Answered step by step

Verified Expert Solution

Question

1 Approved Answer

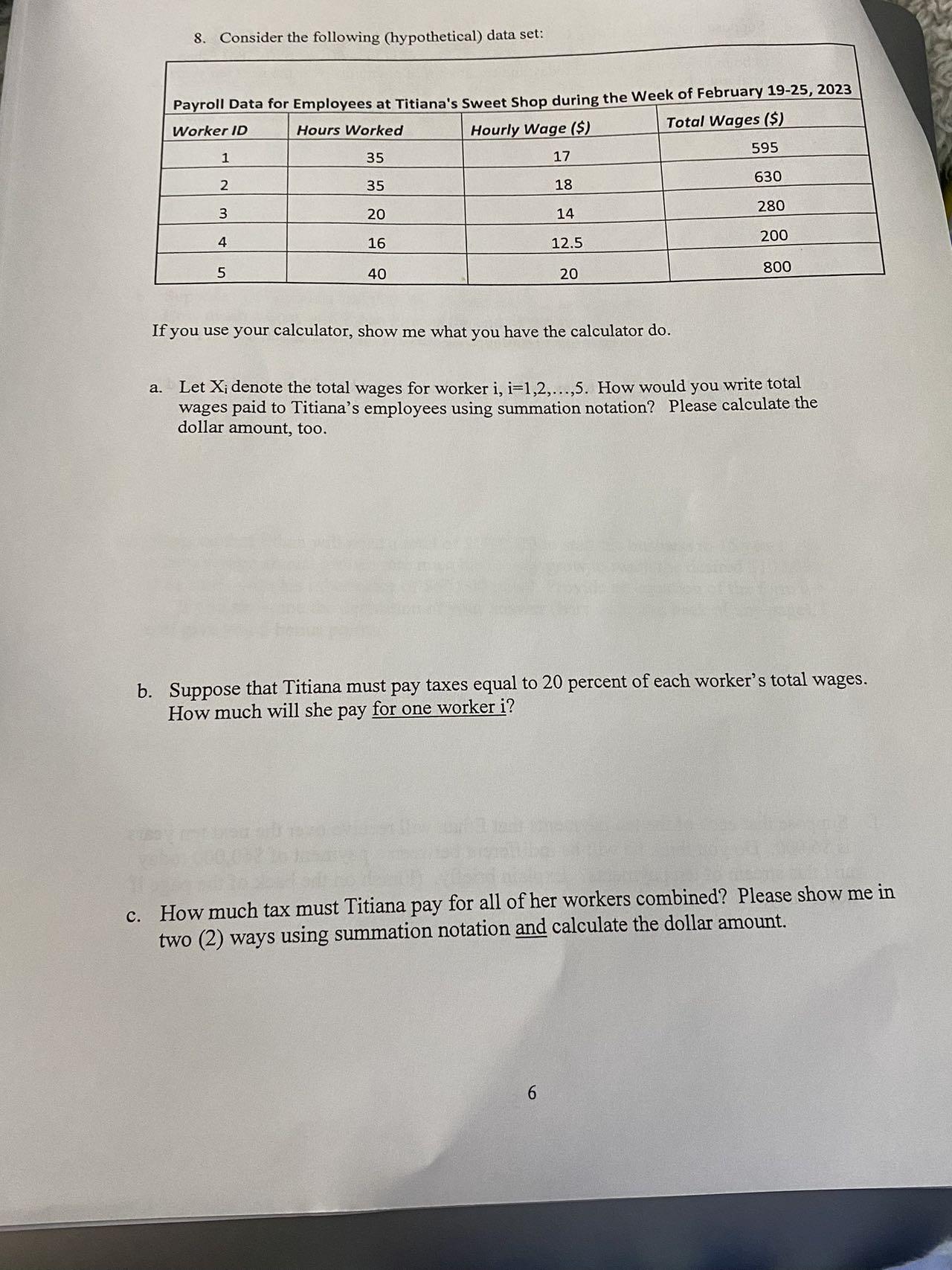

8. Consider the following (hypothetical) data set: Payroll Data for Employees at Titiana's Sweet Shop during the Week of February 19-25, 2023 Worker ID

