Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. How much should you deposit now in an account paying 3.95% CIA in oeder to withdraw 51,500 at the end of each of the

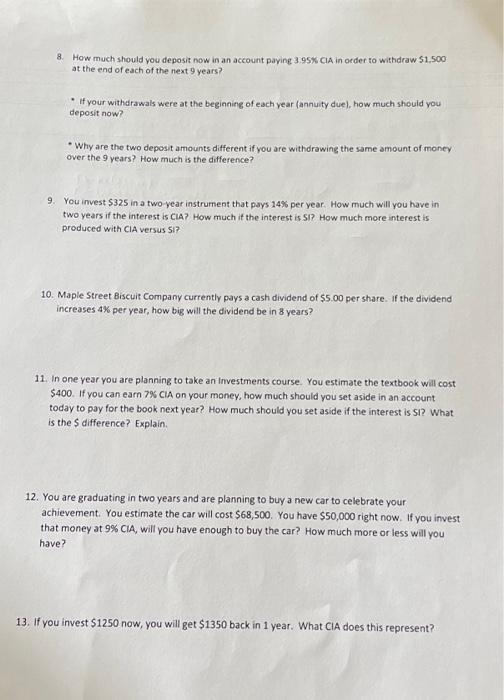

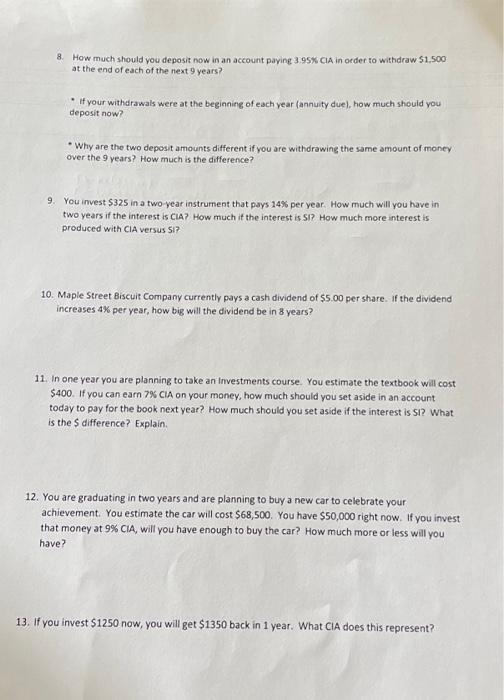

8. How much should you deposit now in an account paying 3.95% CIA in oeder to withdraw 51,500 at the end of each of the next 9 years? - If your withdrawals were at the beginning of each year (annuity due). how much should you deposit now? - Why are the two deposit amounts different if you are withdrawing the same amount of money over the 9 years? How much is the difference? 9. You invest $325 in a two year instrument that pays 14% per year. How much will you have in two years if the interest is ClA? How much if the interest is SI? How much more interest is produced with ClA versus 51 ? 10. Maple Street Biscuit Company currently pays a cash dividend of $5.00 per share. If the dividend increases 4% per year, how big will the dividend be in 8 years? 11. In one year you are planning to take an investments course. You estimate the textbook will cost $400. If you can eam 79 cIA on your money, how much should you set aside in an account today to pay for the book next year? How much should you set aside if the interest is SI? What is the $ difference? Explain. 12. You are graduating in two years and are planning to buy a new car to celebrate your achievement. You estimate the car will cost $68,500. You have $50,000 right now. If you invest that money at 9% CIA, will you have enough to buy the car? How much more or less will you have? 13. If you invest $1250 now, you will get $1350 back in 1 year. What CIA does this represent

8. How much should you deposit now in an account paying 3.95% CIA in oeder to withdraw 51,500 at the end of each of the next 9 years? - If your withdrawals were at the beginning of each year (annuity due). how much should you deposit now? - Why are the two deposit amounts different if you are withdrawing the same amount of money over the 9 years? How much is the difference? 9. You invest $325 in a two year instrument that pays 14% per year. How much will you have in two years if the interest is ClA? How much if the interest is SI? How much more interest is produced with ClA versus 51 ? 10. Maple Street Biscuit Company currently pays a cash dividend of $5.00 per share. If the dividend increases 4% per year, how big will the dividend be in 8 years? 11. In one year you are planning to take an investments course. You estimate the textbook will cost $400. If you can eam 79 cIA on your money, how much should you set aside in an account today to pay for the book next year? How much should you set aside if the interest is SI? What is the $ difference? Explain. 12. You are graduating in two years and are planning to buy a new car to celebrate your achievement. You estimate the car will cost $68,500. You have $50,000 right now. If you invest that money at 9% CIA, will you have enough to buy the car? How much more or less will you have? 13. If you invest $1250 now, you will get $1350 back in 1 year. What CIA does this represent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started