Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Arnold and Linda have given you a file containing the following receipts for expenditures during the year: Prescription medicine and drugs (net of

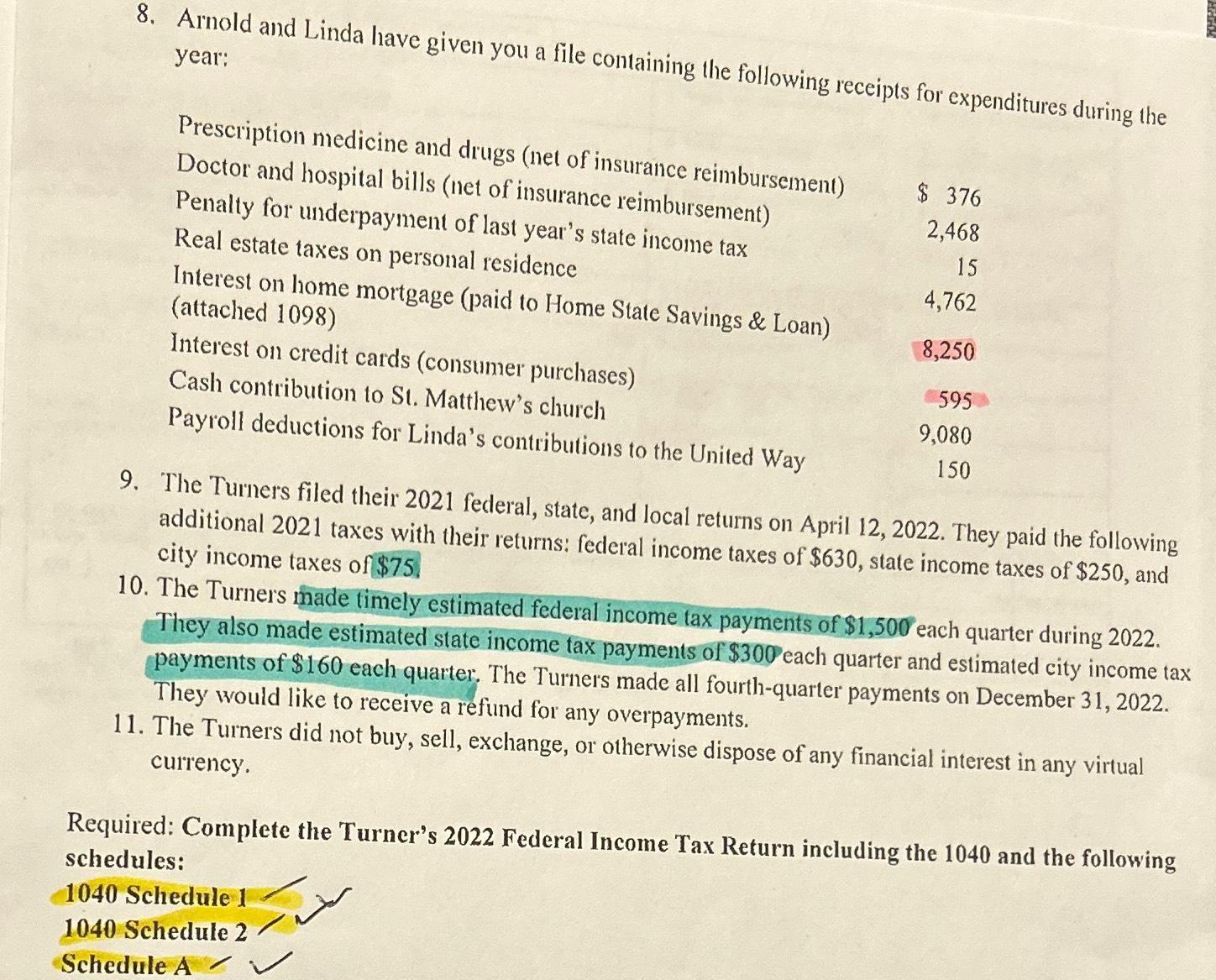

8. Arnold and Linda have given you a file containing the following receipts for expenditures during the year: Prescription medicine and drugs (net of insurance reimbursement) $ 376 Doctor and hospital bills (net of insurance reimbursement) 2,468 Penalty for underpayment of last year's state income tax 15 Real estate taxes on personal residence 4,762 Interest on home mortgage (paid to Home State Savings & Loan) (attached 1098) 8,250 Interest on credit cards (consumer purchases) #595 Cash contribution to St. Matthew's church 9,080 Payroll deductions for Linda's contributions to the United Way 150 9. The Turners filed their 2021 federal, state, and local returns on April 12, 2022. They paid the following additional 2021 taxes with their returns: federal income taxes of $630, state income taxes of $250, and city income taxes of $75 10. The Turners made timely estimated federal income tax payments of $1,500 each quarter during 2022. They also made estimated state income tax payments of $300 each quarter and estimated city income tax payments of $160 each quarter. The Turners made all fourth-quarter payments on December 31, 2022. They would like to receive a refund for any overpayments. 11. The Turners did not buy, sell, exchange, or otherwise dispose of any financial interest in currency. any virtual Required: Complete the Turner's 2022 Federal Income Tax Return including the 1040 and the following schedules: 1040 Schedule 1 1040 Schedule 2 Schedule A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the completed tax forms for the Turners 2022 federal income tax return Form 1040 On Form 1040 1 Filing status is Married filing jointly 2 Wag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started