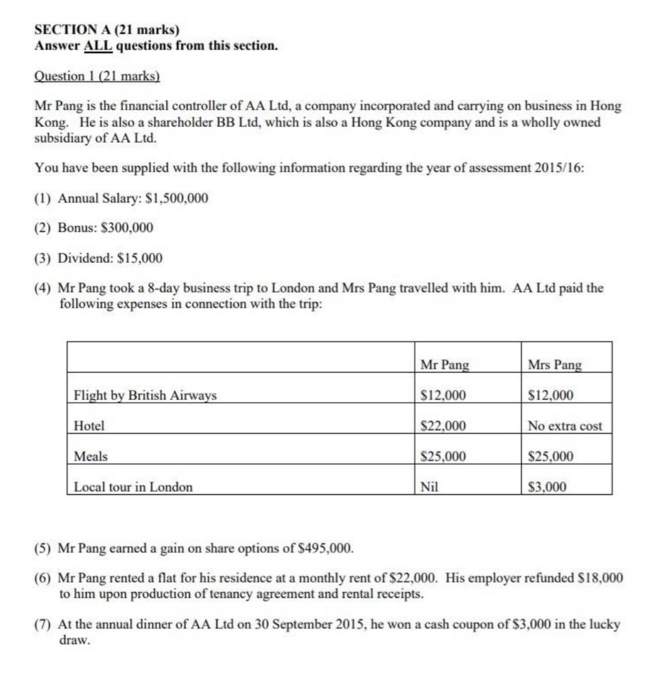

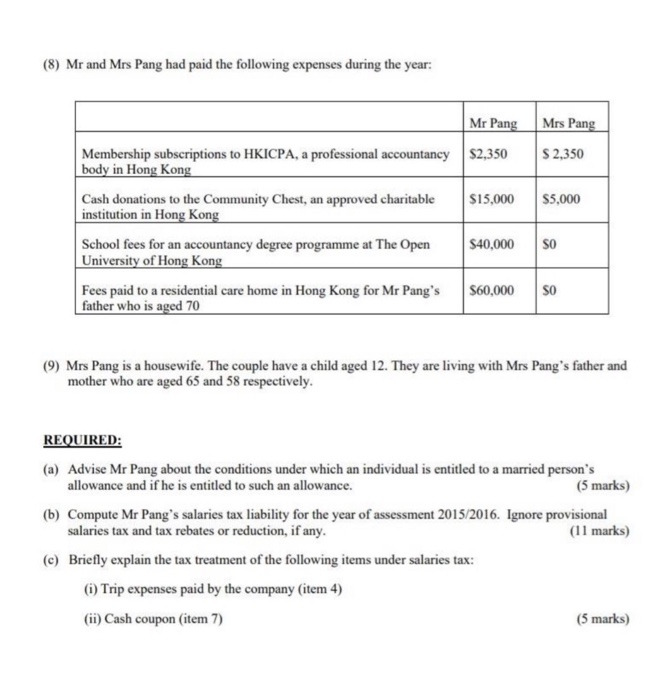

(8) Mr and Mrs Pang had paid the following expenses during the year: Mrs Pang $ 2,350 $5,000 Mr Pang Membership subscriptions to HKICPA, a professional accountancy S2,350 body in Hong Kong Cash donations to the Community Chest, an approved charitable $15,000 institution in Hong Kong School fees for an accountancy degree programme at The Open $40,000 University of Hong Kong Fees paid to a residential care home in Hong Kong for Mr Pang's $60,000 father who is aged 70 SO SO (9) Mrs Pang is a housewife. The couple have a child aged 12. They are living with Mrs Pang's father and mother who are aged 65 and 58 respectively. REQUIRED: (a) Advise Mr Pang about the conditions under which an individual is entitled to a married person's allowance and if he is entitled to such an allowance. (5 marks) (b) Compute Mr Pang's salaries tax liability for the year of assessment 2015/2016. Ignore provisional salaries tax and tax rebates or reduction, if any. (11 marks) (c) Briefly explain the tax treatment of the following items under salaries tax: (1) Trip expenses paid by the company (item 4) (ii) Cash coupon (item 7) (5 marks) (8) Mr and Mrs Pang had paid the following expenses during the year: Mrs Pang $ 2,350 $5,000 Mr Pang Membership subscriptions to HKICPA, a professional accountancy S2,350 body in Hong Kong Cash donations to the Community Chest, an approved charitable $15,000 institution in Hong Kong School fees for an accountancy degree programme at The Open $40,000 University of Hong Kong Fees paid to a residential care home in Hong Kong for Mr Pang's $60,000 father who is aged 70 SO SO (9) Mrs Pang is a housewife. The couple have a child aged 12. They are living with Mrs Pang's father and mother who are aged 65 and 58 respectively. REQUIRED: (a) Advise Mr Pang about the conditions under which an individual is entitled to a married person's allowance and if he is entitled to such an allowance. (5 marks) (b) Compute Mr Pang's salaries tax liability for the year of assessment 2015/2016. Ignore provisional salaries tax and tax rebates or reduction, if any. (11 marks) (c) Briefly explain the tax treatment of the following items under salaries tax: (1) Trip expenses paid by the company (item 4) (ii) Cash coupon (item 7)