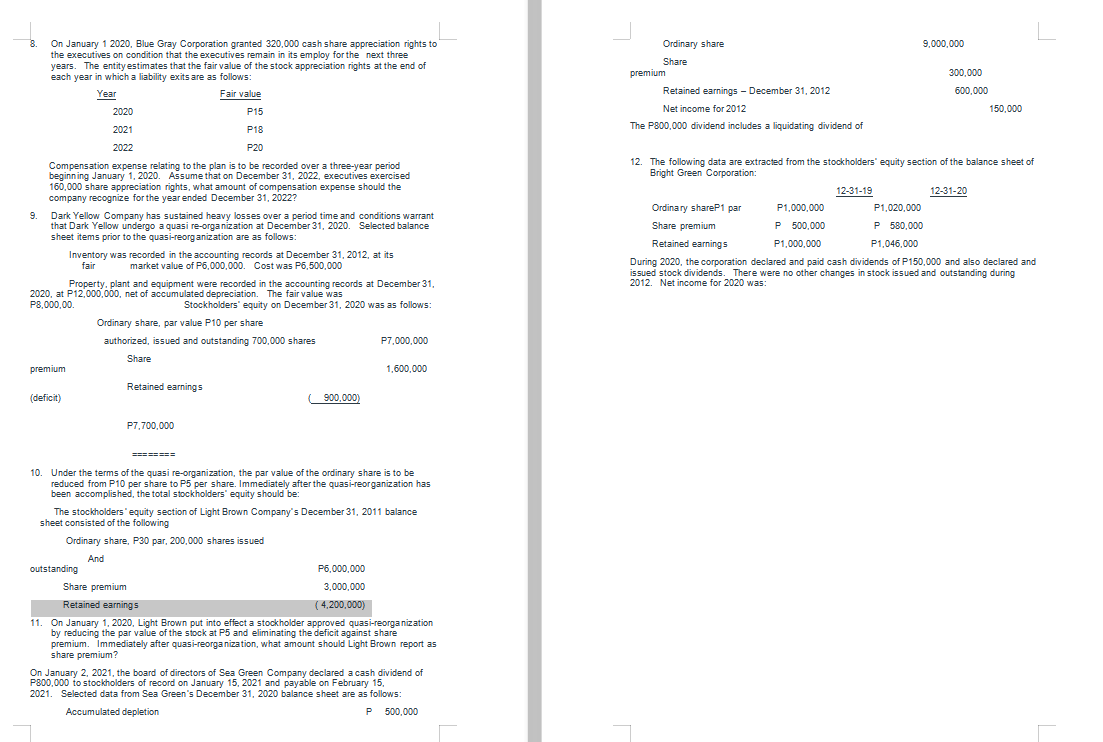

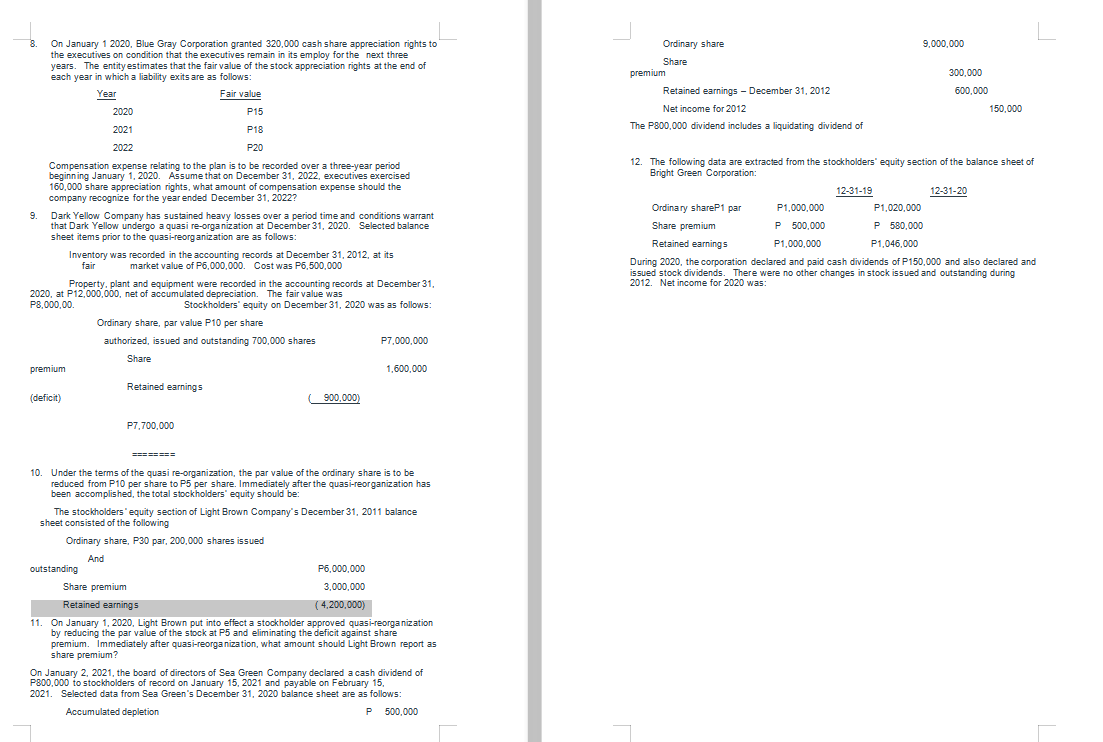

8. 9,000,000 300,000 On January 1 2020, Blue Gray Corporation granted 320.000 cash share appreciation rights to the executives on condition that the executives remain in its employ for the next three years. The entity estimates that the fair value of the stock appreciation rights at the end of each year in which a liability exits are as follows Year Fair value 2020 P15 2021 P18 2022 P20 Ordinary share Share premium Retained earnings - December 31, 2012 Net income for 2012 The P800.000 dividend includes a liquidating dividend of 600.000 150.000 Compensation expense relating to the plan is to be recorded over a three-year period beginning January 1, 2020. Assume that on December 31, 2022, executives exercised 167,000 share appreciation rights, what amount of compensation expense should the company recognize for the year ended December 31, 2022? 9. Dark Yellow Company has sustained heavy losses over a period time and conditions warrant that Dark Yellow undergo a quasi re-organization at December 31, 2020. Selected balance sheet items prior to the quasi-reorganization are as follows: Inventory was recorded in the accounting records at December 31, 2012, at its fair market value of P5,000,000. Cost was P6,500,000 Property, plant and equipment were recorded in the accounting records at December 31, 2020, at P12,000,000, net of accumulated depreciation. The fair value was P8,000.00 Stockholders' equity on December 31, 2020 was as follows: Ordinary share, par value P10 per share authorized, issued and outstanding 700.000 shares P7,000,000 Share premium 1.600.000 Retained earnings (deficit) 900,000) 12. The following data are extracted from the stockholders' equity section of the balance sheet of Bright Green Corporation: 12-31-19 12-31-20 Ordinary shareP1 par P1.000.000 P1,020.000 Share premium P 500,000 P 580,000 Retained earnings P1,000,000 P1,046.000 During 2020, the corporation declared and paid cash dividends of P150,000 and also declared and issued stock dividends. There were no other changes in stock issued and outstanding during 2012. Net income for 2020 was: P7,700,000 10. Under the terms of the quasi re-organization, the par value of the ordinary share is to be reduced from P10 per Share to P5 per share. Immediately after the quasi-reorganization has been accomplished, the total stockholders' equity should be: The stockholders' equity section of Light Brown Company's December 31, 2011 balance , sheet consisted of the following Ordinary share, P30 par, 200,000 shares issued And outstanding P5,000,000 Share premium 3,000,000 Retained earnings (4,200,000) 11. On January 1, 2020. Light Brown put into effect a stockholder approved quasi-reorganization by reducing the par value of the stock at P5 and eliminating the deficit against share premium. Immediately after quasi-reorganization, what amount should Light Brown report as share premium? On January 2, 2021, the board of directors of Sea Green Company declared a cash dividend of P800,000 to stockholders of record on January 15, 2021 and payable on February 15, 2021. Selected data from Sea Green's December 31, 2020 balance sheet are as follows: Accumulated depletion P 500,000 8. 