Answered step by step

Verified Expert Solution

Question

1 Approved Answer

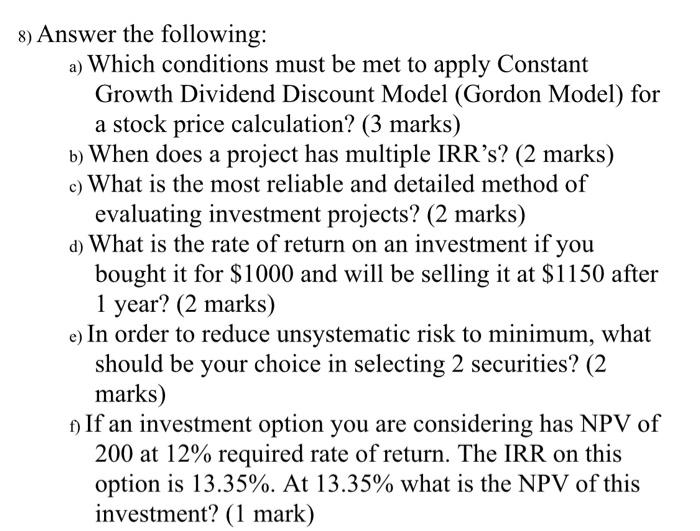

8) Answer the following: a) Which conditions must be met to apply Constant Growth Dividend Discount Model (Gordon Model) for a stock price calculation? (3

8) Answer the following: a) Which conditions must be met to apply Constant Growth Dividend Discount Model (Gordon Model) for a stock price calculation? (3 marks) b) When does a project has multiple IRRs? (2 marks) c) What is the most reliable and detailed method of evaluating investment projects? (2 marks) d) What is the rate of return on an investment if you bought it for $1000 and will be selling it at $1150 after 1 year? (2 marks) e) In order to reduce unsystematic risk to minimum, what should be your choice in selecting 2 securities? (2 marks) f) If an investment option you are considering has NPV of 200 at 12% required rate of return. The IRR on this option is 13.35%. At 13.35% what is the NPV of this investment? (1 mark)

8) Answer the following: a) Which conditions must be met to apply Constant Growth Dividend Discount Model (Gordon Model) for a stock price calculation? (3 marks) b) When does a project has multiple IRRs? (2 marks) c) What is the most reliable and detailed method of evaluating investment projects? (2 marks) d) What is the rate of return on an investment if you bought it for $1000 and will be selling it at $1150 after 1 year? (2 marks) e) In order to reduce unsystematic risk to minimum, what should be your choice in selecting 2 securities? (2 marks) f) If an investment option you are considering has NPV of 200 at 12% required rate of return. The IRR on this option is 13.35%. At 13.35% what is the NPV of this investment? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started