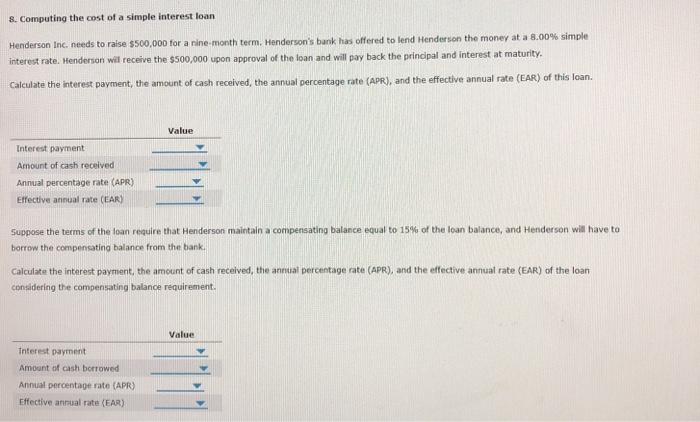

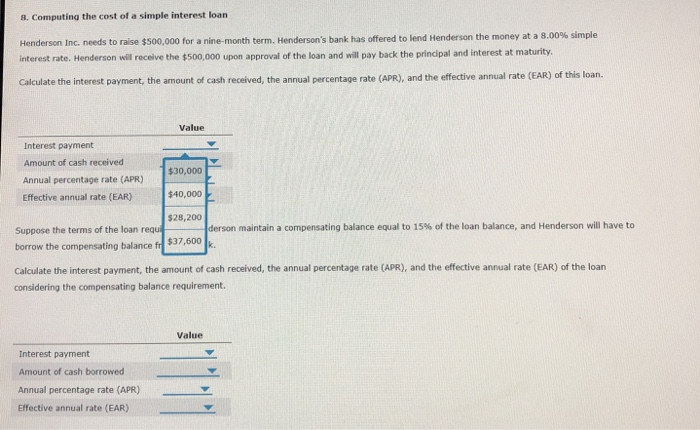

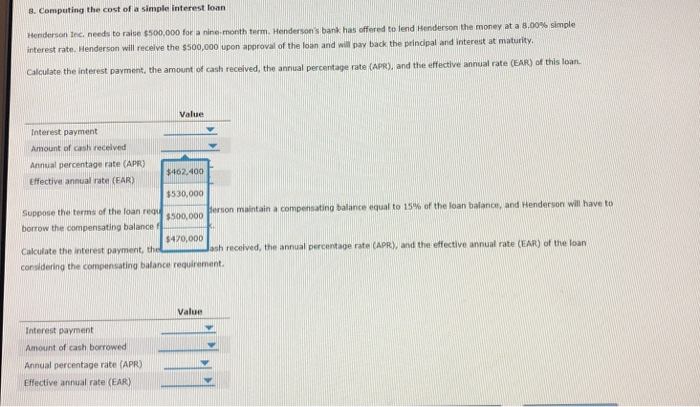

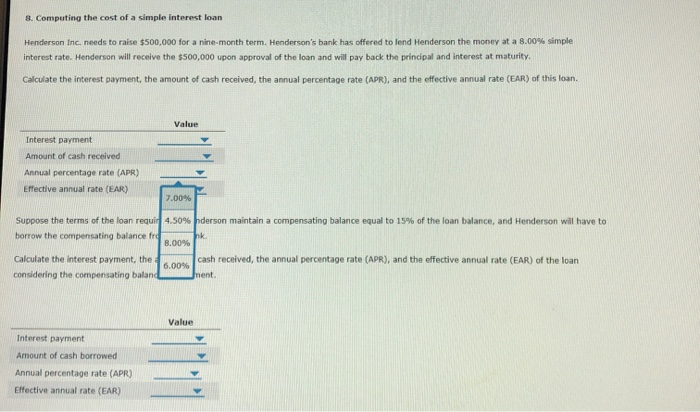

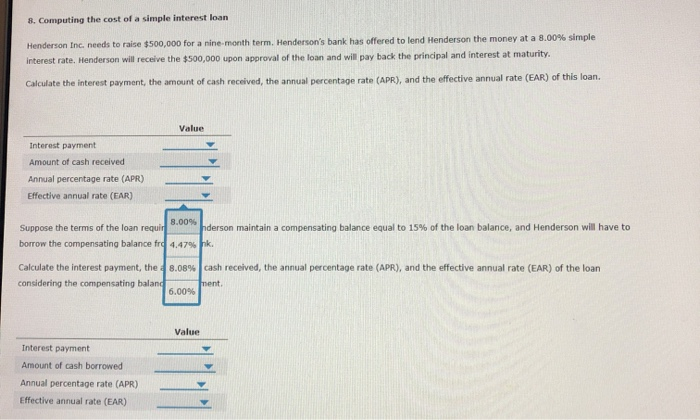

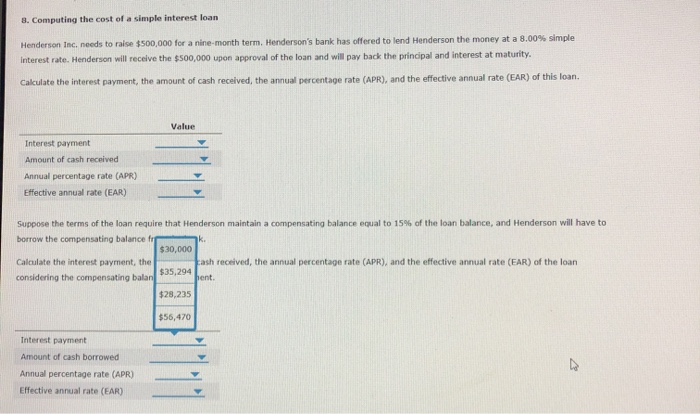

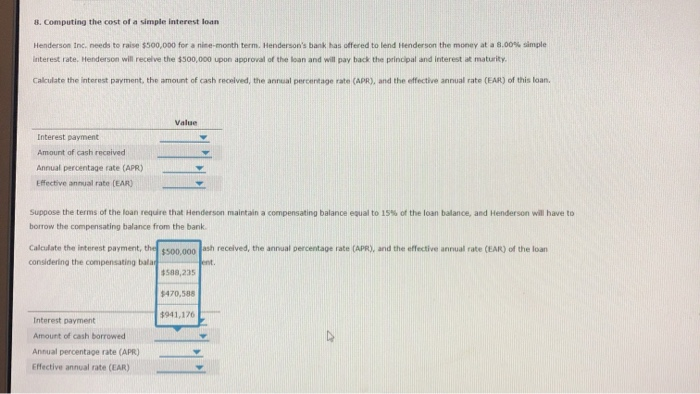

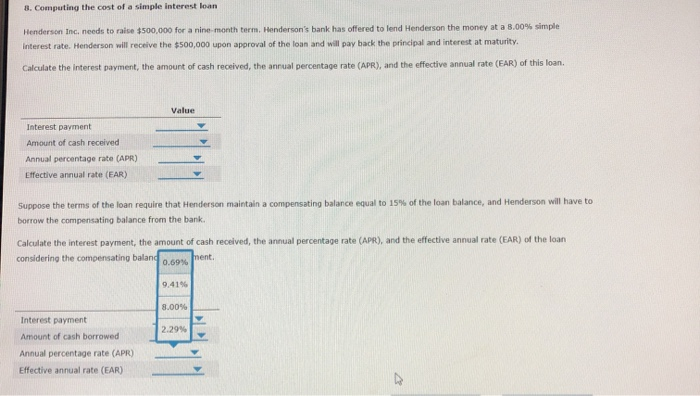

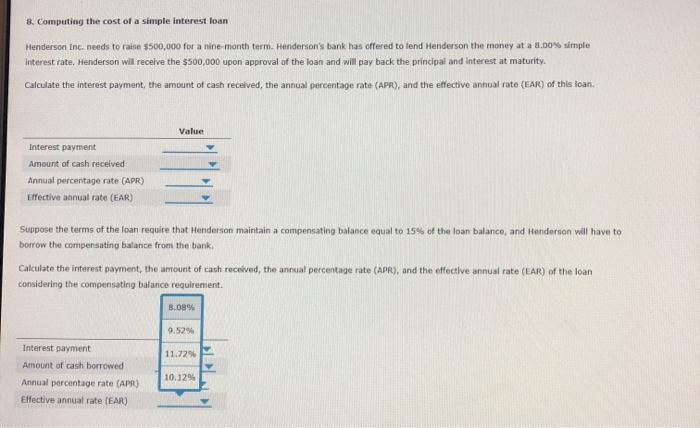

8. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan require that Henderson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance from the bank. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan considering the compensating balance requirement. Value Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 8. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) $30,000 $40,000 $28,200 Suppose the terms of the loan regul borrow the compensating balanced $37,600 derson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan considering the compensating balance requirement. Value Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 3. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) $462,400 Effective annual rate (EAR) $530,000 Suppose the terms of the loan regu $500,000 Serson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance $470,000 Calculate the interest payment, the ash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan considering the compensating balance requirement. Value Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 8. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple Interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) 7.00% derson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to Suppose the terms of the loan requir 4.50% borrow the compensating balance frd 8.00% Calculate the interest payment, the 6.00% considering the compensating baland cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan Value Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 8. Computing the cost of a simple interest loan Henderson Inc needs to raise $500,000 for a nine month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple Interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan reguld 0.00% nderson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance frd 4.47% 8.08% Calculate the interest payment, the considering the compensating baland cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan rent 6.00% Value Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 8. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple Interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity. Cakulate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan require that Henderson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance fo $30,000 Calculate the interest payment, the ash received, the annual percentage rate (APR), and the effective annual rate (FAR) of the loan considering the compensating balan $28,235 335.294 Lent $56,470 Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 8. Computing the cost of a simple interest loan Henderson Inc needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 8.00% simple Interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan require that Henderson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance from the bank ash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan Calculate the interest payment, the $500,000 considering the compensating balad $500,235 $470.588 $941.170 Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 3. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 3.00% simple Interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity, Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan require that Henderson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance from the bank Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan considering the compensating balando. net 0.4196 8.009 Interest payment 2.29% Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 8. Computing the cost of a simple interest loan Henderson Inc. needs to raise $500,000 for a nine-month term. Henderson's bank has offered to lend Henderson the money at a 3.00% simple Interest rate. Henderson will receive the $500,000 upon approval of the loan and will pay back the principal and interest at maturity. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) Suppose the terms of the loan require that Henderson maintain a compensating balance equal to 15% of the loan balance, and Henderson will have to borrow the compensating balance from the bank. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of the loan considering the compensating balance requirement. B.089 9.52% 11.72% Interest payment Amount of cash borrowed Annual percentage rate (APR) Effective annual rate (EAR) 10.1296