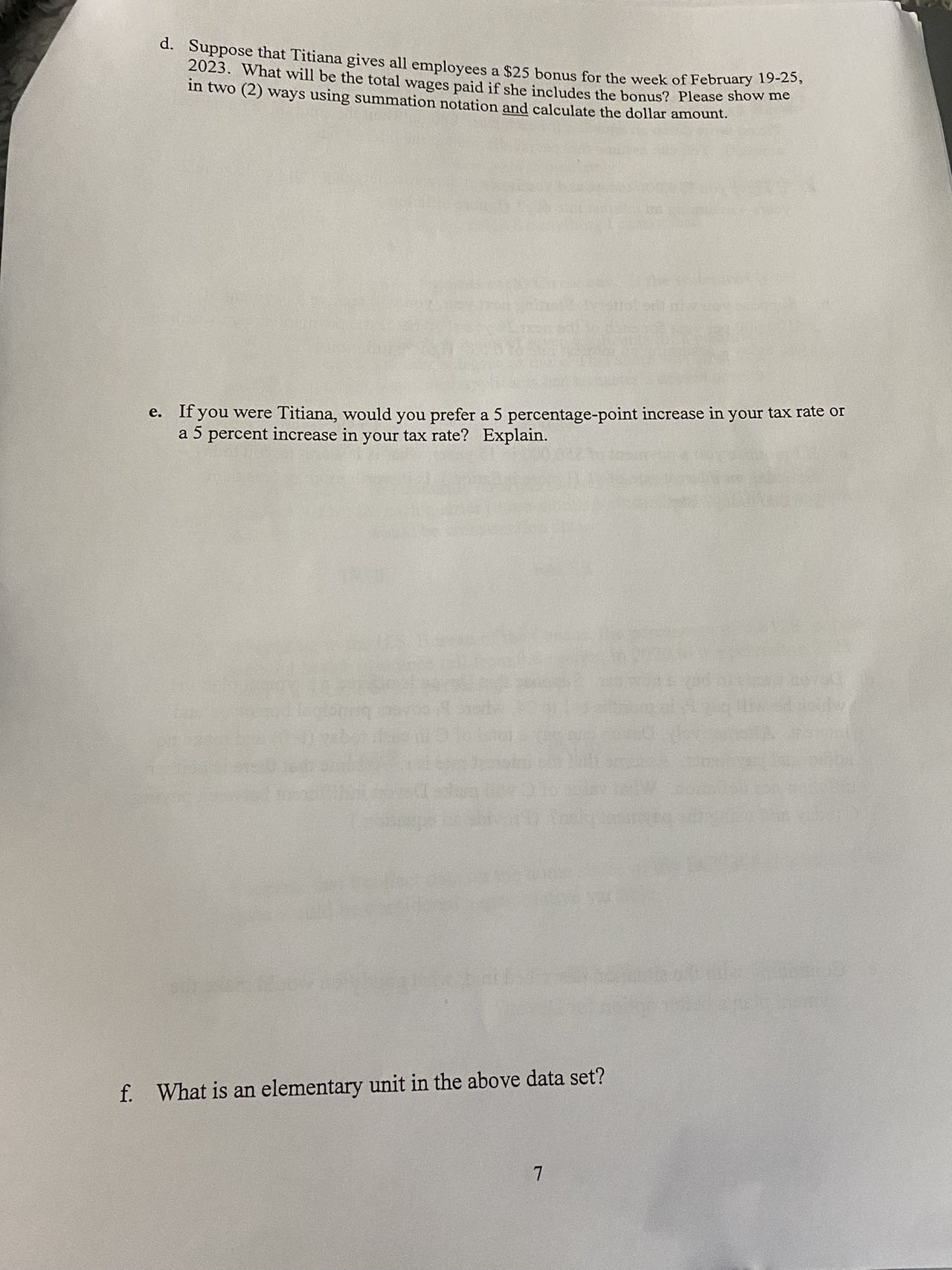

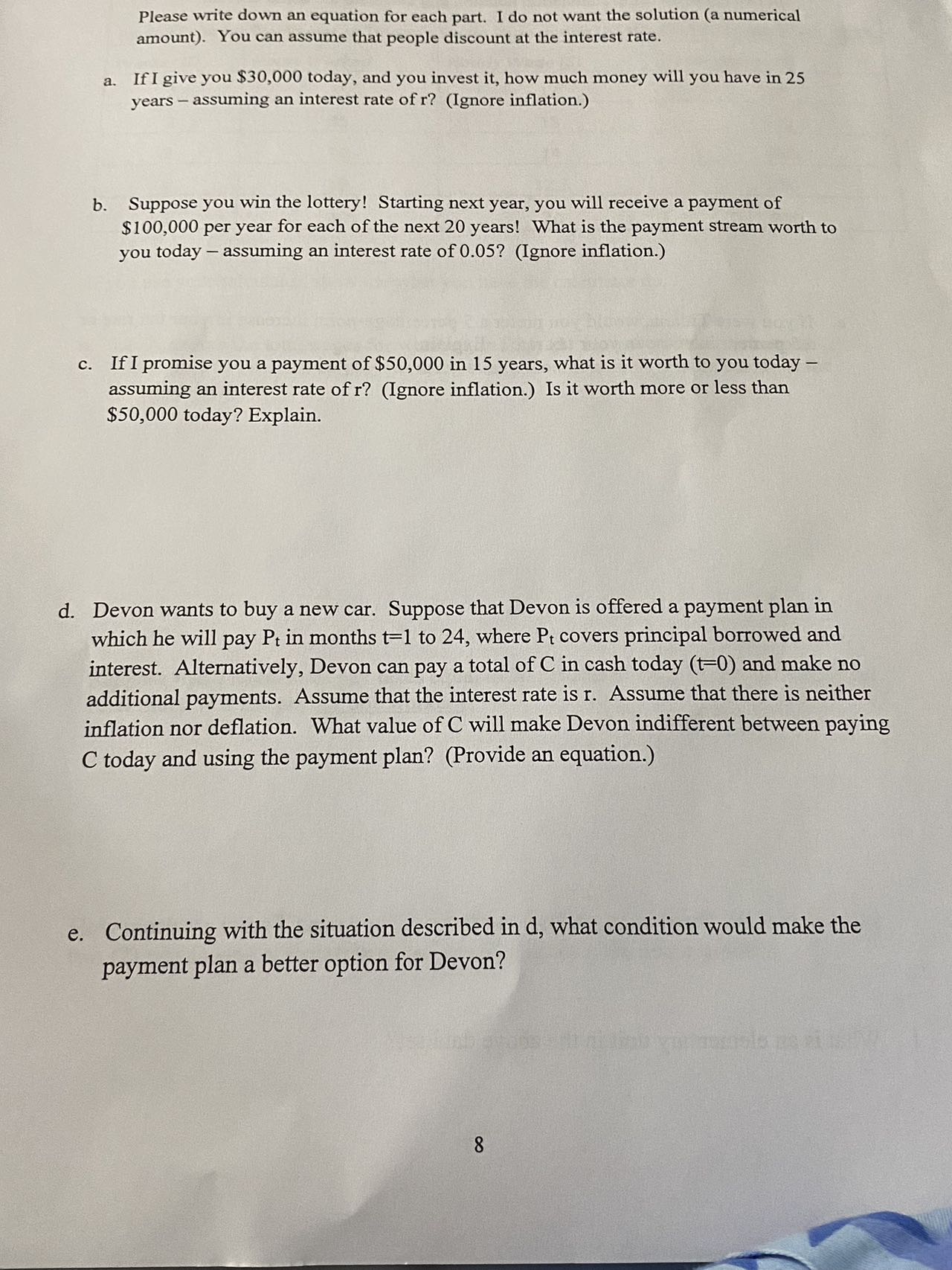

8. Consider the following (hypothetical) data set: Payroll Data for Employees at Titiana's Sweet Shop during the Week of February 19-25, 2023 Worker ID Hours Worked Hourly Wage ($) Total Wages ($) 595 1 35 17 630 2 35 18 280 3 20 14 200 4 16 12.5 5 800 40 20 If you use your calculator, show me what you have the calculator do. a. Let Xi denote the total wages for worker i, i=1,2,...,5. How would you write total wages paid to Titiana's employees using summation notation? Please calculate the dollar amount, too. b. Suppose that Titiana must pay taxes equal to 20 percent of each worker's total wages. How much will she pay for one worker i? c. How much tax must Titiana pay for all of her workers combined? Please show me in two (2) ways using summation notation and calculate the dollar amount. 6 d. Suppose that Titiana gives all employees a $25 bonus for the week of February 19-25, 2023. What will be the total wages paid if she includes the bonus? Please show me in two (2) ways using summation notation and calculate the dollar amount. e. If you were Titiana, would you prefer a 5 percentage-point increase in your tax rate or a 5 percent increase in your tax rate? Explain. f. What is an elementary unit in the above data set? 7 a. Please write down an equation for each part. I do not want the solution (a numerical amount). You can assume that people discount at the interest rate. If I give you $30,000 today, and you invest it, how much money will you have in 25 years - assuming an interest rate of r? (Ignore inflation.) b. Suppose you win the lottery! Starting next year, you will receive a payment of $100,000 per year for each of the next 20 years! What is the payment stream worth to you today - assuming an interest rate of 0.05? (Ignore inflation.) c. If I promise you a payment of $50,000 in 15 years, what is it worth to you today - assuming an interest rate of r? (Ignore inflation.) Is it worth more or less than $50,000 today? Explain. d. Devon wants to buy a new car. Suppose that Devon is offered a payment plan in which he will pay Pt in months t=1 to 24, where Pt covers principal borrowed and interest. Alternatively, Devon can pay a total of C in cash today (t=0) and make no additional payments. Assume that the interest rate is r. Assume that there is neither inflation nor deflation. What value of C will make Devon indifferent between paying C today and using the payment plan? (Provide an equation.) e. Continuing with the situation described in d, what condition would make the payment plan a better option for Devon? 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started