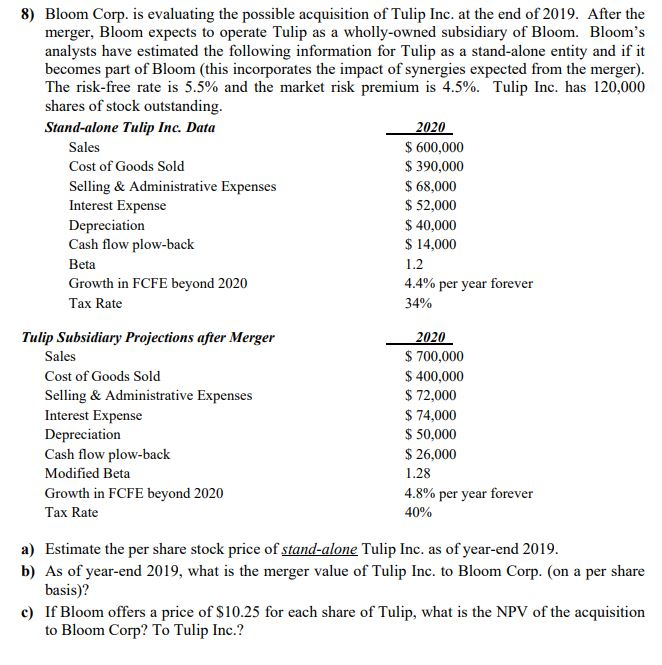

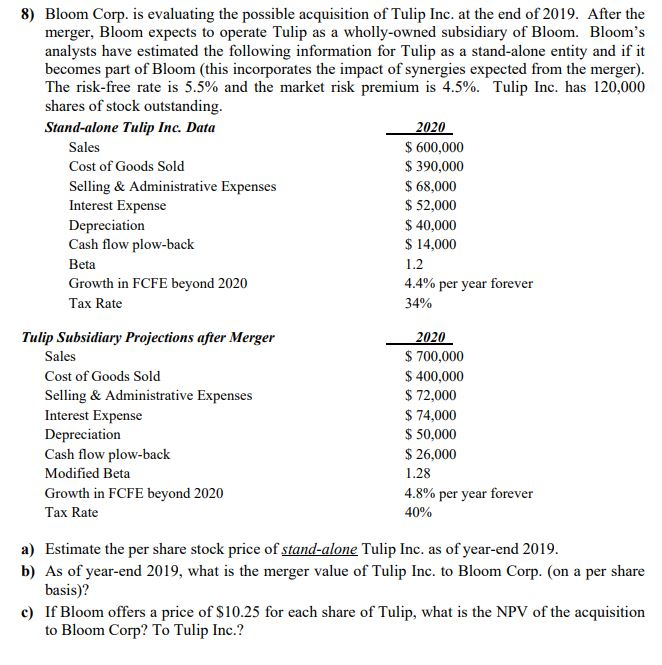

8) Bloom Corp. is evaluating the possible acquisition of Tulip Inc. at the end of 2019. After the merger, Bloom expects to operate Tulip as a wholly-owned subsidiary of Bloom. Bloom's analysts have estimated the following information for Tulip as a stand-alone entity and if it becomes part of Bloom (this incorporates the impact of synergies expected from the merger) The risk-free rate is 5.5% and the market risk premium is 4.5%. Tulip Inc. has 120,000 shares of stock outstanding. Stand-alone Tulip Inc. Data $ 600,000 $ 390,000 $68,000 $ 52,000 $40,000 S 14,000 1.2 4.4% per year forever 34% Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Beta Growth in FCFE beyond 2020 Tax Rate Tulip Subsidiary Projections after Merger $700,000 $400,000 $ 72,000 $74,000 $50,000 $ 26,000 1.28 4.8% per year forever 40% Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate a) Estimate the per share stock price of stand-alone Tulip Inc. as of year-end 2019 b) As of year-end 2019, what is the merger value of Tulip Inc. to Bloom Corp. (on a per share basis)? If Bloom offers a price of S10.25 for each share of Tulip, what is the NPV of the acquisition to Bloom Corp? To Tulip Inc.? c) 8) Bloom Corp. is evaluating the possible acquisition of Tulip Inc. at the end of 2019. After the merger, Bloom expects to operate Tulip as a wholly-owned subsidiary of Bloom. Bloom's analysts have estimated the following information for Tulip as a stand-alone entity and if it becomes part of Bloom (this incorporates the impact of synergies expected from the merger) The risk-free rate is 5.5% and the market risk premium is 4.5%. Tulip Inc. has 120,000 shares of stock outstanding. Stand-alone Tulip Inc. Data $ 600,000 $ 390,000 $68,000 $ 52,000 $40,000 S 14,000 1.2 4.4% per year forever 34% Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Beta Growth in FCFE beyond 2020 Tax Rate Tulip Subsidiary Projections after Merger $700,000 $400,000 $ 72,000 $74,000 $50,000 $ 26,000 1.28 4.8% per year forever 40% Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate a) Estimate the per share stock price of stand-alone Tulip Inc. as of year-end 2019 b) As of year-end 2019, what is the merger value of Tulip Inc. to Bloom Corp. (on a per share basis)? If Bloom offers a price of S10.25 for each share of Tulip, what is the NPV of the acquisition to Bloom Corp? To Tulip Inc.? c)