Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. A firm is considering a project with the following information: Project will require purchase of a machine for $101,517.00 that is MACRS depreciable over

8. A firm is considering a project with the following information:

- Project will require purchase of a machine for $101,517.00 that is MACRS depreciable over a five-year schedule. (no depreciation until end of year 1).

- Project will require immediate non-depreciable expenses of $26,962.00 TODAY (year 0).

- Project will have the following projected balance sheet values of NWC:

| YEAR | 0 | 1 | 2 |

|---|---|---|---|

| NWC Level | $4,000 | 8.00% of sales | 10.00% of sales |

- Sales for the project will be $45,622.00 per year, with all other expenses (excluding depreciation) at 50.00% of sales.

- The tax rate for the firm is 40.00%, while the cost of capital is 12.00%

*assume project goes beyond two years

What is the projects cash flow for year 1?

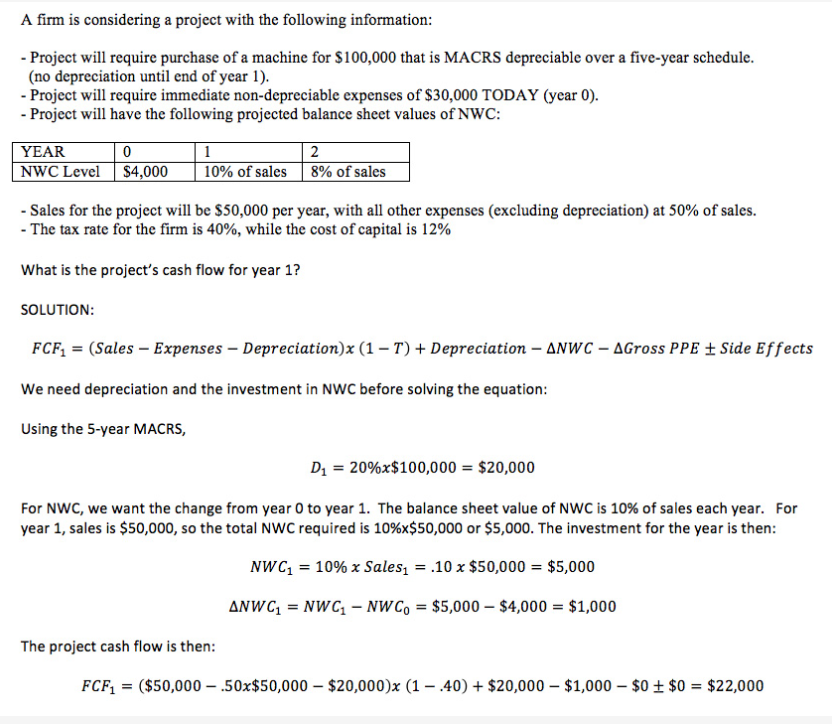

A firm is considering a project with the following information: - Project will require purchase of a machine for $100,000 that is MACRS depreciable over a five-year schedule. (no depreciation until end of year 1 ). - Project will require immediate non-depreciable expenses of $30,000 TODAY (year 0). - Project will have the following projected balance sheet values of NWC: - Sales for the project will be $50,000 per year, with all other expenses (excluding depreciation) at 50% of sales. - The tax rate for the firm is 40%, while the cost of capital is 12% What is the project's cash flow for year 1 ? SOLUTION: FCF 1=( Sales - Expenses - Depreciation )x(1T)+ Depreciation NWCGrossPPE Side Effects We need depreciation and the investment in NWC before solving the equation: Using the 5-year MACRS, D1=20%x$100,000=$20,000 For NWC, we want the change from year 0 to year 1 . The balance sheet value of NWC is 10% of sales each year. For year 1 , sales is $50,000, so the total NWC required is 10%x$50,000 or $5,000. The investment for the year is then: NWC1=10%xSales1=.10x$50,000=$5,000NWC1=NWC1NWC0=$5,000$4,000=$1,000 The project cash flow is then: FCF1=($50,000.50x$50,000$20,000)x(1.40)+$20,000$1,000$0$0=$22,000

A firm is considering a project with the following information: - Project will require purchase of a machine for $100,000 that is MACRS depreciable over a five-year schedule. (no depreciation until end of year 1 ). - Project will require immediate non-depreciable expenses of $30,000 TODAY (year 0). - Project will have the following projected balance sheet values of NWC: - Sales for the project will be $50,000 per year, with all other expenses (excluding depreciation) at 50% of sales. - The tax rate for the firm is 40%, while the cost of capital is 12% What is the project's cash flow for year 1 ? SOLUTION: FCF 1=( Sales - Expenses - Depreciation )x(1T)+ Depreciation NWCGrossPPE Side Effects We need depreciation and the investment in NWC before solving the equation: Using the 5-year MACRS, D1=20%x$100,000=$20,000 For NWC, we want the change from year 0 to year 1 . The balance sheet value of NWC is 10% of sales each year. For year 1 , sales is $50,000, so the total NWC required is 10%x$50,000 or $5,000. The investment for the year is then: NWC1=10%xSales1=.10x$50,000=$5,000NWC1=NWC1NWC0=$5,000$4,000=$1,000 The project cash flow is then: FCF1=($50,000.50x$50,000$20,000)x(1.40)+$20,000$1,000$0$0=$22,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started