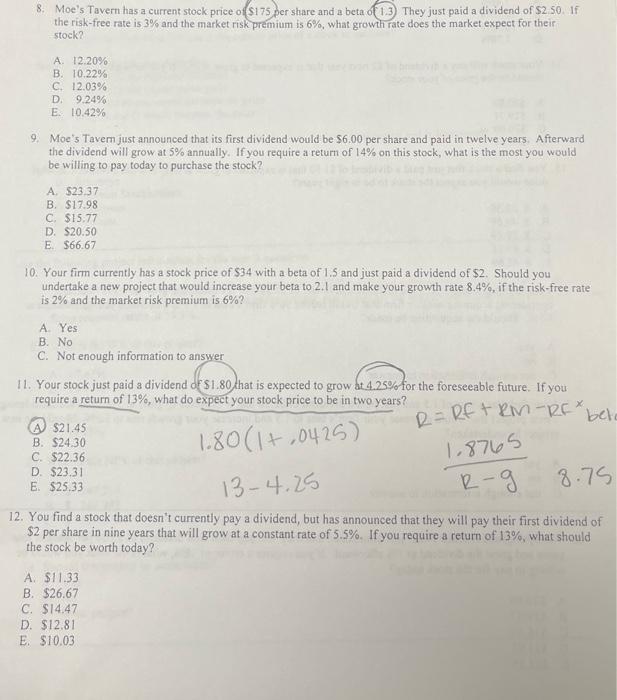

8. Moe's Tavern has a current stock price of $175 per share and a beta of 1.3) They just paid a dividend of $2.50. If the risk-free rate is 3% and the market risk premium is 6%, what growth rate does the market expect for their stock? A. 12.20% B. 10.22% C. 12.03% D. 9.24% E. 10.42% 9. Moe's Tavem just announced that its first dividend would be $6.00 per share and paid in twelve years. Afterward the dividend will grow at 5% annually. If you require a return of 14% on this stock, what is the most you would be willing to pay today to purchase the stock? A. 523.37 B. $17.98 C. $15,77 D. 520.50 E. $66.67 10. Your firm currently has a stock price of $34 with a beta of 1.5 and just paid a dividend of $2. Should you undertake a new project that would increase your beta to 2.1 and make your growth rate 8.4%, if the risk-free rate is 2% and the market risk premium is 6% ? A. Yes B. No C. Not enough information to answer 11. Your stock just paid a dividend of $1.80 that is expected to grow at 4.25% for the foreseeable future. If you require a return of 13%, what do expect your stock price to be in two years? (A) $21.45 B. $24.30 C. $22.36 D. $23.31 E. $25,33 134.26 12. You find a stock that doesn't currently pay a dividend, but has announced that they will pay their first dividend of $2 per share in nine years that will grow at a constant rate of 5.5%. If you require a return of 13%, what should the stock be worth today? A. $11.33 B. $26.67 C. S14.47 D. $12.81 E. $10.03 8. Moe's Tavern has a current stock price of $175 per share and a beta of 1.3) They just paid a dividend of $2.50. If the risk-free rate is 3% and the market risk premium is 6%, what growth rate does the market expect for their stock? A. 12.20% B. 10.22% C. 12.03% D. 9.24% E. 10.42% 9. Moe's Tavem just announced that its first dividend would be $6.00 per share and paid in twelve years. Afterward the dividend will grow at 5% annually. If you require a return of 14% on this stock, what is the most you would be willing to pay today to purchase the stock? A. 523.37 B. $17.98 C. $15,77 D. 520.50 E. $66.67 10. Your firm currently has a stock price of $34 with a beta of 1.5 and just paid a dividend of $2. Should you undertake a new project that would increase your beta to 2.1 and make your growth rate 8.4%, if the risk-free rate is 2% and the market risk premium is 6% ? A. Yes B. No C. Not enough information to answer 11. Your stock just paid a dividend of $1.80 that is expected to grow at 4.25% for the foreseeable future. If you require a return of 13%, what do expect your stock price to be in two years? (A) $21.45 B. $24.30 C. $22.36 D. $23.31 E. $25,33 134.26 12. You find a stock that doesn't currently pay a dividend, but has announced that they will pay their first dividend of $2 per share in nine years that will grow at a constant rate of 5.5%. If you require a return of 13%, what should the stock be worth today? A. $11.33 B. $26.67 C. S14.47 D. $12.81 E. $10.03