9,000,000 300,000 On January 1 2020, Blue Gray Corporation granted 320.000 cash share appreciation rights to the executives on condition that the executives remain in its employ for the next three years. The entity estimates that the fair value of the stock appreciation rights at the end of each year in which a liability exits are as follows Year Fair value 2020 P15 2021 P18 2022 P20 Ordinary share Share premium Retained earnings - December 31, 2012 Net income for 2012 The P800.000 dividend includes a liquidating dividend of 600.000 150.000 Compensation expense relating to the plan is to be recorded over a three-year period beginning January 1, 2020. Assume that on December 31, 2022, executives exercised 167,000 share appreciation rights, what amount of compensation expense should the company recognize for the year ended December 31, 2022? 9. Dark Yellow Company has sustained heavy losses over a period time and conditions warrant that Dark Yellow undergo a quasi re-organization at December 31, 2020. Selected balance sheet items prior to the quasi-reorganization are as follows: Inventory was recorded in the accounting records at December 31, 2012, at its fair market value of P5,000,000. Cost was P6,500,000 Property, plant and equipment were recorded in the accounting records at December 31, 2020, at P12,000,000, net of accumulated depreciation. The fair value was P8,000.00 Stockholders' equity on December 31, 2020 was as follows: Ordinary share, par value P10 per share authorized, issued and outstanding 700.000 shares P7,000,000 Share premium 1.600.000 Retained earnings (deficit) 900,000) 12. The following data are extracted from the stockholders' equity section of the balance sheet of Bright Green Corporation: 12-31-19 12-31-20 Ordinary shareP1 par P1.000.000 P1,020.000 Share premium P 500,000 P 580,000 Retained earnings P1,000,000 P1,046.000 During 2020, the corporation declared and paid cash dividends of P150,000 and also declared and issued stock dividends. There were no other changes in stock issued and outstanding during 2012. Net income for 2020 was: P7,700,000 10. Under the terms of the quasi re-organization, the par value of the ordinary share is to be reduced from P10 per Share to P5 per share. Immediately after the quasi-reorganization has been accomplished, the total stockholders' equity should be: The stockholders' equity section of Light Brown Company's December 31, 2011 balance , sheet consisted of the following Ordinary share, P30 par, 200,000 shares issued And outstanding P5,000,000 Share premium 3,000,000 Retained earnings (4,200,000) 11. On January 1, 2020. Light Brown put into effect a stockholder approved quasi-reorganization by reducing the par value of the stock at P5 and eliminating the deficit against share premium. Immediately after quasi-reorganization, what amount should Light Brown report as share premium? On January 2, 2021, the board of directors of Sea Green Company declared a cash dividend of P800,000 to stockholders of record on January 15, 2021 and payable on February 15, 2021. Selected data from Sea Green's December 31, 2020 balance sheet are as follows: Accumulated depletion P 500,000