Answered step by step

Verified Expert Solution

Question

1 Approved Answer

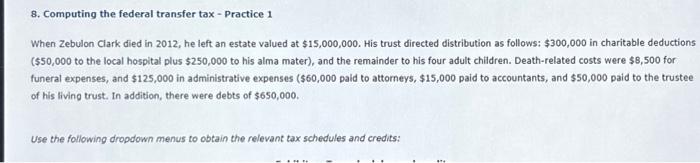

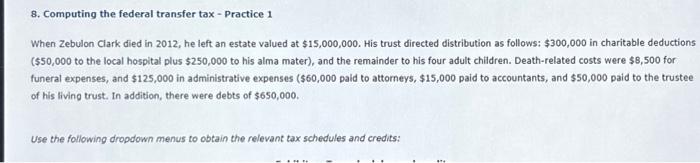

8. Computing the federal transfer tax-Practice 1 When Zebulon Clark died in 2012, he left an estate valued at ( $ 15,000,000 ). His trust

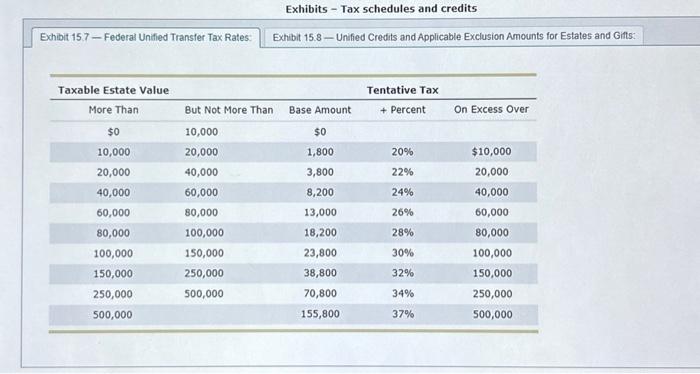

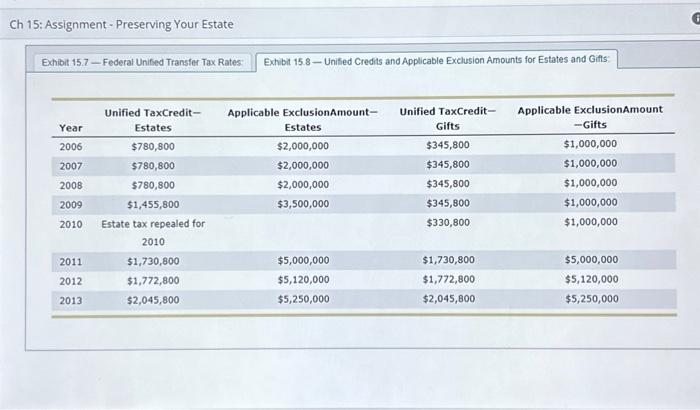

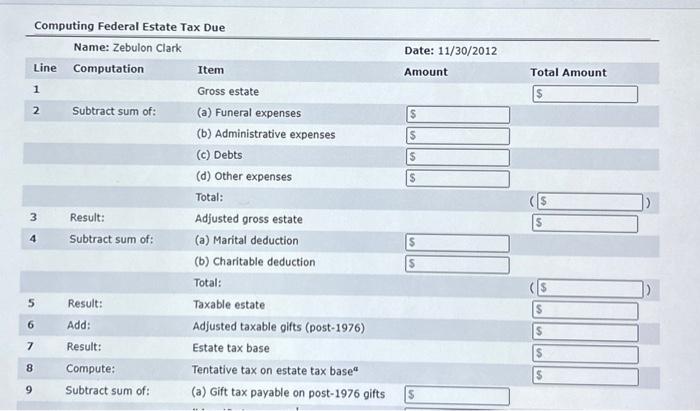

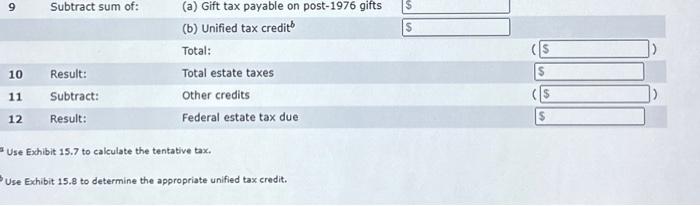

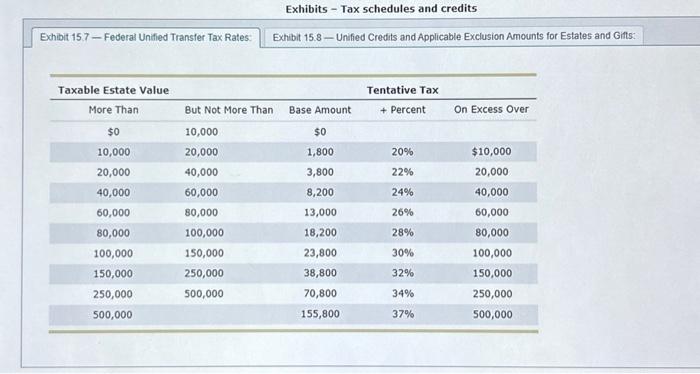

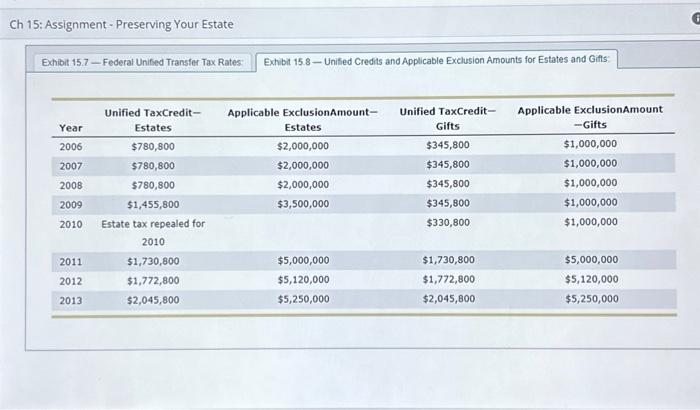

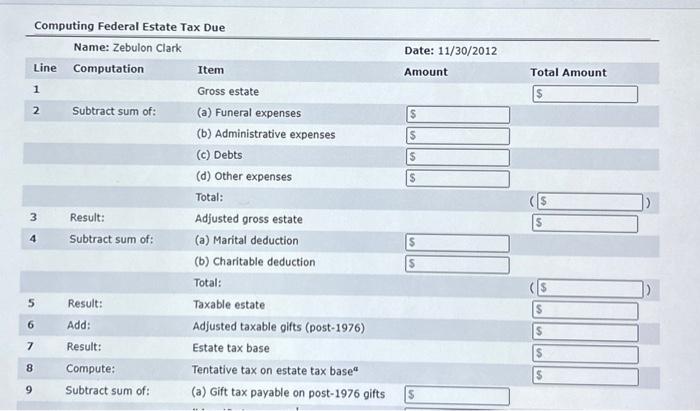

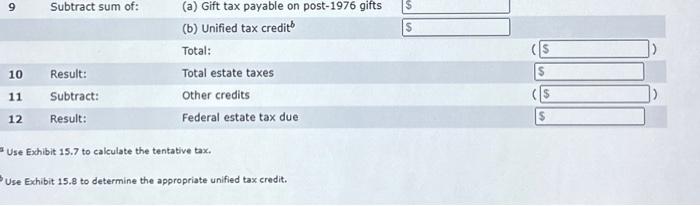

8. Computing the federal transfer tax-Practice 1 When Zebulon Clark died in 2012, he left an estate valued at \\( \\$ 15,000,000 \\). His trust directed distribution as follows: \\( \\$ 300,000 \\) in charitable deductions ( \\( \\$ 50,000 \\) to the local hospital plus \\( \\$ 250,000 \\) to his alma mater), and the remainder to his four adult children. Death-related costs were \\( \\$ 8,500 \\) for funeral expenses, and \\( \\$ 125,000 \\) in administrative expenses \\( (\\$ 60,000 \\) paid to attorneys, \\( \\$ 15,000 \\) paid to accountants, and \\( \\$ 50,000 \\) paid to the trustee of his living trust. In addition, there were debts of \\( \\$ 650,000 \\). Use the following dropdown menus to obtain the relevant tax schedules and credits: Exhibits - Tax schedules and credits Echibit 15.7 - Federal