Question: 8. Accounts receivable eEffective credit management involves establishing credit standards for extending credt to customers, determining the company's terms of credit, and setting up procedures

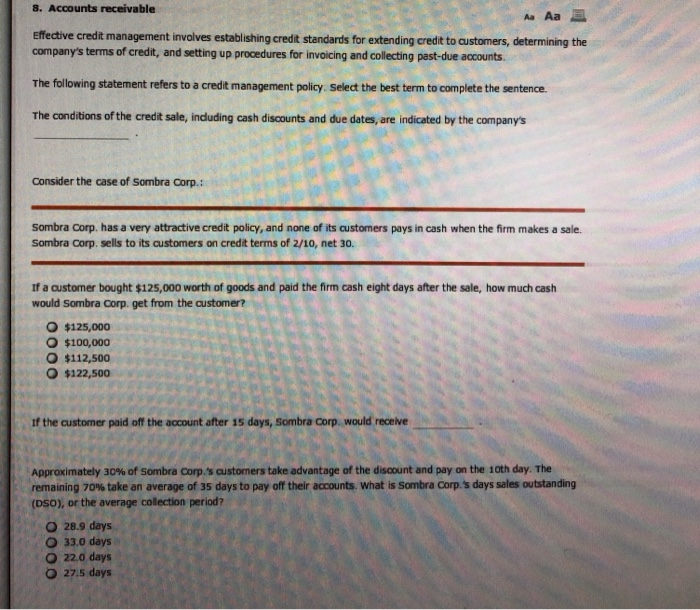

8. Accounts receivable eEffective credit management involves establishing credit standards for extending credt to customers, determining the company's terms of credit, and setting up procedures for invoicing and collecting past-due accounts. The following statement refers to a credit management policy. Select the best term to complete the sentence. The conditions of the credit sale, induding cash discounts and due dates, are indicated by the company's Consider the case of Sombra Corp.: Sombra Corp. has a very attractive credit policy, and none of its customers pays in cash when the firm makes a sale. Sombra Corp. sells to its customers on credit terms of 2/10, net 30. If a customer bought $125,000 worth of goods and paid the firm cash eight days after the sale, how much cash would Sombra Corp. get from the customer? $125,000 O $100,000 O $112,500 O $122,500 If the customer paid off the account after 15 days, Sombra Corp would receive Approximately 30% of sombra corp.'s astomers take advantage of the discount and pay on the 10th day. The remaining 70% take an average of 35 days to pay off their accounts, what is sombra corp.'s days sales outstanding (DSO), or the average collection period? O 28.9 days O 33.0 days O 22.0 days O 27.5 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts