Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows,

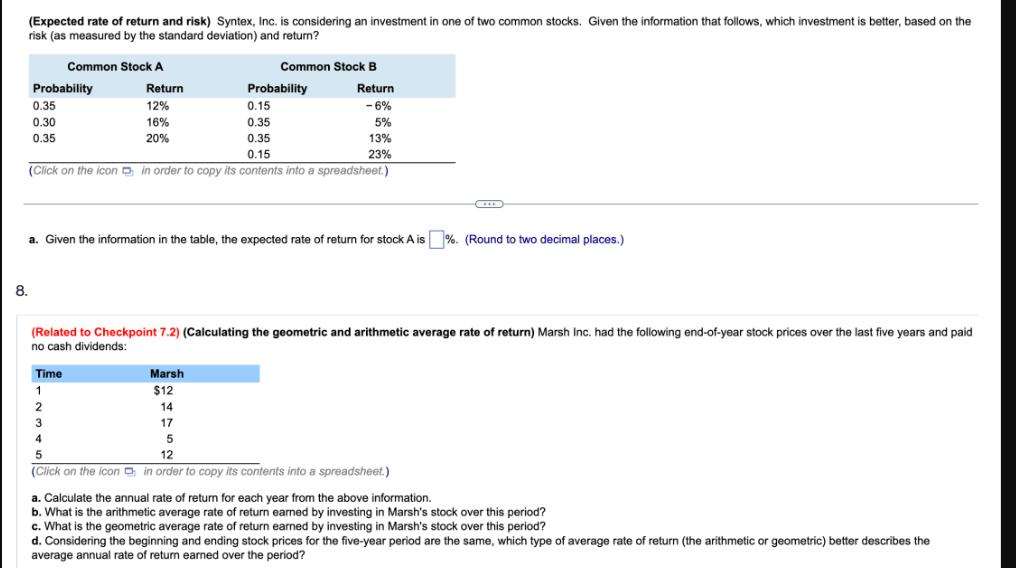

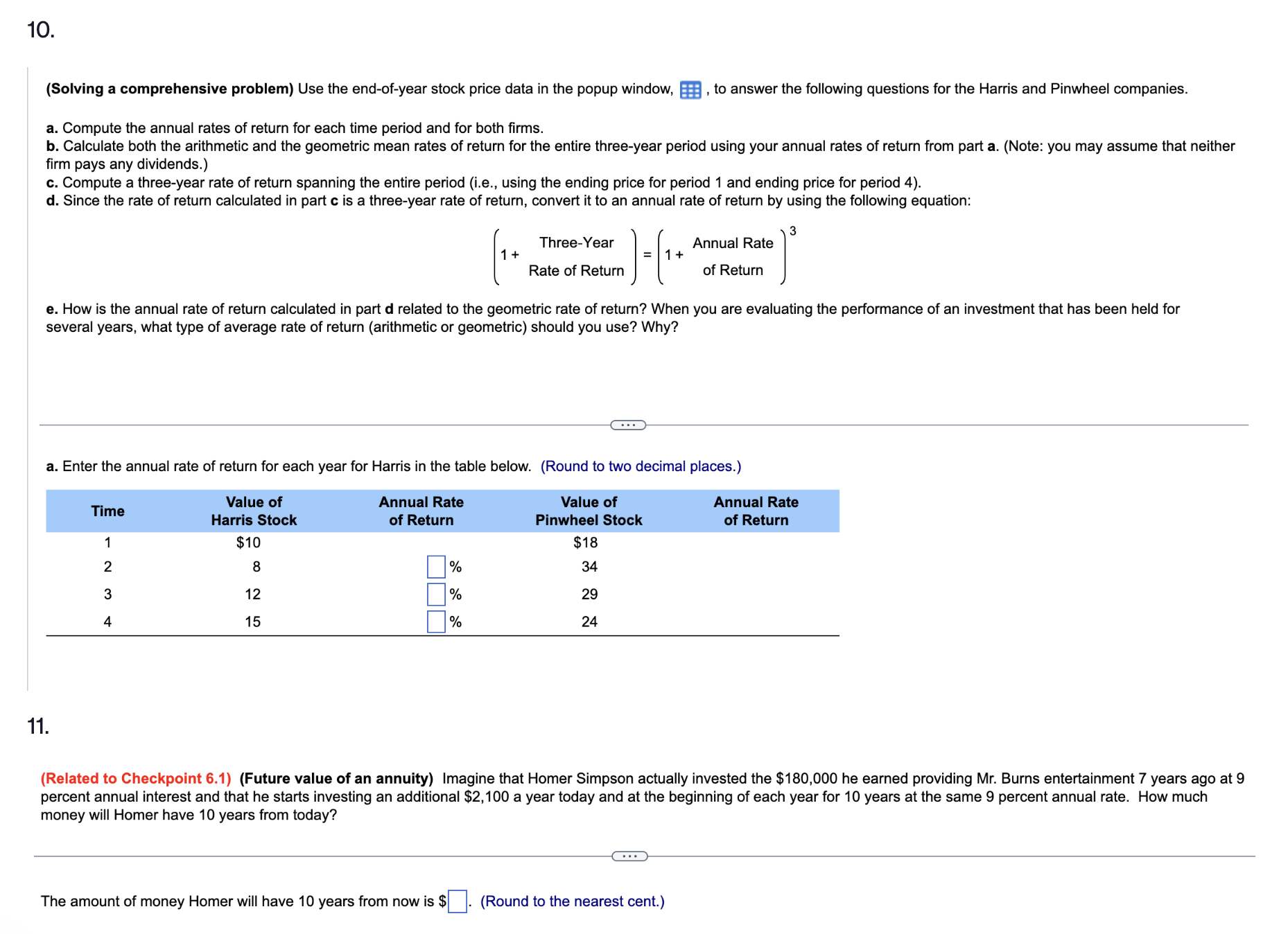

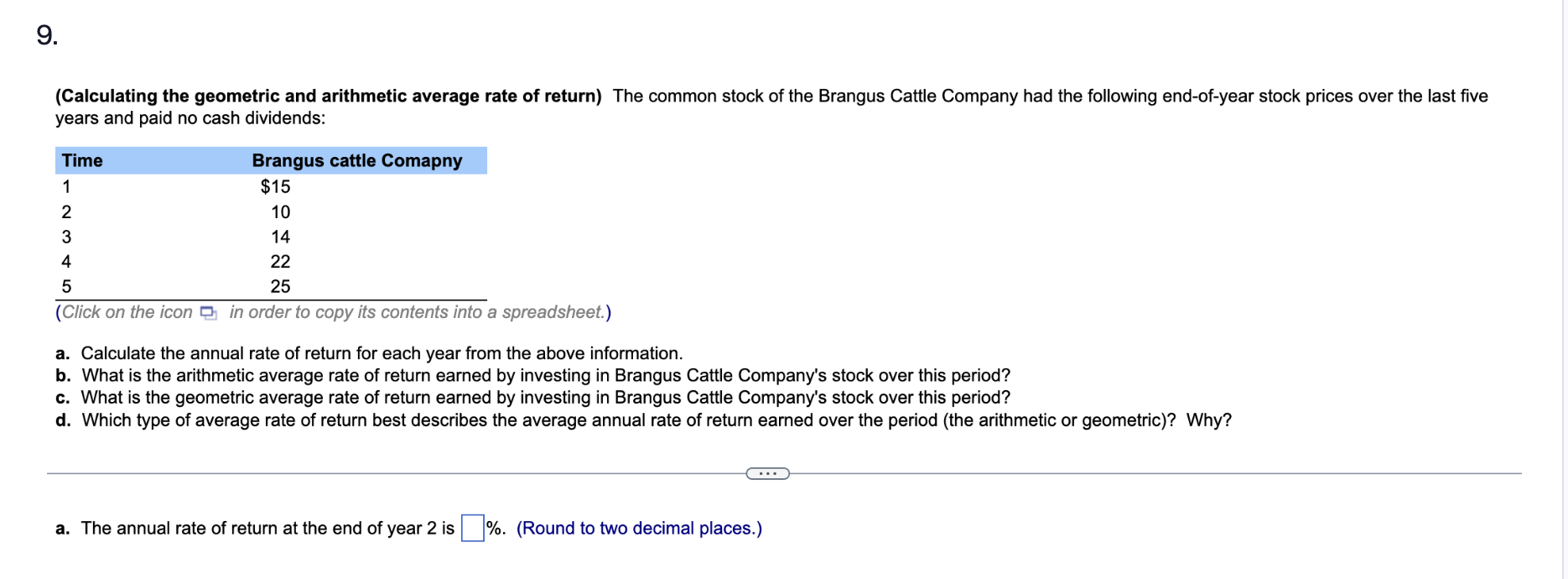

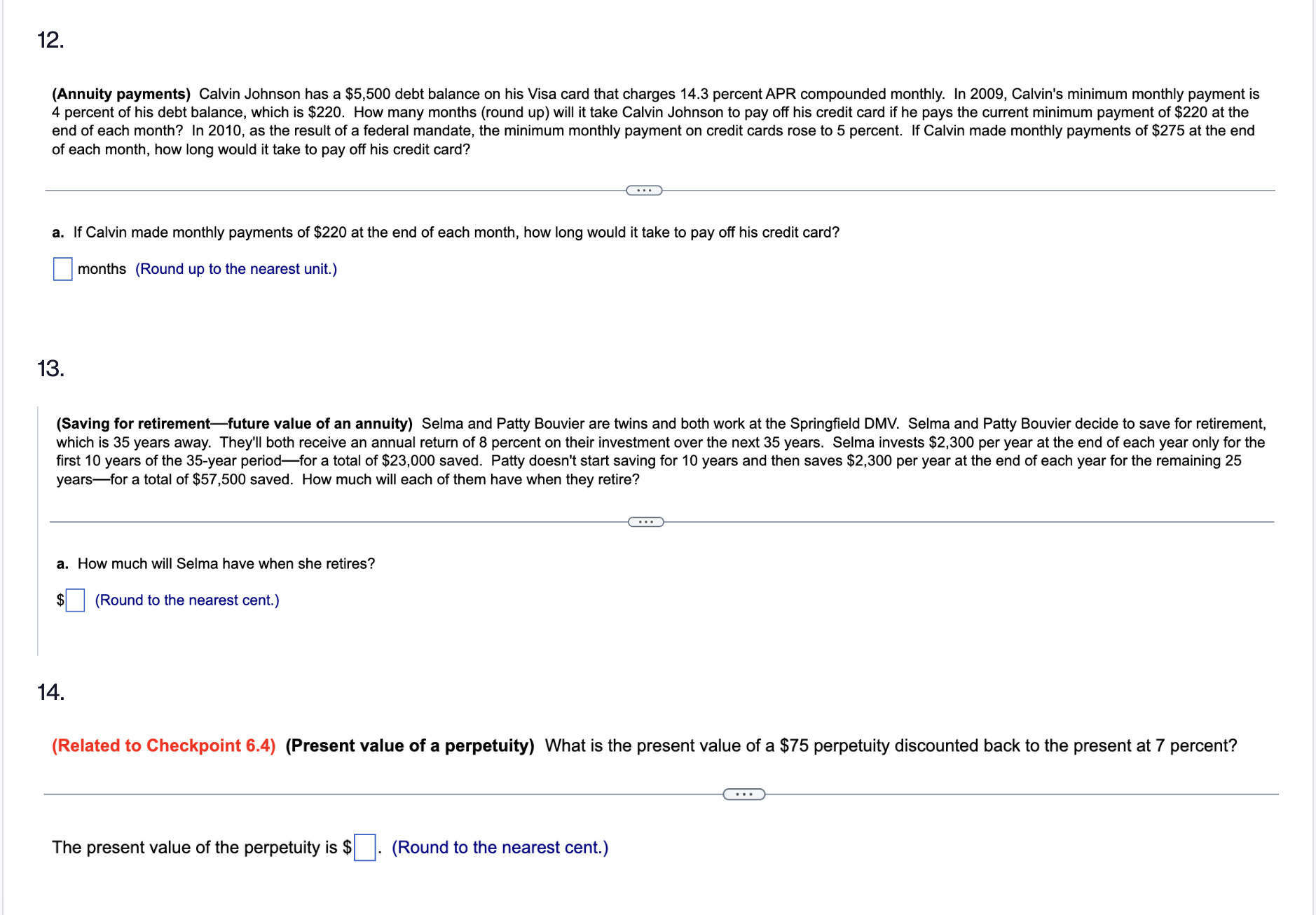

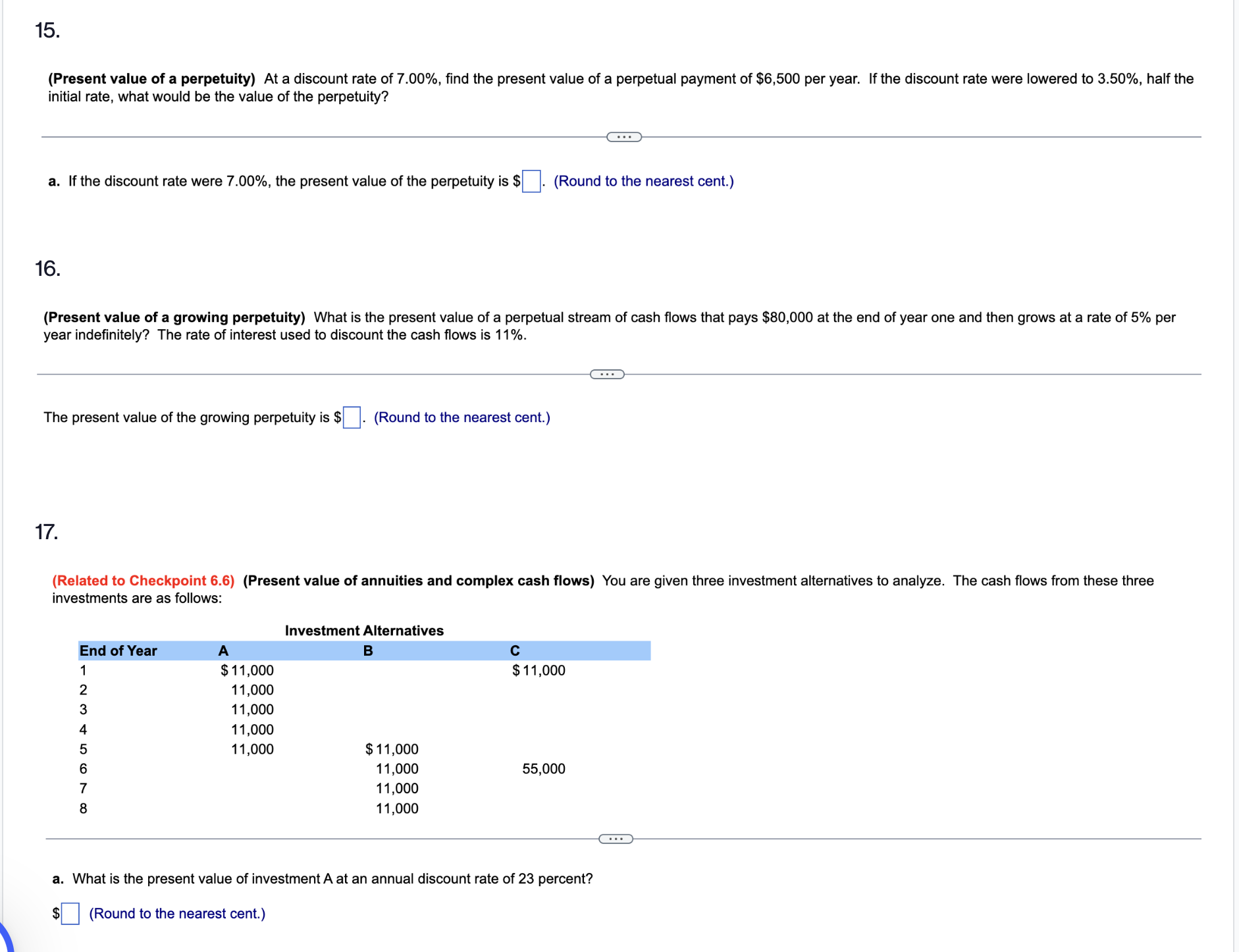

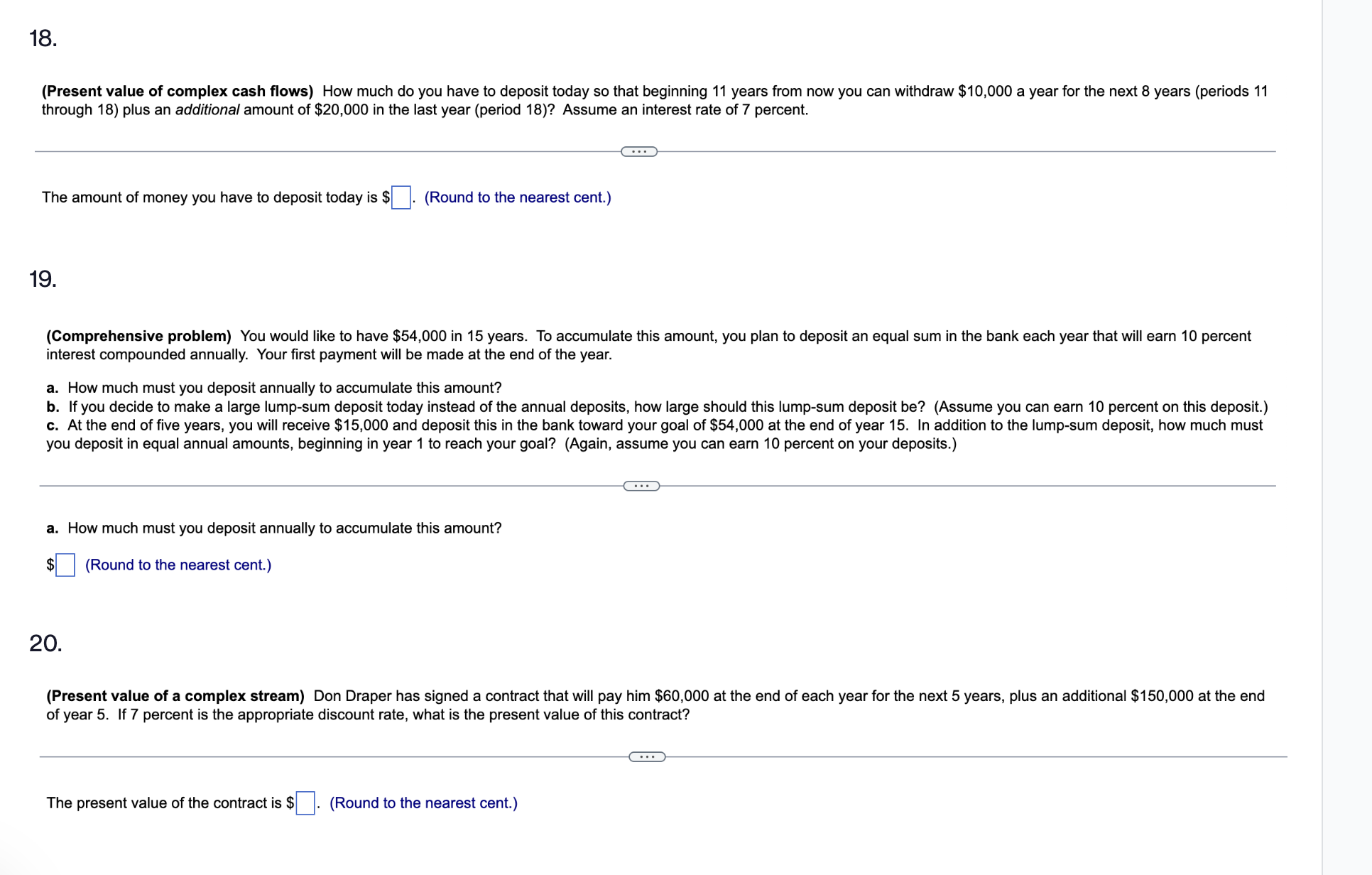

8. (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability 0.35 0.30 0.35 Return Probability 12% 0.15 16% 0.35 20% 0.35 0.15 Return -6% 5% 13% 23% (Click on the icon in order to copy its contents into a spreadsheet.) a. Given the information in the table, the expected rate of return for stock A is %. (Round to two decimal places.) (Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends: Time 1 Marsh $12 2 3 4 5 14 17 5 12 (Click on the icon in order to copy its contents into a spreadsheet.) a. Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of return earned by investing in Marsh's stock over this period? c. What is the geometric average rate of return earned by investing in Marsh's stock over this period? d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate of return (the arithmetic or geometric) better describes the average annual rate of return earned over the period? 