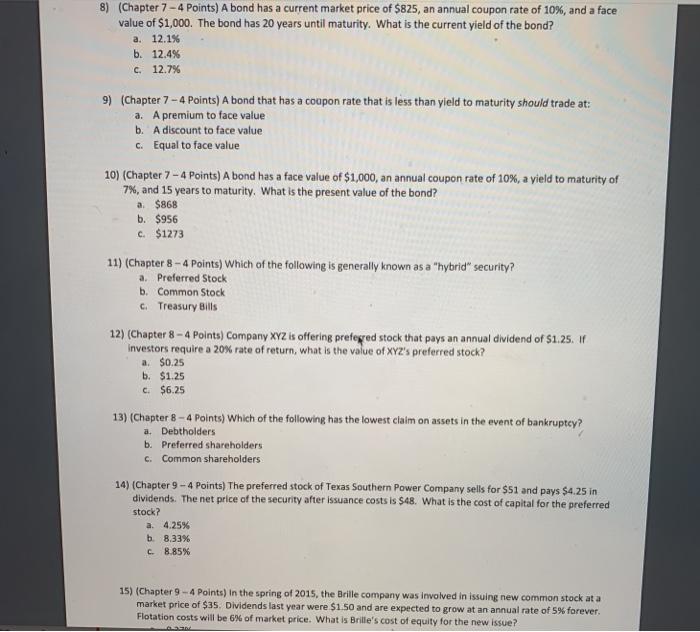

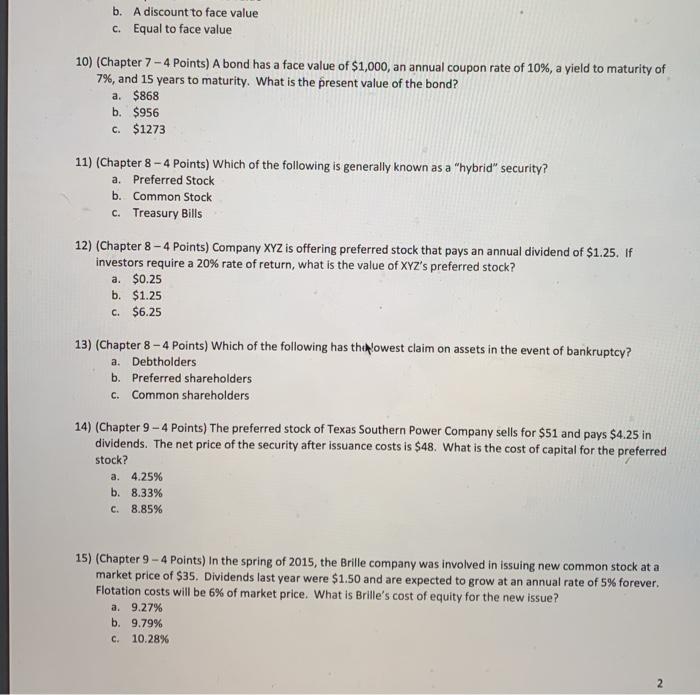

8) (Chapter 7 - 4 Points) A bond has a current market price of $825, an annual coupon rate of 10%, and a face value of $1,000. The bond has 20 years until maturity. What is the current yield of the bond? a. 12.1% b. 12.4% C. 12.7% 9) (Chapter 7 - 4 Points) A bond that has a coupon rate that is less than yield to maturity should trade at: a. A premium to face value b. A discount to face value c. Equal to face value 10) (Chapter 7 - 4 Points) A bond has a face value of $1,000, an annual coupon rate of 10%, a yield to maturity of 7%, and 15 years to maturity. What is the present value of the bond? a $868 b. $956 c. $1273 11) (Chapter 8 - 4 Points) Which of the following is generally known as a "hybrid security? a. Preferred Stock b. Common Stock c. Treasury Bills 12) (Chapter 8 - 4 Points) Company XYZ is offering preferred stock that pays an annual dividend of $1.25. if Investors require a 20% rate of return, what is the value of XYZ's preferred stock? a $0.25 b. $1.25 C$6.25 13) (Chapter 8 - 4 Points) Which of the following has the lowest claim on assets in the event of bankruptcy? a. Debtholders b. Preferred shareholders c. Common shareholders 14) (Chapter 9 -4 Points) The preferred stock of Texas Southern Power Company sells for $1 and pays $4.25 in dividends. The net price of the security after issuance costs is $48. What is the cost of capital for the preferred stock? a. 4.25% b 8.33% C 8.85% 15) (Chapter 9 -4 Points) in the spring of 2015, the Brille company was involved in issuing new common stock at a market price of $35. Dividends last year were $1.50 and are expected to grow at an annual rate of 5% forever. Flotation costs will be 6% of market price. What is Brille's cost of equity for the new issue? b. A discount to face value C. Equal to face value 10) (Chapter 7 - 4 points) A bond has a face value of $1,000, an annual coupon rate of 10%, a yield to maturity of 7%, and 15 years to maturity. What is the present value of the bond? a. $868 b. $956 C. $1273 11) (Chapter 8 - 4 Points) Which of the following is generally known as a "hybrid" security? a. Preferred Stock b. Common Stock C. Treasury Bills 12) (Chapter 8 - 4 Points) Company XYZ is offering preferred stock that pays an annual dividend of $1.25. If investors require a 20% rate of return, what is the value of XYZ's preferred stock? a. $0.25 b. $1.25 C. $6.25 13) (Chapter 8 - 4 Points) Which of the following has thepowest claim on assets in the event of bankruptcy? a. Debtholders b. Preferred shareholders C. Common shareholders 14) (Chapter 9 -4 Points) The preferred stock of Texas Southern Power Company sells for $51 and pays $4.25 in dividends. The net price of the security after issuance costs is $48. What is the cost of capital for the preferred stock? a. 4.25% b. 8.33% C. 8.85% 15) (Chapter 9 -4 Points) In the spring of 2015, the Brille company was involved in issuing new common stock at a market price of $35. Dividends last year were $1.50 and are expected to grow at an annual rate of 5% forever, Flotation costs will be 6% of market price. What is Brille's cost of equity for the new issue? a. 9.27% b. 9.79% c. 10.28% 2