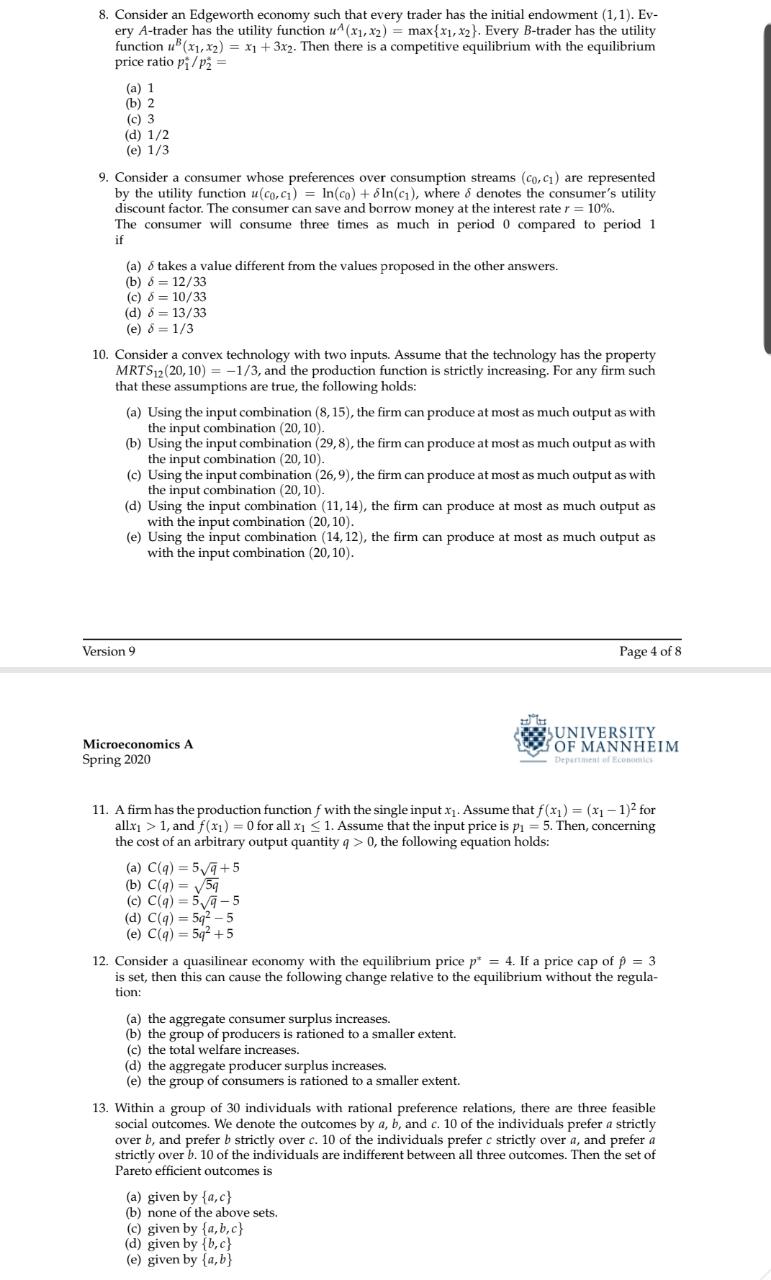

8. Consider an Edgeworth economy such that every trader has the initial endowment (1, 1). Ev- ery A-trader has the utility function u (x1, x2) = max{x1, x2). Every B-trader has the utility function u"(x1,x2) = x1 + 3x2. Then there is a competitive equilibrium with the equilibrium price ratio pi / P2 = (a) 1 (b) 2 (c) 3 (d) 1/2 (e) 1/3 9. Consider a consumer whose preferences over consumption streams (co, c1) are represented by the utility function u(co, ci) = In(co) + In(c1), where o denotes the consumer's utility discount factor. The consumer can save and borrow money at the interest rate r = 10% The consumer will consume three times as much in period 0 compared to period 1 if (a) 5 takes a value different from the values proposed in the other answers. (b) 5 = 12/33 (c) 5 = 10/33 (d) 6 = 13/33 (e) 6 =1/3 10. Consider a convex technology with two inputs. Assume that the technology has the property MRTS12(20, 10) = -1/3, and the production function is strictly increasing. For any firm such that these assumptions are true, the following holds: (a) Using the input combination (8, 15), the firm can produce at most as much output as with the input combination (20, 10). (b) Using the input combination (29,8), the firm can produce at most as much output as with the input combination (20, 10). (c) Using the input combination (26,9), the firm can produce at most as much output as with the input combination (20, 10). (d) Using the input combination (11, 14), the firm can produce at most as much output as with the input combination (20, 10). (e) Using the input combination (14, 12), the firm can produce at most as much output as with the input combination (20, 10). Version 9 Page 4 of 8 Microeconomics A UNIVERSITY Spring 2020 OF MANNHEIM Department of Econan 11. A firm has the production function f with the single input x1. Assume that f(x]) = (x] -1)2 for allx, > 1, and f(x1) = 0 for all x1 2 1. Assume that the input price is p1 = 5. Then, concerning the cost of an arbitrary output quantity q > 0, the following equation holds: (a) C(q) =5v/q+5 (b) C(q) = V/5q (c) C(q) = 5/q -5 (d) C(q) = 5q2 - 5 (e) C(q) = 592 +5 12. Consider a quasilinear economy with the equilibrium price p* = 4. If a price cap of p = 3 is set, then this can cause the following change relative to the equilibrium without the regula- tion: (a) the aggregate consumer surplus increases. (b) the group of producers is rationed to a smaller extent. (c) the total welfare increases. (d) the aggregate producer surplus increases. (e) the group of consumers is rationed to a smaller extent. 13. Within a group of 30 individuals with rational preference relations, there are three feasible social outcomes. We denote the outcomes by a, b, and c. 10 of the individuals prefer a strictly over b, and prefer b strictly over c. 10 of the individuals prefer c strictly over a, and prefer a strictly over b. 10 of the individuals are indifferent between all three outcomes. Then the set of Pareto efficient outcomes is (a) given by {a, c} (b) none of the above sets. (c) given by {a, b,c} (d) given by {b, c} (e) given by {a, b}