Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8 2 1 ? 2 4 , 1 1 : 3 7 AM Training detail: Curriculum Alice was a full - year resident of Washington

: AM

Training detail: Curriculum

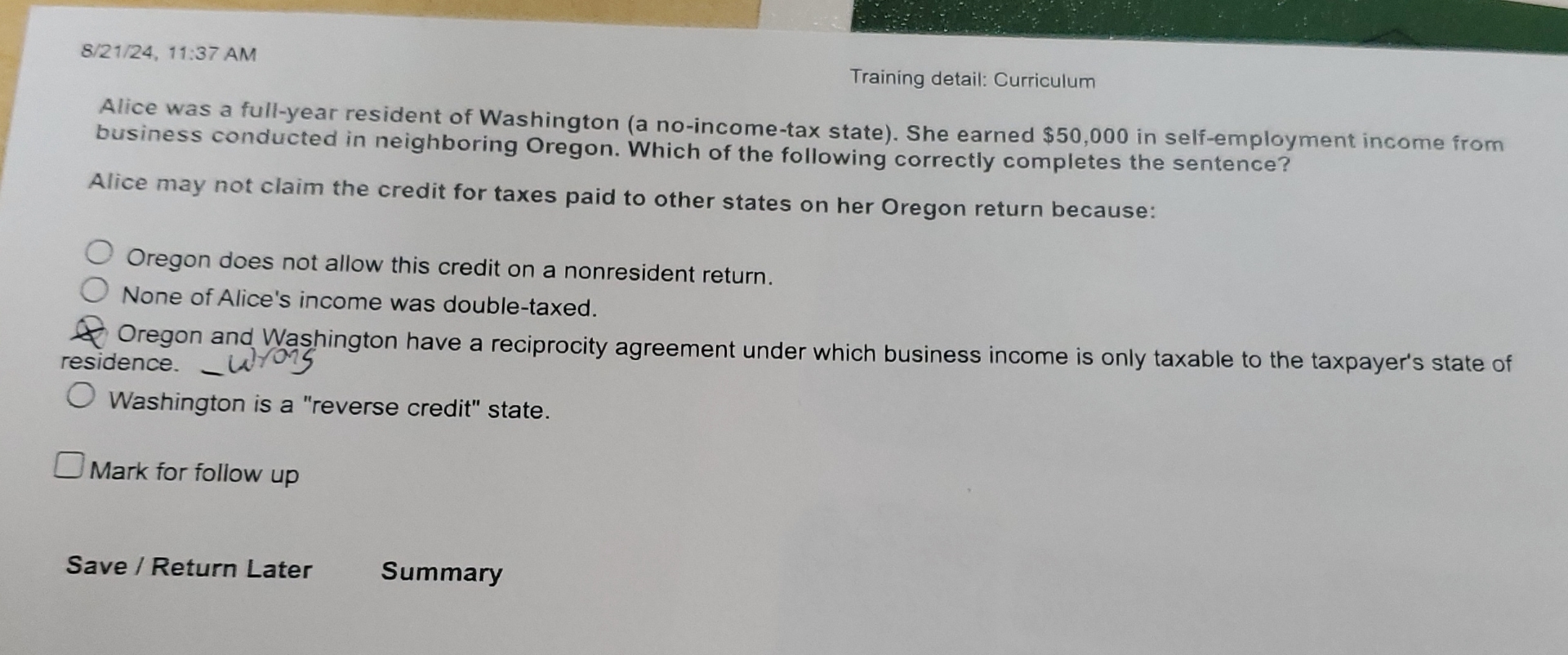

Alice was a fullyear resident of Washington a noincometax state She earned $ in selfemployment income from business conducted in neighboring Oregon. Which of the following correctly completes the sentence?

Alice may not claim the credit for taxes paid to other states on her Oregon return because:

Oregon does not allow this credit on a nonresident return.

None of Alice's income was doubletaxed. residence. wh Wash

Washington is a "reverse credit" state.

Mark for follow up

Save Return Later

Summary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started