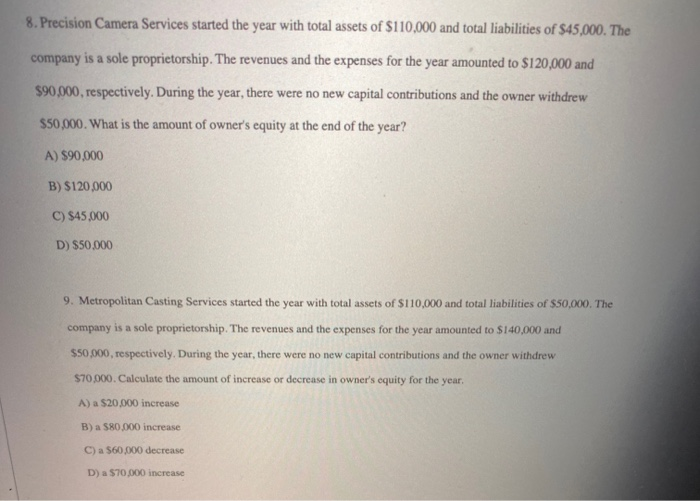

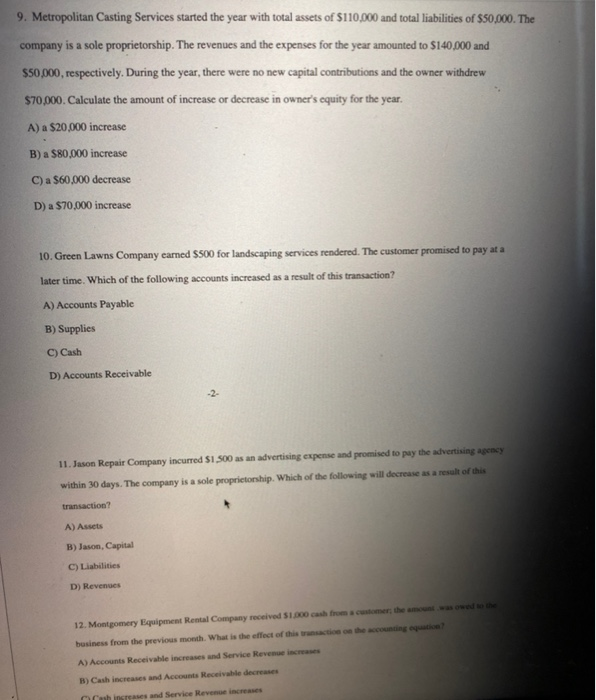

8. Precision Camera Services started the year with total assets of $110,000 and total liabilities of $45,000. The company is a sole proprietorship. The revenues and the expenses for the year amounted to $120,000 and $90,000, respectively. During the year, there were no new capital contributions and the owner withdrew $50,000. What is the amount of owner's equity at the end of the year? A) $90,000 B) $120.000 C) $45.000 D) $50.000 9. Metropolitan Casting Services started the year with total assets of $110,000 and total liabilities of $50,000. The company is a sole proprietorship. The revenues and the expenses for the year amounted to $140,000 and $50,000, respectively. During the year, there were no new capital contributions and the owner withdrew $70,000. Calculate the amount of increase or decrease in owner's equity for the year, A) a $20.000 increase B) a $80,000 increase C) a $60.000 decrease D) a $70,000 increase 9. Metropolitan Casting Services started the year with total assets of $110,000 and total liabilities of $50,000. The company is a sole proprietorship. The revenues and the expenses for the year amounted to $140,000 and $50,000, respectively. During the year, there were no new capital contributions and the owner withdrew $70,000. Calculate the amount of increase or decrease in owner's equity for the year. A) a $20,000 increase B) a $80,000 increase C) a $60,000 decrease D) a $70,000 increase 10. Green Lawns Company earned $500 for landscaping services rendered. The customer promised to pay at a later time. Which of the following accounts increased as a result of this transaction? A) Accounts Payable B) Supplies C) Cash D) Accounts Receivable 11. Jason Repair Company incurred $1.500 as an advertising expense and promised to pay the advertising Agency within 30 days. The company is a sole proprietorship. Which of the following will decrease as a result of this transaction? A) Assets B) Jason, Capital C) Liabilities D) Revenues 12. Montgomery Equipment Rental Company received $1.000 cash from customer the mode business from the previous month. What is the effect of this reaction on the counting A) Accounts Receivable increases and Service Revenue increases B) Cash increases and Accounts Receivable decreases ush insteas and Service Revenue increases