Answered step by step

Verified Expert Solution

Question

1 Approved Answer

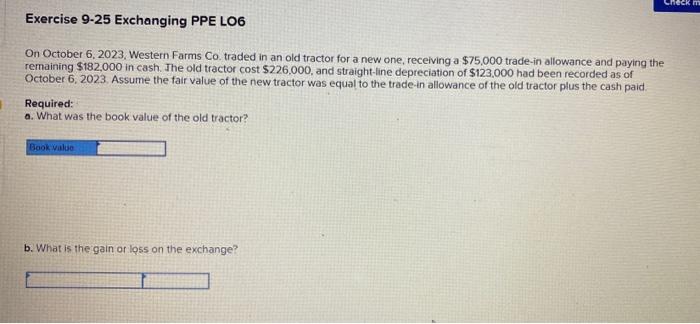

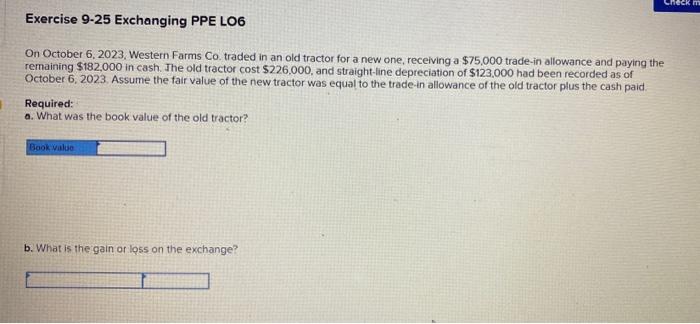

8 On October 6, 2023. Western Farms Co. traded in an old tractor for a new one, receiving a $75,000 trade-in allowance and paying the

8

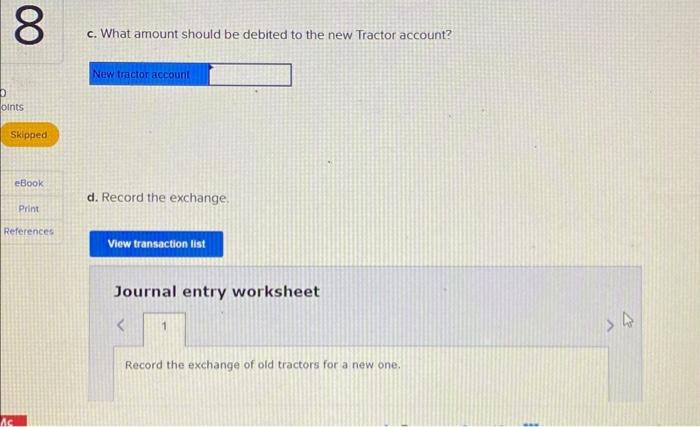

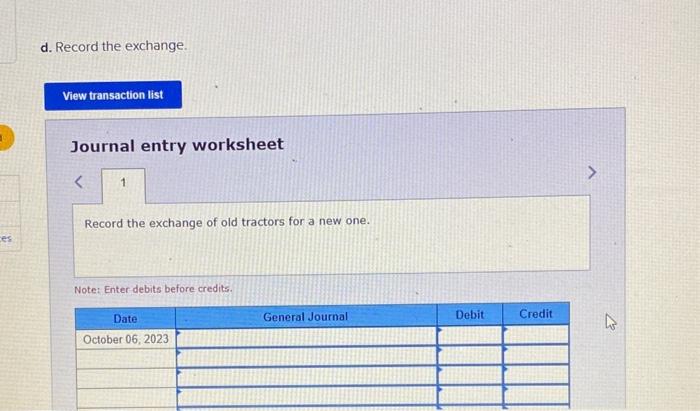

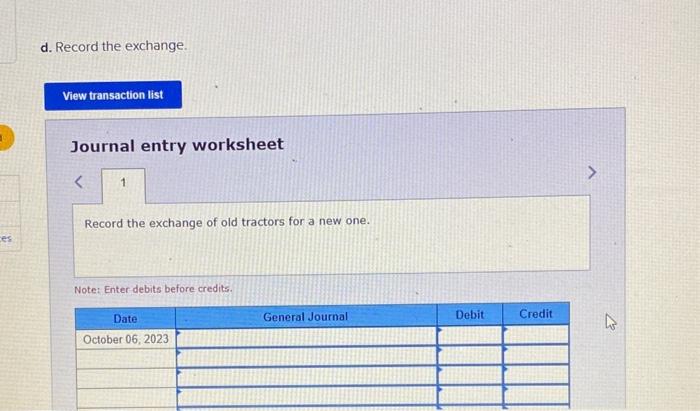

On October 6, 2023. Western Farms Co. traded in an old tractor for a new one, receiving a $75,000 trade-in allowance and paying the remaining $182,000 in cash. The old tractor cost $226.000, and straight-line depreciation of $123,000 had been recorded as of October 6,2023 . Assume the fair value of the new tractor was equal to the trade-in allowance of the old tractor plus the cash paid. Required: a. What was the book value of the old tractor? b. What is the gain or loss on the exchange? c. What amount should be debited to the new Tractor account? d. Record the exchange. d. Record the exchange. Journal entry worksheet Record the exchange of old tractors for a new one. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started