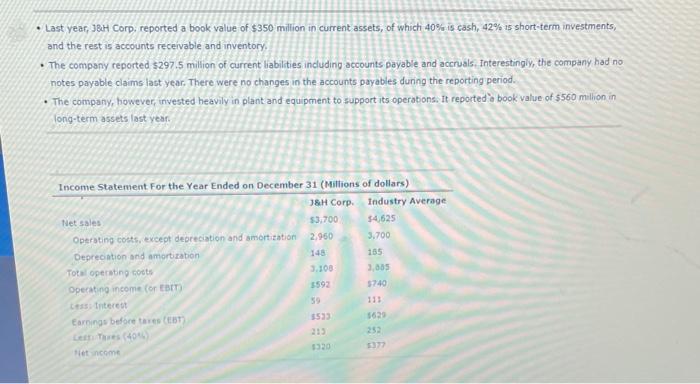

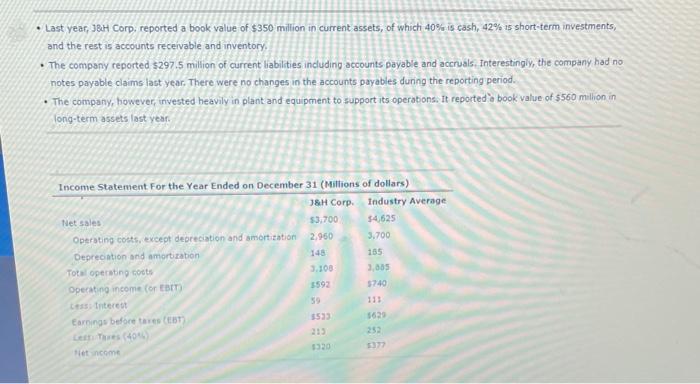

8. Free cash flow Accounting statements represent a company's earnings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's real cash pribor Which of the following statements best describes fret cash flow? The cash flow available for distribution to all investors after the company has made all investments in fixed assets and working capital necessary to sustain a firm's ongoing operations The exceu cach generated by revenues less all operating expenses. Suppose you are the only owner of a chain of coffee shops near Universities Your current cates are doing well, but you are enterested in starting a forie ding restaurant. You decide to use the cath generated from your enting business to enter into a new business. Your accountant prondes you with the following data on your current financial performance: Financial update as of June 15 You can be generates $111.000 EBIT . The corporate trattapable to your busines35% The depreciation rooted in the financial statemente 21.145. You don't need to spend money for new equipment in your existing cover you do 516,650 of doch You need to purchase 58.880 inch tables and point, and more formal leware-ant that you calling and wages bevable, wit rode 55 550 Last year, JBH Corp. reported a book value of $350 million in current assets, of which 40% is cash, 42% 15 short-term investments, and the rest is accounts receivable and inventory. The company reported $297.5 million of current liabilities including accounts payable and accruals Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. The company, however, invested heavily in plant and equipment to support its operations. It reported'a book value of $560 million in long-term assets last year. Income Statement For the Year Ended on December 31 (Millions of dollars) J&H Corp. Industry Average 53.700 $4,625 Net sales 2.960 3.700 Operating costs, except depreciation and amortization 155 Deprecation and amortization 3.100 3.305 Tots operating costs 1592 5240 111 Operating income (or EBIT) Lettere Earnings before tres 3533 1620 1320 etcome 8. Free cash flow Accounting statements represent a company's earnings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's real cash pribor Which of the following statements best describes fret cash flow? The cash flow available for distribution to all investors after the company has made all investments in fixed assets and working capital necessary to sustain a firm's ongoing operations The exceu cach generated by revenues less all operating expenses. Suppose you are the only owner of a chain of coffee shops near Universities Your current cates are doing well, but you are enterested in starting a forie ding restaurant. You decide to use the cath generated from your enting business to enter into a new business. Your accountant prondes you with the following data on your current financial performance: Financial update as of June 15 You can be generates $111.000 EBIT . The corporate trattapable to your busines35% The depreciation rooted in the financial statemente 21.145. You don't need to spend money for new equipment in your existing cover you do 516,650 of doch You need to purchase 58.880 inch tables and point, and more formal leware-ant that you calling and wages bevable, wit rode 55 550 Last year, JBH Corp. reported a book value of $350 million in current assets, of which 40% is cash, 42% 15 short-term investments, and the rest is accounts receivable and inventory. The company reported $297.5 million of current liabilities including accounts payable and accruals Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. The company, however, invested heavily in plant and equipment to support its operations. It reported'a book value of $560 million in long-term assets last year. Income Statement For the Year Ended on December 31 (Millions of dollars) J&H Corp. Industry Average 53.700 $4,625 Net sales 2.960 3.700 Operating costs, except depreciation and amortization 155 Deprecation and amortization 3.100 3.305 Tots operating costs 1592 5240 111 Operating income (or EBIT) Lettere Earnings before tres 3533 1620 1320 etcome