Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8.) Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year: Purchased a long-term investment for

8.) Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year:

- Purchased a long-term investment for cash, $19,000.

- Paid cash dividend, $10,400.

- Sold equipment for $6,800 cash (cost, $22,600; accumulated depreciation, $15,800).

- Issued shares of no-par stock, 580 shares at $10 cash per share.

- Net income was $21,000.

- Depreciation expense was $3,800.

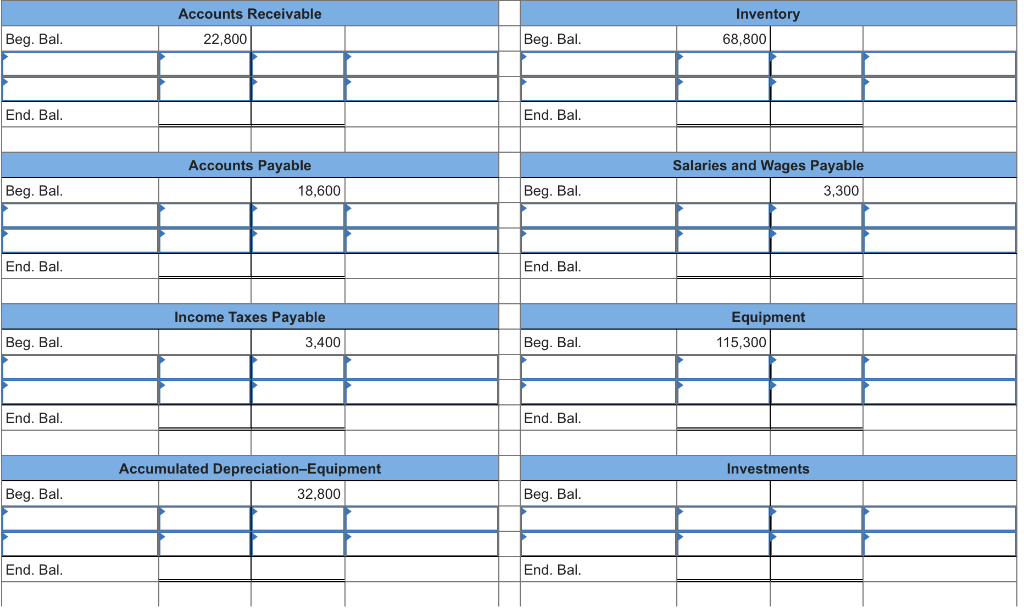

Its comparative balance sheet is presented below:

| Ending Balances | Beginning Balances | ||||||||

| Cash | $ | 25,800 | $ | 26,500 | |||||

| Accounts receivable | 22,800 | 22,800 | |||||||

| Inventory | 74,200 | 68,800 | |||||||

| Investments | 19,000 | 0 | |||||||

| Equipment | 92,700 | 115,300 | |||||||

| Accumulated DepreciationEquipment | (20,800 | ) | (32,800 | ) | |||||

| Total | $ | 213,700 | $ | 200,600 | |||||

| Accounts payable | $ | 14,800 | $ | 18,600 | |||||

| Salaries and wages payable | 1,900 | 3,300 | |||||||

| Income taxes payable | 5,300 | 3,400 | |||||||

| Notes payable (long-term) | 58,000 | 58,000 | |||||||

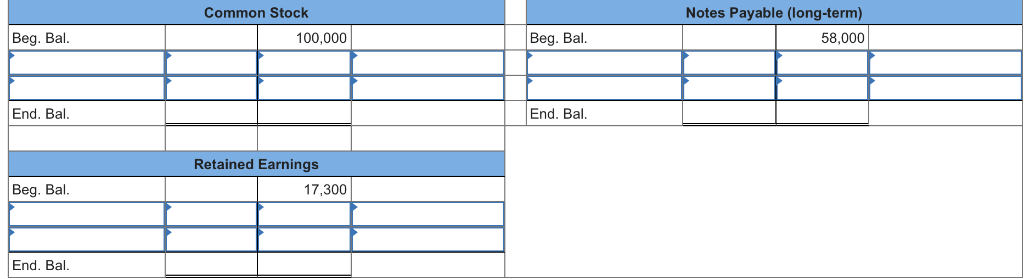

| Common stock | 105,800 | 100,000 | |||||||

| Retained earnings | 27,900 | 17,300 | |||||||

| Total | $ | 213,700 | $ | 200,600 | |||||

Required:

