Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8 Mark e of 4% As the CFO of Sarah Ltd., you are calculating the cost of capital for the firm's projects. The company currently

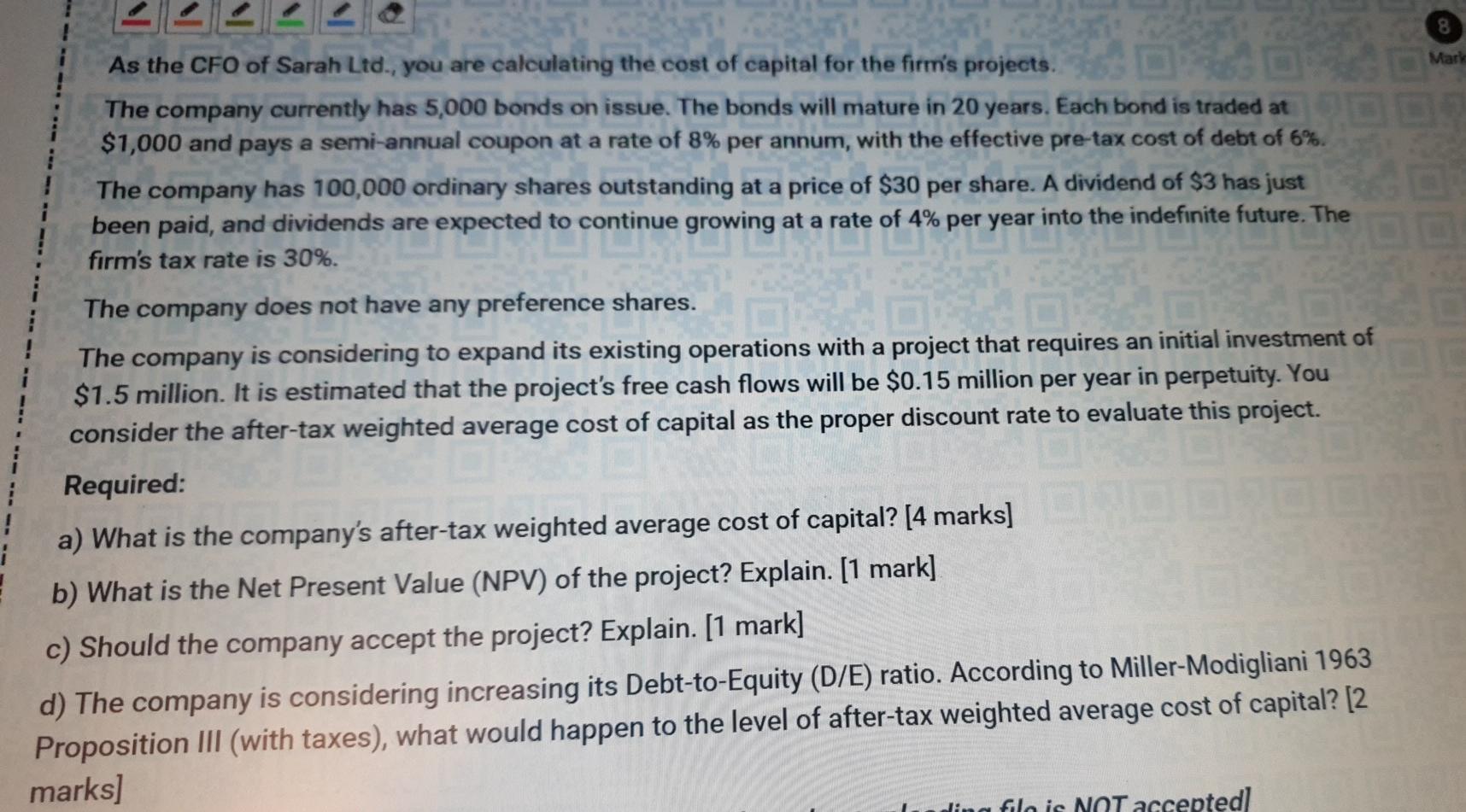

8 Mark e of 4% As the CFO of Sarah Ltd., you are calculating the cost of capital for the firm's projects. The company currently has 5,000 bonds on issue. The bonds will mature in 20 years. Each bond is traded at $1,000 and pays a semi-annual coupon at a rate of 8% per annum, with the effective pre-tax cost of debt of 6%. The company has 100,000 ordinary shares outstanding at a price of $30 per share. A dividend of $3 has just been paid, and dividends are expected to continue growing at a rate of 4% per year into the indefinite future. The firm's tax rate is 30%. The company does not have any preference shares. The company is considering to expand its existing operations with a project that requires an initial investment of $1.5 million. It is estimated that the project's free cash flows will be $0.15 million per year in perpetuity. You consider the after-tax weighted average cost of capital as the proper discount rate to evaluate this project. Required: a) What is the company's after-tax weighted average cost of capital? [4 marks] b) What is the Net Present Value (NPV) of the project? Explain. [1 mark] c) Should the company accept the project? Explain. [1 mark] d) The company is considering increasing its Debt-to-Equity (D/E) ratio. According to Miller-Modigliani 1963 Proposition III (with taxes), what would happen to the level of after-tax weighted average cost of capital? [2 marks] ding filo is NOT accepted]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started