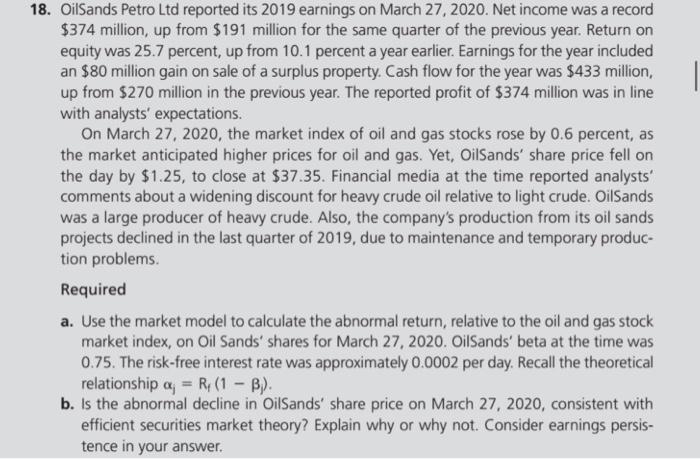

8. OilSands Petro Ltd reported its 2019 earnings on March 27, 2020. Net income was a record $374 million, up from $191 million for the same quarter of the previous year. Return on equity was 25.7 percent, up from 10.1 percent a year earlier. Earnings for the year included an $80 million gain on sale of a surplus property. Cash flow for the year was $433 million, up from $270 million in the previous year. The reported profit of $374 million was in line with analysts' expectations. On March 27, 2020, the market index of oil and gas stocks rose by 0.6 percent, as the market anticipated higher prices for oil and gas. Yet, OilSands' share price fell on the day by $1.25, to close at $37.35. Financial media at the time reported analysts comments about a widening discount for heavy crude oil relative to light crude. OilSands was a large producer of heavy crude. Also, the company's production from its oil sands projects declined in the last quarter of 2019 , due to maintenance and temporary production problems. Required a. Use the market model to calculate the abnormal return, relative to the oil and gas stock market index, on Oil Sands' shares for March 27, 2020. OilSands' beta at the time was 0.75. The risk-free interest rate was approximately 0.0002 per day. Recall the theoretical relationship j=Rf(1). b. Is the abnormal decline in OilSands' share price on March 27, 2020, consistent with efficient securities market theory? Explain why or why not. Consider earnings persistence in your answer. 8. OilSands Petro Ltd reported its 2019 earnings on March 27, 2020. Net income was a record $374 million, up from $191 million for the same quarter of the previous year. Return on equity was 25.7 percent, up from 10.1 percent a year earlier. Earnings for the year included an $80 million gain on sale of a surplus property. Cash flow for the year was $433 million, up from $270 million in the previous year. The reported profit of $374 million was in line with analysts' expectations. On March 27, 2020, the market index of oil and gas stocks rose by 0.6 percent, as the market anticipated higher prices for oil and gas. Yet, OilSands' share price fell on the day by $1.25, to close at $37.35. Financial media at the time reported analysts comments about a widening discount for heavy crude oil relative to light crude. OilSands was a large producer of heavy crude. Also, the company's production from its oil sands projects declined in the last quarter of 2019 , due to maintenance and temporary production problems. Required a. Use the market model to calculate the abnormal return, relative to the oil and gas stock market index, on Oil Sands' shares for March 27, 2020. OilSands' beta at the time was 0.75. The risk-free interest rate was approximately 0.0002 per day. Recall the theoretical relationship j=Rf(1). b. Is the abnormal decline in OilSands' share price on March 27, 2020, consistent with efficient securities market theory? Explain why or why not. Consider earnings persistence in your