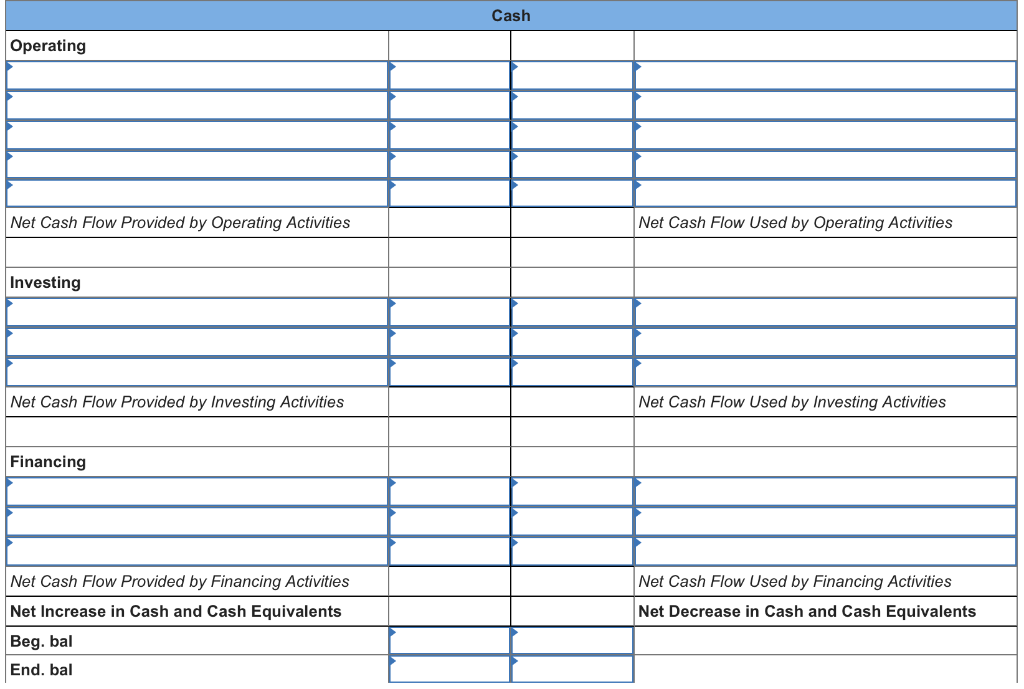

- Complete the T-account worksheet to be used to prepare the statement of cash flows for the current year (First is the cash worksheet, then the others).

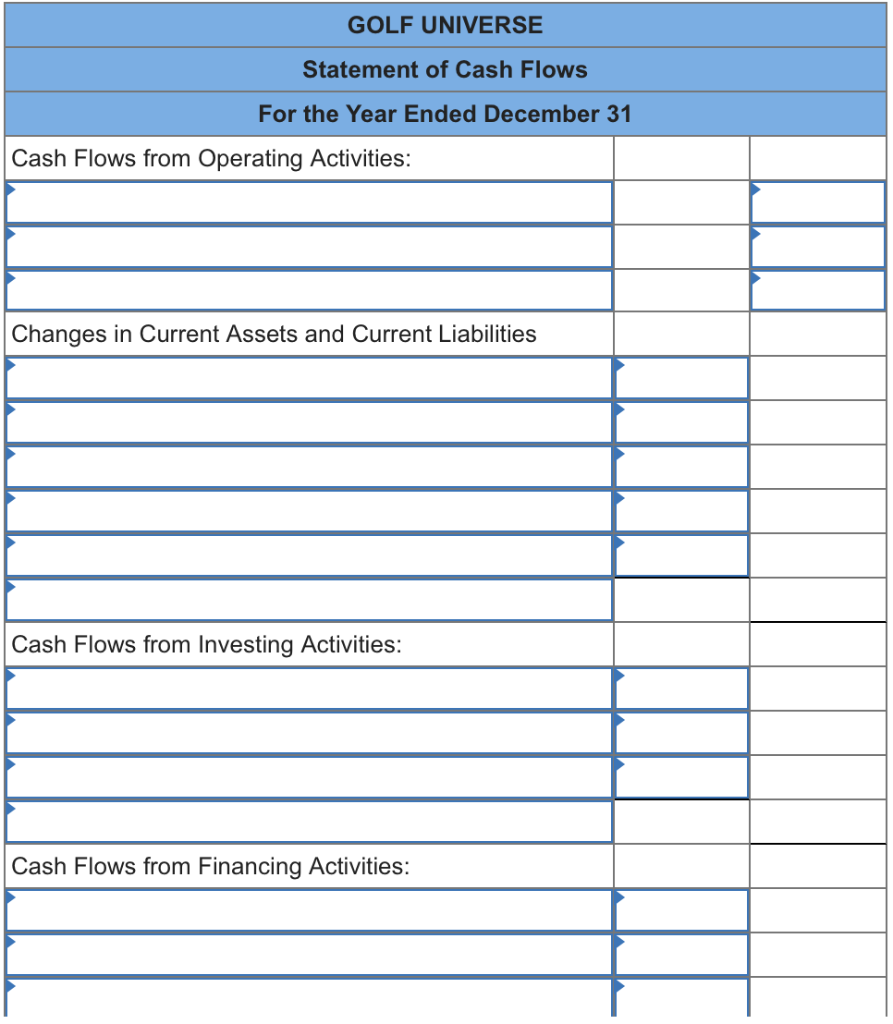

2. Based on the T-account worksheet, prepare the statement of cash flows for the current year in proper format (Not all of the Cash Flows from Financing Activities cells fit in the screenshot, but there are 7 cells).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started