Unified Transfer Tax Rates: Exhibit 15.8 - Unified Credits and Applicable Exclusion Amounts for Estates and Gifts: \\begin{tabular}{ccccc} \\hline Taxable Estate Value & & \\multicolumn{3}{c}{ Tentative Tax } \\\\ \\hline More Than & But Not More Than & Base Amount & + Percent & On Excess Over \\\\ \\( \\$ 0 \\) & 10,000 & \\( \\$ 0 \\) & & \\\\ 10,000 & 20,000 & 1,800 & \20 & \\( \\$ 10,000 \\) \\\\ 20,000 & 40,000 & 3,800 & \22 & 20,000 \\\\ 40,000 & 60,000 & 8,200 & \24 & 40,000 \\\\ 60,000 & 80,000 & 13,000 & \26 & 60,000 \\\\ 80,000 & 100,000 & 18,200 & \28 & 80,000 \\\\ 100,000 & 150,000 & 23,800 & \30 & 100,000 \\\\ 150,000 & 250,000 & 38,800 & \32 & 150,000 \\\\ 250,000 & 500,000 & 70,800 & \34 & 250,000 \\\\ 500,000 & & 155,800 & \37 & 500,000 \\end{tabular} Exhibit 15.8 - Unifed Credits and Applicable Exclusion Amounts for Estates and Gifts: Computing Federal Estate Tax Due Use Exhibit 15.7 to calculate the tentative tax, Use Exhibit 15.8 to determine the appropriate unified tax credit

8. Computing the federal transfer tax-Practice 1 When Zebulon Clark died in 2012, he left an estate valued at \\( \\$ 15,000,000 \\). His trust directed distribution as follows: \\( \\$ 300,000 \\) in charitable deductions ( \\( \\$ 50,000 \\) to the local hospital plus \\( \\$ 250,000 \\) to his alma mater), and the remainder to his four adult children. Death-related costs were \\( \\$ 8,500 \\) for funeral expenses, and \\( \\$ 