10. (Solving a comprehensive problem) Use the end-of-year stock price data in the popup window, to answer the following questions for the Harris and Pinwheel companies. a. Compute the annual rates of return for each time period and for both firms. b. Calculate both the arithmetic and the geometric mean rates of return for the entire three-year period using your annual rates of return from part a. (Note: you may assume that neither firm pays any dividends.) c. Compute a three-year rate of return spanning the entire period (i.e., using the ending price for period 1 and ending price for period 4). d. Since the rate of return calculated in part c is a three-year rate of return, convert it to an annual rate of return by using the following equation: 3 1 + Three-Year Rate of Return 1 + Annual Rate of Return e. How is the annual rate of return calculated in part d related to the geometric rate of return? When you are evaluating the performance of an investment that has been held for several years, what type of average rate of return (arithmetic or geometric) should you use? Why? ... Time a. Enter the annual rate of return for each year for Harris in the table below. (Round to two decimal places.) Value of Harris Stock Annual Rate of Return Value of Pinwheel Stock Annual Rate of Return 1 $10 $18 2 8 % 34 3 12 % 29 4 15 % 24 11. (Related to Checkpoint 6.1) (Future value of an annuity) Imagine that Homer Simpson actually invested the $180,000 he earned providing Mr. Burns entertainment 7 years ago at 9 percent annual interest and that he starts investing an additional $2,100 a year today and at the beginning of each year for 10 years at the same 9 percent annual rate. How much money will Homer have 10 years from today? The amount of money Homer will have 10 years from now is $ (Round to the nearest cent.) 9. (Calculating the geometric and arithmetic average rate of return) The common stock of the Brangus Cattle Company had the following end-of-year stock prices over the last five years and paid no cash dividends: Time 1 2 3 4 5 Brangus cattle Comapny $15 10 14 22 25 (Click on the icon in order to copy its contents into a spreadsheet.) a. Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of return earned by investing in Brangus Cattle Company's stock over this period? c. What is the geometric average rate of return earned by investing in Brangus Cattle Company's stock over this period? d. Which type of average rate of return best describes the average annual rate of return earned over the period (the arithmetic or geometric)? Why? a. The annual rate of return at the end of year 2 is %. (Round to two decimal places.) 12. (Annuity payments) Calvin Johnson has a $5,500 debt balance on his Visa card that charges 14.3 percent APR compounded monthly. In 2009, Calvin's minimum monthly payment is 4 percent of his debt balance, which is $220. How many months (round up) will it take Calvin Johnson to pay off his credit card if he pays the current minimum payment of $220 at the end of each month? In 2010, as the result of a federal mandate, the minimum monthly payment on credit cards rose to 5 percent. If Calvin made monthly payments of $275 at the end of each month, how long would it take to pay off his credit card? a. If Calvin made monthly payments of $220 at the end of each month, how long would it take to pay off his credit card? months (Round up to the nearest unit.) 13. (Saving for retirement-future value of an annuity) Selma and Patty Bouvier are twins and both work at the Springfield DMV. Selma and Patty Bouvier decide to save for retirement, which is 35 years away. They'll both receive an annual return of 8 percent on their investment over the next 35 years. Selma invests $2,300 per year at the end of each year only for the first 10 years of the 35-year period-for a total of $23,000 saved. Patty doesn't start saving for 10 years and then saves $2,300 per year at the end of each year for the remaining 25 years for a total of $57,500 saved. How much will each of them have when they retire? a. How much will Selma have when she retires? (Round to the nearest cent.) 14. (Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a $75 perpetuity discounted back to the present at 7 percent? The present value of the perpetuity is $ (Round to the nearest cent.) 15. (Present value of a perpetuity) At a discount rate of 7.00%, find the present value of a perpetual payment of $6,500 per year. If the discount rate were lowered to 3.50%, half the initial rate, what would be the value of the perpetuity? a. If the discount rate