Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ers ely, en. be me hat hat the 8. (LO 6) AP Capital balances in the Alouette partnership are Trem- blay, Capital $50,000; St-Jean,

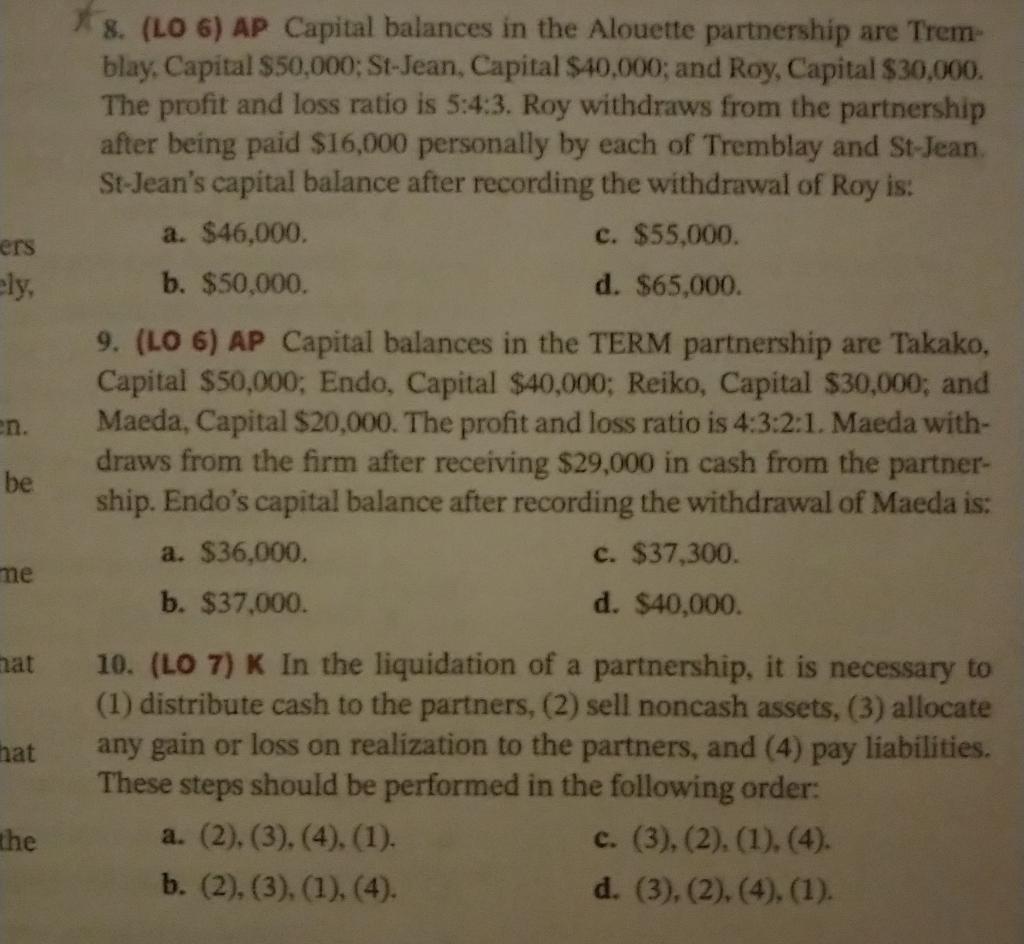

ers ely, en. be me hat hat the 8. (LO 6) AP Capital balances in the Alouette partnership are Trem- blay, Capital $50,000; St-Jean, Capital $40,000; and Roy, Capital $30,000. The profit and loss ratio is 5:4:3. Roy withdraws from the partnership after being paid $16,000 personally by each of Tremblay and St-Jean St-Jean's capital balance after recording the withdrawal of Roy is: a. $46,000. c. $55,000. b. $50,000. d. $65,000. 9. (LO 6) AP Capital balances in the TERM partnership are Takako, Capital $50,000; Endo, Capital $40,000; Reiko, Capital $30,000; and Maeda, Capital $20,000. The profit and loss ratio is 4:3:2:1. Maeda with- draws from the firm after receiving $29,000 in cash from the partner- ship. Endo's capital balance after recording the withdrawal of Maeda is: a. $36,000. c. $37,300. b. $37,000. d. $40,000. 10. (LO 7) K In the liquidation of a partnership, it is necessary to (1) distribute cash to the partners, (2) sell noncash assets, (3) allocate any gain or loss on realization to the partners, and (4) pay liabilities. These steps should be performed in the following order: a. (2), (3), (4), (1). b. (2), (3), (1), (4). c. (3), (2), (1), (4). d. (3), (2), (4), (1).

Step by Step Solution

★★★★★

3.45 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Question Q8 L06 Capital balances in the Alouette partnership are Tremblay Capital 50000 StJean Capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started