Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Assume that you have following existing loans: Credit card debt with interest rate of 22% Auto loan with interest rate of 9% Bike loan

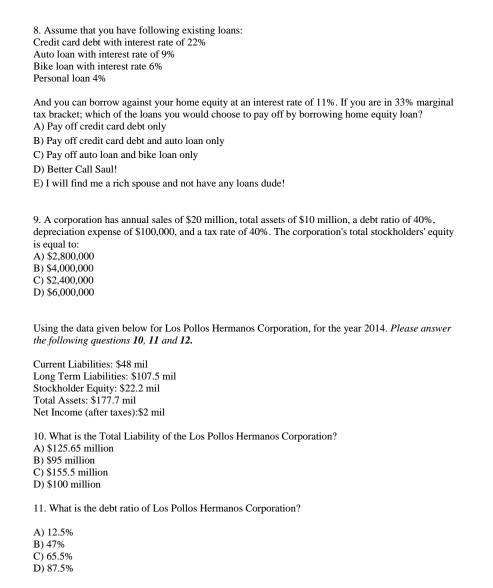

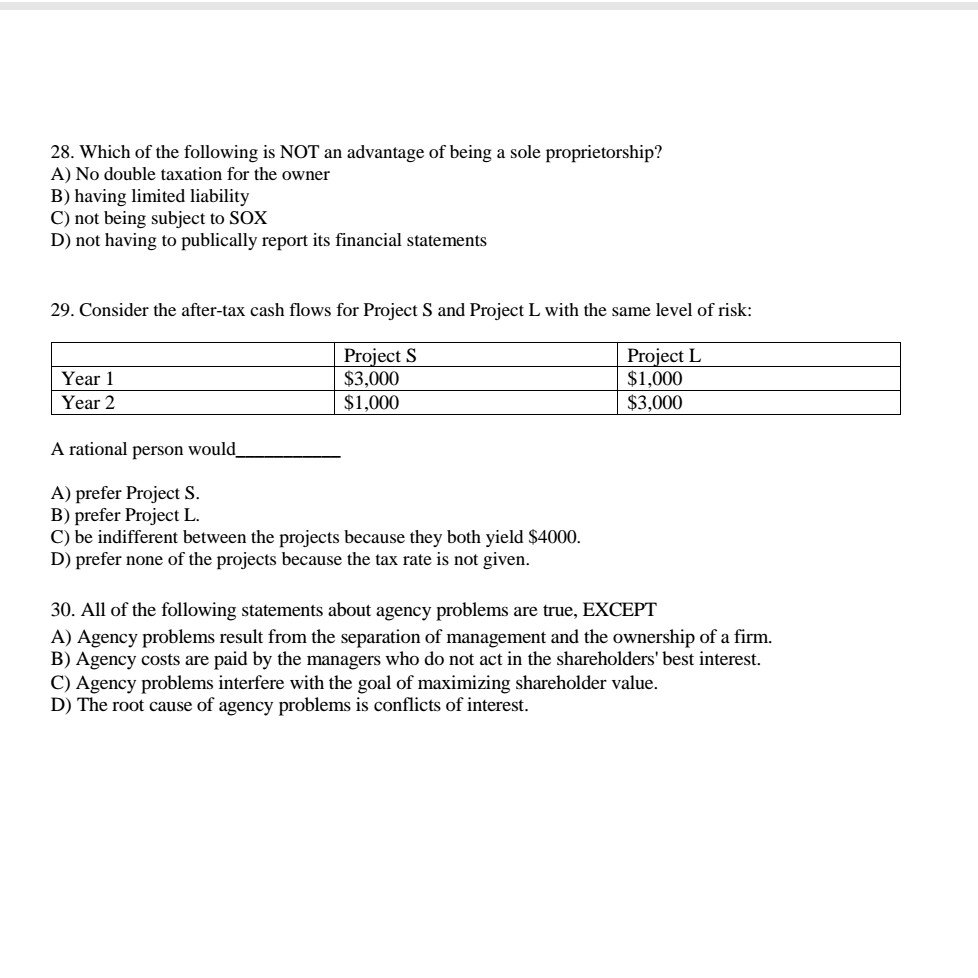

8. Assume that you have following existing loans: Credit card debt with interest rate of 22% Auto loan with interest rate of 9% Bike loan with interest rate 6% Personal loan 4% And you can borrow against your home equity at an interest rate of 11%. If you are in 33% marginal tax bracket: which of the loans you would choose to pay off by borrowing home equity loan? A) Pay off credit card debt only B) Pay off credit card debt and auto loan only C) Pay off auto loan and bike loan only D) Better Call Saul! E) I will find me a rich spouse and not have any loans dude! 9, A corporation has annual sales of $20 million, total assets of $10 million, a debt ratio of 40%, depreciation expense of $100.000, and a tax rate of 40%. The corporation's total stockholders' equity is equal to: A) $2,800,000 B) $4,000,000 C) S2.400,000 D) $6,000,000 Using the data given below for Los Pollos Hermanos Corporation, for the year 2014. Please answer the following questions 10, II and 12. Current Liabilities: $48 mil Long Term Liabilities: $107.5 mil Stockholder Equity: $22.2 mil Total Assets: $177.7 mil Net Income (after taxes):$2 mil 10. What is the Total Liability of the Los Pollos Hermanos Corporation? A) $125.65 million B) $95 million C) S155.5 million D) $100 million 11. What is the debt ratio of Los Pollos Hermanos Corporation? A) 12.5% B) 47% C) 65.5% D) 87.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started