were 7.00%, the present value of the perpetuity is $ (Round to the nearest cent.) 16. (Present value of a growing perpetuity) What is the present value of a perpetual stream of cash flows that pays $80,000 at the end of year one and then grows at a rate of 5% per year indefinitely? The rate of interest used to discount the cash flows is 11%. The present value of the growing perpetuity is $ (Round to the nearest cent.) 17. (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year A B C 1 $11,000 $11,000 2345678 11,000 11,000 11,000 11,000 $11,000 11,000 55,000 11,000 11,000 a. What is the present value of investment A at an annual discount rate of 23 percent? $ (Round to the nearest cent.) ... 18. (Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $10,000 a year for the next 8 years (periods 11 through 18) plus an additional amount of $20,000 in the last year (period 18)? Assume an interest rate of 7 percent. The amount of money you have to deposit today is $ (Round to the nearest cent.) 19. (Comprehensive problem) You would like to have $54,000 in 15 years. To accumulate this amount, you plan to deposit an equal sum in the bank each year that will earn 10 percent interest compounded annually. Your first payment will be made at the end of the year. a. How much must you deposit annually to accumulate this amount? b. If you decide to make a large lump-sum deposit today instead of the annual deposits, how large should this lump-sum deposit be? (Assume you can earn 10 percent on this deposit.) c. At the end of five years, you will receive $15,000 and deposit this in the bank toward your goal of $54,000 at the end of year 15. In addition to the lump-sum deposit, how much must you deposit in equal annual amounts, beginning in year 1 to reach your goal? (Again, assume you can earn 10 percent on your deposits.) a. How much must you deposit annually to accumulate this amount? $ (Round to the nearest cent.) 20. (Present value of a complex stream) Don Draper has signed a contract that will pay him $60,000 at the end of each year for the next 5 years, plus an additional $150,000 at the end of year 5. If 7 percent is the appropriate discount rate, what is the present value of this contract? The present value of the contract is $ 1. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started