under a one-year loan agreement. The annual interest rate is 6%. As of the end of the year, no entry has yet been made to record the accrued interest on the loan. Which debit or credit is correctly included in the adjusting journal entry necessary on December 31 to record the unpaid interest? O Credit to interest payable for $600. O Debit to interest expense for $3,000. Credit to cash for $600. Debit to interest payable for $3,000