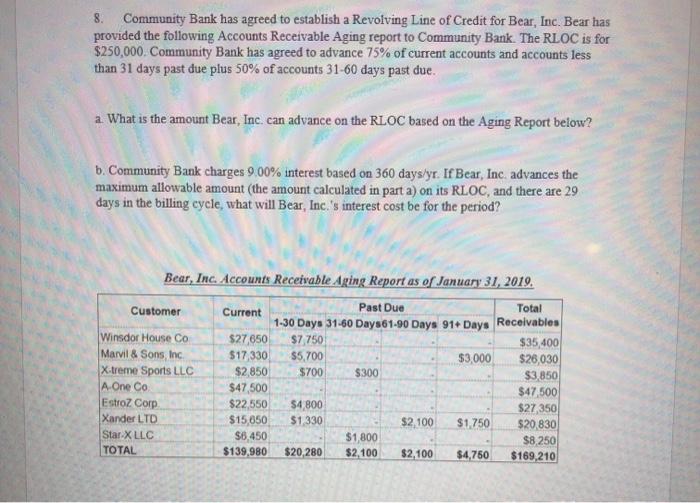

8. Community Bank has agreed to establish a Revolving Line of Credit for Bear, Inc. Bear has provided the following Accounts Receivable Aging report to Community Bank. The RLOC is for $250,000. Community Bank has agreed to advance 75% of current accounts and accounts less than 31 days past due plus 50% of accounts 31-60 days past due. a What is the amount Bear, Inc. can advance on the RLOC based on the Aging Report below? 8. Community Bank charges 9.00% interest based on 360 days/yr. If Bear, Inc advances the maximum allowable amount the amount calculated in part a) on its RLOC, and there are 29 days in the billing cycle, what will Bear, Inc.'s interest cost be for the period? Bear, Inc. Accounts Receivable Aging Report as of January 31, 2019. Customer Past Due Total Current 1-30 Days 31-60 Days61-90 Days 91+ Days Receivables Winsdor House Co $27,650 $7 750 $35 400 Marvil & Sons, Inc $17,330 $5,700 $3,000 $26,030 X-treme Sports LLC $2,850 $700 $300 $3,850 A One Co $47,500 $47,500 Estroz Corp $22550 54 800 $27350 Xander LTD $15,050 $1330 $2 100 $1,750 $20,830 Star X LLC $6,450 $1,800 $8,250 TOTAL $139,980 $20,280 $2,100 $2,100 $4,750 $169,210 8. Community Bank has agreed to establish a Revolving Line of Credit for Bear, Inc. Bear has provided the following Accounts Receivable Aging report to Community Bank. The RLOC is for $250,000. Community Bank has agreed to advance 75% of current accounts and accounts less than 31 days past due plus 50% of accounts 31-60 days past due. a What is the amount Bear, Inc. can advance on the RLOC based on the Aging Report below? 8. Community Bank charges 9.00% interest based on 360 days/yr. If Bear, Inc advances the maximum allowable amount the amount calculated in part a) on its RLOC, and there are 29 days in the billing cycle, what will Bear, Inc.'s interest cost be for the period? Bear, Inc. Accounts Receivable Aging Report as of January 31, 2019. Customer Past Due Total Current 1-30 Days 31-60 Days61-90 Days 91+ Days Receivables Winsdor House Co $27,650 $7 750 $35 400 Marvil & Sons, Inc $17,330 $5,700 $3,000 $26,030 X-treme Sports LLC $2,850 $700 $300 $3,850 A One Co $47,500 $47,500 Estroz Corp $22550 54 800 $27350 Xander LTD $15,050 $1330 $2 100 $1,750 $20,830 Star X LLC $6,450 $1,800 $8,250 TOTAL $139,980 $20,280 $2,100 $2,100 $4,750 $169,210