125,000 \\) in administrative expenses \\( (\\$ 60,000 \\) paid to attorneys, \\( \\$ 15,000 \\) paid to accountants, and \\( \\$ 50,000 \\) paid to the trustee of his living trust. In addition, there were debts of \\( \\$ 650,000 \\). Use the following dropdown menus to obtain the relevant tax schedules and credits: Exhibits - Tax schedules and credits Echibit 15.7 - Federal Unified Transfer Tax Rates: Exhibit 15.8 - Unified Credits and Applicable Exclusion Amounts for Estates and Gifts: \\begin{tabular}{ccccc} \\hline Taxable Estate Value & & \\multicolumn{3}{c}{ Tentative Tax } \\\\ \\hline More Than & But Not More Than & Base Amount & + Percent & On Excess Over \\\\ \\( \\$ 0 \\) & 10,000 & \\( \\$ 0 \\) & & \\\\ 10,000 & 20,000 & 1,800 & \20 & \\( \\$ 10,000 \\) \\\\ 20,000 & 40,000 & 3,800 & \22 & 20,000 \\\\ 40,000 & 60,000 & 8,200 & \24 & 40,000 \\\\ 60,000 & 80,000 & 13,000 & \26 & 60,000 \\\\ 80,000 & 100,000 & 18,200 & \28 & 80,000 \\\\ 100,000 & 150,000 & 23,800 & \30 & 100,000 \\\\ 150,000 & 250,000 & 38,800 & \32 & 150,000 \\\\ 250,000 & 500,000 & 70,800 & \34 & 250,000 \\\\ 500,000 & & 155,800 & \37 & 500,000 \\end{tabular} Exhibit 15.8 - Unifed Credits and Applicable Exclusion Amounts for Estates and Gifts: Computing Federal Estate Tax Due Use Exhibit 15.7 to calculate the tentative tax, Use Exhibit 15.8 to determine the appropriate unified tax credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started