Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. A company's manufacturing division estimates $500,000 of overhead for the year and its assembly division estimates $25,000 of overhead for the year. The

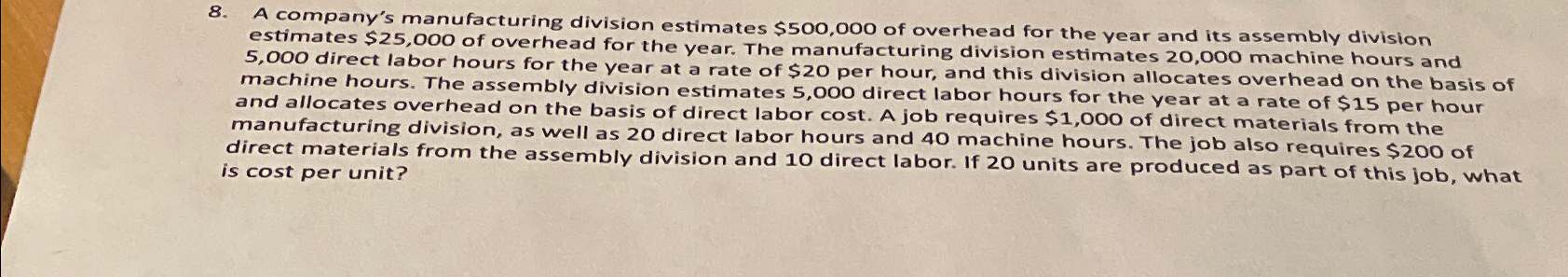

8. A company's manufacturing division estimates $500,000 of overhead for the year and its assembly division estimates $25,000 of overhead for the year. The manufacturing division estimates 20,000 machine hours and 5,000 direct labor hours for the year at a rate of $20 per hour, and this division allocates overhead on the basis of machine hours. The assembly division estimates 5,000 direct labor hours for the year at a rate of $15 per hour and allocates overhead on the basis of direct labor cost. A job requires $1,000 of direct materials from the manufacturing division, as well as 20 direct labor hours and 40 machine hours. The job also requires $200 of direct materials from the assembly division and 10 direct labor. If 20 units are produced as part of this job, what is cost per unit?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cost per unit we need to determine the total cost incurred for the job and then divide it by the number of units produced Lets calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started